Capstone will supply 25% of all industrial gas turbines by 2028

Forecast International, which continually tracks and forecasts the outlook for gas turbines, says that on the industrial and marine side, several stimuli are at work building a companion market for a related but different series of gas turbines of many sizes. World demand for electrical power continues to rise, particularly in the rapidly developing Asian countries. In many countries, high-polluting coal-burning power plants are being shut down in favor of large, more efficient gas turbines to handle baseload power requirements, while smaller GTs serve as auxiliary power sources for peaking power needs.

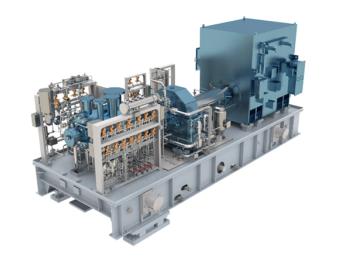

Another market driver – the U.S. – is now the world leader in natural gas production and is rapidly advancing to the No. 1 spot as an oil producer. The result of this has been thousands of miles of new pipelines crisscrossing the continent. Many of the new power plants will thus be able to function more cleanly by burning natural gas straight off the pipelines. At the same time, hundreds of pumping stations are being equipped with medium-size gas turbines to perform mechanical drive compression and pumping duties, and to serve as a source of auxiliary power generation.

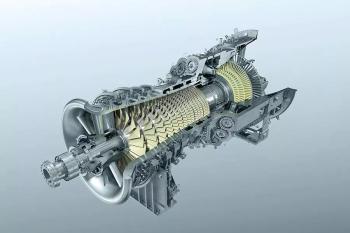

As a result of this demand, Forecast International's analysts are now projecting that 48,000+ industrial gas turbines valued at over $619 billion will be produced through 2028. However, in terms of market share, the production of industrial and marine gas turbines, many of which are mammoth-sized, will line up quite differently than production of their aviation cousins. Capstone Turbine, which produces only very small GTs, will produce 24.2% of the units, followed by Solar Turbines with 17.9%. But in terms of value of production, General Electric, in several divisions, is expected to dominate world production with 35%, followed by Siemens with 15.38% and Alstom with 9.71%.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.