Duke Energy to exit its Midwest generation business

Duke Energy has initiated a strategic process to exit its Midwest commercial generation business, which includes ownership interests in 13 power plants.

"Our merchant power plants have delivered volatile returns in the challenging competitive market in the Midwest," said Lynn Good, president, CEO and vice chairman of Duke Energy. "This earnings profile is not a strategic fit for Duke Energy and we have begun a process to exit the business.

The Midwest generation business includes 13 power plants with a total capacity of approximately 6,600 megawatts. These plants are owned or partially owned by Duke Energy Ohio and reported in the company's Commercial Businesses unit.

Eleven are located in Ohio, one is in Illinois and one in Pennsylvania. The plants are dispatched into the wholesale power market by PJM.

"These power plants are competitive in the market, equipped with significant environmental controls, and efficiently staffed by a great team of approximately 600 employees and contractors," said Marc Manly, president of Duke Energy's Commercial Businesses. "We will continue to focus on safely operating and managing these plants during this process, which we expect will take up to 12 to 18 months."

Redeployment of any Midwest generation sale proceeds is expected to be accretive.

As a result of this announcement, the company will take an estimated pre-tax impairment charge of $1 to $2 billion in the first quarter of 2014. This impairment will be treated as a special item and excluded from Duke Energy's adjusted diluted earnings per share results.

Citigroup and Morgan Stanley will advise Duke Energy in the transaction.

The following is an alphabetical listing of the 13 power plants in Midwest generation.

- Beckjord Station (coal), located in New Richmond, Ohio. Partially owned by DP&L and AEP.

- Beckjord Station (oil), located in New Richmond, Ohio. Partially owned by DP&L and AEP.

- Conesville Station (coal), located in Conesville, Ohio. Partially owned by DP&L and AEP.

- Dicks Creek (natural gas), located in Middletown, Ohio. 100 percent owned by Duke.

- Fayette Energy Facility (natural gas), located in Masontown, Pa. 100 percent owned by Duke.

- Hanging Rock Energy Facility (natural gas), located in Ironton, Ohio, 100 percent owned by Duke.

- Killen Station (coal), located in Wrightsville, Ohio. Partially owned by DP&L only.

- Lee Energy Facility (natural gas), located in Dixon, Ill. 100 percent owned by Duke.

- Miami Fort Station (coal), located in North Bend, Ohio. Partially owned by DP&L only.

- Miami Fort Station (natural gas), located in North Bend, Ohio. 100 percent owned by Duke.

- Stuart Station (coal), located in Aberdeen, Ohio. Partially owned by DP&L and AEP.

- Washington Energy Facility (natural gas), located in Beverly, Ohio. 100 percent owned by Duke.

- Zimmer Generating Station (coal), located in Moscow, Ohio. Partially owned by DP&L and AEP.

Newsletter

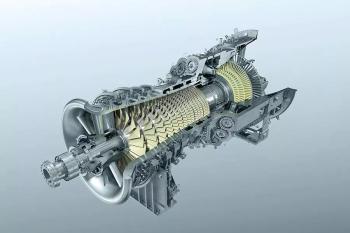

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.