India Power Growing Pains

How the 75-year-old republic is dealing with coal

India is celebrating its 75th anniversary. Development in the energy sector has skyrocketed, and so too has an awareness of a significant problem – dependence on coal. India and China lead the global supply chain for coal investment, topping the scales at over $80 billion combined. India stands as the world’s second-largest coal consumer and producer. Roughly half of its 403 GW installed capacity is coal. Let’s look at what is being done to diversify India’s energy mix.

One of India’s primary goals is becoming a $5 trillion economy. To achieve this, exploitation of its natural resources is a necessity. India holds the fourth largest coal reserves in the world at over 350 billion metric tons (MT). State-run companies are putting 2.5 trillion rupees, or $31 billion into that market. The country is massively reliant on coal, both from an economic and energy standpoint. Recent efforts have been made towards renewables, but many officials believe coal will dominate for several more decades. India predicts $54.5 billion in investments for clean coal projects through 2031. While the technology is proven for carbon emission reduction, it’s costly and requires vast investment to reach large-scale implementation.

Power plants met 201 GW of demand back in April. It reached 210 GW in June. Analysts expect over 220 GW before the end of summer. The minimum expected fulfillment by coal inventories is 160 GW during peak hours. The power ministry predicts an increase in power requirements for coal at 1375 billion units (BU) for 2021-22, and 1650 BU for 2022-2023. This is a great increase from 2020-21, where demand was just 1275 BU. Monsoons and extreme heat account for two prominent power grid disruptions the country regularly faces. With coal making up so much of the energy economy, there isn’t much to fall back on when production lines are held up. As a result, rolling blackouts occurred for a period of 2-8 hours daily during April. Reports indicate that power plants in the country have roughly nine days of coal in reserve, which is a third of the recommended level. Widespread outages and increasing demand for coal are major problems the government seeks to address.

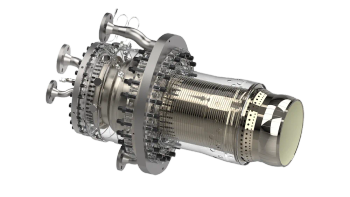

One significant project the country has been working towards is the Kakrapar Nuclear Power Plant in Gujarat. The third unit is expected to enter operation in December. It’s the first Indian-designed 700 MWe pressurized heavy water reactor (PHWR). This is just one of 21 new nuclear power plants currently in the construction phase around India. By 2031, 15.7 GWe of nuclear generating capacity is expected. 15.7 GW out of 220 GW is progress, but it’s only the tip of the Indian coal problem.

Another project is being contracted out to Siemens Gamesa Renewable Power. It involves the European company supplying onshore wind turbines for Indian energy firm Azure Power Global. It is sending 96 SG 3.6-145 onshore wind turbines for the company’s first wind energy project. To date, Siemens Gamesa’s has given 1.4 GW of wind energy to India. This follows legislation recently passed in the lower house of parliament, which requires greater use of renewable energy targeting industrial polluters. These developments allude to a carbon market similar to the US.

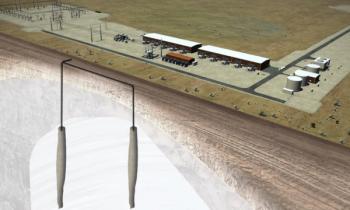

According to the International Trade Administration (ITA), India has set a goal to have 15% of its energy come from natural gas by 2022. The International Energy Agency (IEA)’s report “Energy in India Today” indicates that for this to be realized, India will need to increase current levels by roughly 10%. While recent advances have seen an uptick in natural gas, biomass, oil, and renewables, coal still reigns supreme. Government initiatives and positive media coverage may help inspire action, but the reality is India is troubled by a coal reliance that will take decades and billions of dollars to solve.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.