Engine wars, acquisitions and mergers in the GT industry

In his

Pratt & Whitney has its new geared fan GTF engine to offer that is being well accepted for these sized planes. War is now raging between GE and Pratt for this coming lucrative market of the new planes scheduled to use this sized engine. Right now, the fierce fighting seems to be going about neck and neck.

Siemens is also in the news. On September 22, Siemens announced that it will be taking over the Rolls Royce energy and compressor gas turbine business. This is a follow-up on the acquisition of the P&W industrial aero business by MHI about a year ago. In addition, Siemens will purchase the Dresser-Rand business as well. Siemens says these two moves will round out their plans for the foreseeable future and put them in a good position to meet the future oil and gas market.

On October 28, Siemens released another item in order to update their H-class GTs. Their entire fleet of 11 SGT8000H 286MW (430MW CC) units now operating have attained 100,000 hours of operation. As of September, Siemens has sold 40 of these GTs. To date, the first 8000H unit, installed in Germany, holds the world's record of 60.75 percent efficiency as tested in 2011. Siemens says the efficiency level of over 61 percent can be now be achieved with the latest versions to match GE and perhaps exceed them.

MHI’s fossil power merger

Mitsubishi Heavy Industries has not released any news recently about their large high efficiency heavy duty GTs, but there is a bit of other news of interest. Mitsubishi has merged its fossil power generation business with Hitachi to form a new company called Mitsubishi Hitachi Power Systems Americas (MHPSA). Its headquarters is to be located in Lake Mary, Florida, close to Orlando, with links to Savannah, Georgia and Houston, Texas. Its products and services will include gas, steam and geothermal turbines for the electric power industry. Testing of the new PW4000 GT electric generator set has been completed and will be given later under Pratt & Whitney.

Consequences on global GT market

There is big breaking news about Alstom and GE that has broad consequences on the Global industrial Gas Turbine Market. Alstom came out of the original Swiss industrial gas turbine manufacturer Brown Bovery, the grandfather of all gas turbines. General Electric finally has been given the green light by France to acquire this world class company. GE won the contest for Alstom back in June after a fierce fight for the company by Siemens and MHI, but France held up the deal.

Now there will be only three big players in the large industrial GT World market. GE, MHI and Siemens. The market was previously shared with a breakdown of 39 percent for GE, 28 percent for Siemens, 16 percent for MHI and 14 percent for Alstom. GE is really going all out for the World GT market and is pouring in big money into it as given earlier in this blog. This takeover says a lot about what GE thinks about the future of industrial GTs.

What will become of the reheat GT24 and 26s and other Alstom/ABB designs? Will GE drop them? We will have to wait and see, but chances are they will because of GE's new remarkable 7H and 9H designs. What about the alliance between Alstom and R-R? What will the future hold? There are all kinds of questions to be answered.

Rolls Royce is turning over its industrial operations to Siemens, as reported earlier in this blog. But on October 31, it announced that it had picked up an order for 12 large Trent 60 DLE industrial aeros, ISO rated 54.2 MW at 43.6 percent efficiency for a proposed Lake Charles, Louisiana LNG export plant. These GTs are to drive the main refrigeration compressors in the proposed plant. These are very large mechanical drivers and large compressors. The Air Products C3MR refrigeration process will be used. This project has been given tentative approval by the US DOE subject to the US final approval, expected to take place in the first half of 2015.

Tests on new FT4000

Pratt and Whitney reported on October 1that it successfully completed two months’ tests on the new FT 4000 next generation aeroderivative gas turbine at its West Palm Beach, Florida facilities paving the way for commercial introduction scheduled for December of 2015. It will be known as the FT4000 Swift. It will be packaged and marketed by the new MHI group called PW Power Systems, Inc. (PWPS) located in Japan that was set up a couple of years ago. Further field testing will take place on a simple cycle twin pack version rate at 120MW by Exelon Corporation. The single pack 60MW unit will compete with the GE LM6000. GE does not offer a dual unit arrangement driving one double-ended generator.

