CERAWeek 2024: Houston Energy Conference Draws Thought Leaders on Climate Change

The blockbuster event tackled energy and power markets, supply chains, net zero, and beyond, but the biggest surprise may have been artificial intelligence.

Some people call it the Super Bowl of the energy world—this is the 41st year of the famous CERAWeek by S&P Global. Held March 10 – 14 in Houston, this year’s theme was multidimensional energy transition: markets, climate, technology, and geopolitics. Maybe too long of a title, but it’s hard to be brief about a conference that draws 9,000 attendees and more than 600 speakers from 80+ counties.

Bill Gates talked about a new modular nuclear power technology funded and ready for installation number one in Wyoming. Also on stage were the CEOs of ExxonMobil, Chevron, OXY, ConocoPhillips, Hess, TotalEnergies, Saudi Aramco, bp, Petrobras, Siemens Energy, Mitsubishi Power, Baker Hughes, Williams, Cheniere LNG, Bechtel … and the list goes on.

Each participated in panel discussions and one-on-one interviews with Dr. Daniel (“Dan”) Yergin, author and co-founder of CERAWeek. There were also international government officials, including Danielle Smith, Premier of Alberta, Canada, and the ministers of energy from Kuwait, Brazil, Abu Dhabi, and beyond. The discussions ranged from oil and gas markets, renewable energy, climate change, battery storage, and electric cars.

But there was an elephant in the room that kept popping up in every discussion: artificial intelligence (AI)—the effect of AI on all aspects of the energy business. Numerous U.S.-based utilities got a surprise during the course of 2023: Their forecasts for future electricity demand required large revisions due to the explosive growth of AI data centers.

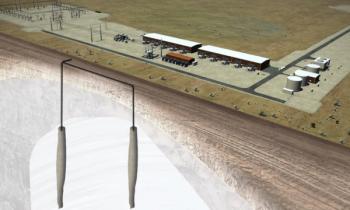

Data centers have been around since the late 90s as passive warehouses to store customer data for banks, Amazon, and the like. But there is a new breed of data centers for AI applications. The AI data center is more than a warehouse; it utilizes data as input to MANUFACTURE an intellectual product. The sophisticated chips made by NVIDIA run faster and hotter and consume five times more electricity, much of it for cooling, as a legacy data warehouse. These AI data centers run 24 X 365 baseload and demand high levels of reliability. They tend to be located near metropolitan areas that have strong fiber optic infrastructure.

Loudon County, Virginia has the largest AI data center concentration in the world. It is served by Dominion Energy who is racing to get additional gas turbine generators installed. Dallas and Atlanta also have attracted large numbers of AI data centers. Georgia Power, the utility that serves metro Atlanta, recently stunned regulators when it disclosed a huge correction to its load forecast pointing to AI data centers as the main culprit.

Many big cities are now pulling back the economic incentives previously provided to attract data centers. Soaring power consumption is also delaying coal plant closures in Kansas, Nebraska, Wisconsin, and South Carolina.

You might say there was a second elephant in the room: The recent “pause” to the permitting of new LNG export facilities by the U.S. Department of Energy (DOE). With the United States now being the largest producer of LNG, all the major players were in the auditorium listening to U.S. Secretary of Energy Janet Granholm explain that the Biden Administration’s pause should be “well in the rearview mirror” by early 2025. She said the pause was called for “in order for our DOE labs to conduct a data-based assessment of what further expansions of U.S. exports mean for our climate, for global energy, for national and global security, our allies and for domestic prices.”

The audience was not impressed, especially Senators Joe Marchin and Dan Sullivan. “The pause ought to be paused immediately.” A pause cannot be called temporary if it has no end date—that’s a freeze.

Interesting to note that on March 22, the last day of the conference, 16 U.S. states filed suit against the U.S. government stating, “The LNG export ban is not justified by any statutory authority and thus is beyond the President’s powers,” and stating that the ban is “arbitrary and capricious” and “unconstitutional.”

Among the 16 governors signing the lawsuit was Alaskan Governor Mike Dunleavy. Dunleavy was concerned that without an immediate reversal of the pause, buyers of U.S. LNG would worry that purchasing it could be affected by future presidential edicts. Indeed, within days after the pause was issued on Jan. 26, the country of Qatar announced funding for a major expansion of its LNG export complex. In addition, Russia announced to Europe the availability of additional LNG supply.

Dunleavy noted that Alaska is developing a US$43 billion LNG export terminal near Anchorage and while it is not directly affected by the pause, the quest for private financing will be damaged. Dunleavy has also been frustrated by questionable restrictions placed on drilling and exploration for minerals on federal land in Alaska. He summed it up by saying, “This won’t be cleared up for Alaska unless Donald Trump is re-elected.”

No surprise that many aspects of energy policy in the United States and other countries are often at the top of the political agenda.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.