It is interesting to note that Exelon is a pioneering company and not afraid to purchase untried GTs as the company has also just recently purchased the first all-new 4 GE 7HA.02 GTs, the first one not even run yet, as reported earlier in this blog.

Flight test of geared GTF

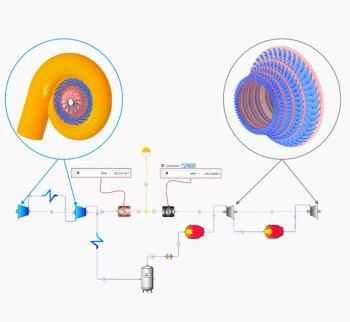

P&W is now flight testing its geared GTF 30,000 pound thrust PW1100 G fan engine. Much smaller geared fan engines have been around for a number of years and are used to power business jets, but it has been much harder to develop a larger geared unit. The idea is sound because the core and power turbine can be made to run at optimum high speed as the power turbine is not tied to the low speed of the fan. The RPM of the fan can also be designed to run at its optimum speed. The high-speed power turbine is much smaller in diameter and has fewer blades and vanes. This part of the engine costs less to make and weighs much less than the non geared direct drive engine.

The fan can be made with a larger diameter to give a more optimum thrust for sub-sonic planes. The GTF has an 81-inch diameter fan to give a bypass ratio of 12.1, about 10 percent higher than its competitor, the new GE/CFM LEAP, with its 11.1 bypass ratio and 78-inch diameter fan. Both the new LEAP and GTF engines will have a 15 percent lower fuel burn than current equivalent engines. Both engines weigh almost the same.

The trick for the new GTF was how to make an efficient, durable, light-weight, long life and acceptable compact in-line planetary gear to drive the fan. It took P&W working with its German partner 10 years to develop the new, large geared fan engine. They did not give up and now the new GTF is here. Both GE and R-R at first poo-hoo-ed the idea, but both are now considering making a large geared fan engine.

The new engine has been well received by most of the plane manufactures and the orders are pouring in for a lot of new planes. Various versions and sizes to form a family of the Pratt GTF are being developed and offered. The company has orders for the new Airbus 320neo, the Chinese Comac 919, the regional single Isle narrow body (SINB) MHI MRJ, the Embraer E-jet, the Bombardier CS100s, the Russian Irkut MC-21, and the new large Gulf Stream business jet. Because of the lower velocity of the greater mass of air exiting the larger fans, the noise level is about half that of the regular fan driven planes. Nevertheless, the Boeing company is sticking to the new GE/CFM LEAP engine so far, for the new 737 MAX. Pressure is mounting by the airlines for Boeing to offer the GTF as well as the LEAP for the new 737 MAX. Pratt could very well win this war.

Industrial version of GE/CFM LEAP

The GE/CFM LEAP will probably not be considered for an industrial version, but the GTF could very well be made to drive a 3600 or 3000 RPM electric generator with the proper planetary gear design. An inter-cooled, super-charged version is also possible, maybe even reheat. If the production rate becomes high enough then the GTF could be industrialized by Pratt and marketed by MHI (PWPS) to compliment the new PW4000. The GTF could have a manufacturing cost advantage with a higher efficiency over the mature and aging GE LM 2500. The game is how to make more money. MHI and Pratt should take a look at using the new GTF for industrial duty. Maybe they already have.

This Blog has given an up-to-date story of the effect the new fracked natural gas is having on the North American industrial gas turbine market and why we can expect to see more GTs and CCs being manufactured, purchased and installed here in the United States and also in Canada and Mexico. A report has also been given on several changes in ownership of large gas turbine companies and new ones formed to meet the growing demand. Details on new GTs entering the market have been given. The industrial gas turbine and combined cycle market, burning the new, low-cost and abundant supply of fracked shale natural gas, has never looked any brighter and more promising.

(Ivan G. Rice was past chairman of the South Texas Section of ASME (1974 - 75), past chairman of the ASME Gas Turbine Division (now IGTI) (1975 - 76). A Life Fellow Member of ASME and Life Member of NSPE/TSPE, he has authored many articles and ASME papers on gas turbines, inter-cooling, reheat, HRSGs, steam cooling and steam injection.)

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.