POWERGEN 2024: EPRI Talks Hydrogen, Ammonia, Co-Firing Challenges

At POWERGEN 2024, the Electric Power Research Institute (EPRI) discussed ammonia and hydrogen, co-firing, technical challenges, and shared the latest on large-scale hydrogen projects.

On Tuesday at POWERGEN 2024, speaker Marc Lemmons of the Electric Power Research Institute (EPRI) led the technical session, The Future of Hydrogen and Ammonia Firing. Lemmons discussed the emerging interest in hydrogen and ammonia firing in the wake of large corporations making commitments to net-zero targets. He also covered the technical challenges of co-firing hydrogen and ammonia, including the economic, political, and thermodynamic roadblocks present within the power generation industry.

EPA Greenhouse Gas Ruling

Lemmons, a senior technical leader at EPRI, gave a detailed outline of the Environmental Protection Agency’s (EPA) recent ruling regarding the retirement of coal plants, CO2 emission guidelines, and the transition to green hydrogen power generation.

Coal-fired power plants have been the hardest hit by the EPA’s 111(d) ruling, which aims to retire coal power significantly by 2030. If the EPA’s plan is successfully executed, coal may be reduced to a total power generation share of 80 GW with 90% of the plants outfitted for carbon-capture applications. Coal fleets are retiring at an elevated rate due to greenhouse gas (GHG) and CO2 emissions associated with their operation.

“We have a pretty large installed capacity of approximately 214 GW, which is roughly about 22% of our power generation today. If the EPA drives the retirement of coal power as proposed, then by 2040 a maximum of 80 GW with carbon capture will remain. A lot of these coal assets are 30 to 40 years old, and they’re aging, so I think the general trend is seeing a reduction in coal power,” said Lemmons.

Hydrogen and Ammonia Availability

With the retirement of coal-fired fleets, the EPA is encouraging the integration of hydrogen for power generation. The available infrastructure for implementing hydrogen fuel is significantly limited, with only about 1,600 miles of hydrogen-ready pipeline throughout the southern United States, primarily in Texas and Louisiana. Despite the limited availability of hydrogen pipelines, organizations are currently repurposing natural gas pipelines for pure and mixed hydrogen transportation.

Regarding the readiness of ammonia firing, the United States. maintains 3,000 miles of ammonia pipeline in the country’s central regions. These ammonia lines are equipped with centrifugal pumps and transport an ammonia blend, rather than a pure-ammonia fuel.

“The perk of ammonia is that we are very familiar with it, and it’s easily transportable," Lemmons said. "Now, while I don’t think it makes the most sense for U.S. utilities to start investing in time in ammonia firing, remote areas, especially out west, may benefit from using ammonia."

As the interest in hydrogen for power generation grows, one must consider the energy requirements to produce and refine the fuel for large-scale implementation. Most hydrogen for power applications is derived from steam methane reforming, which uses minimal electricity in comparison to emerging water electrolysis technologies. The electricity demand to generate enough hydrogen for widespread consumption is not currently feasible, as a 96% hydrogen blend would demand more than 50% of the country’s current electricity production.

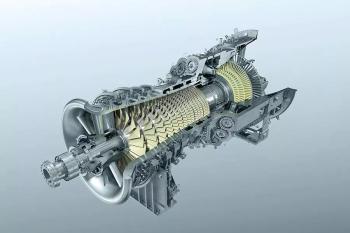

Electrical demand is not the only obstacle in the way of large-scale hydrogen integration—embrittlement and high flame temperatures may cause damage to boilers and associated equipment. Lemmons discussed the impact of hydrogen burning on equipment: “We tend to worry about the higher burn temperature, so there might be a change in materials at the blade tips. You have to consider damage mechanisms, short-term overheating, long-term overheating, and higher blade temperatures occurring within an HRC or traditional boiler.”

Industry Demos

Industry demonstrations for hydrogen and ammonia firing have similar objectives, including the establishment of best practices for blending, operation without major modifications, and the measurement of emissions as a result of hydrogen or ammonia burning. Specific to major ammonia demonstrations within the industry, most companies are using a 20% ammonia blend with plans to achieve a 50% blend target by 2028.

Despite the encroachment of hydrogen and ammonia in the power generation sector, many power providers are hesitant to adopt the technology. These roadblocks remain at the forefront of concerns for major energy drivers.

“When we talk about the production and transportation of hydrogen, there’s quite a big lag there. I don’t think there’s much traction in the power industry; I believe in due time we can get there, but there remains a lot of big roadblocks,” Lemmons concluded.

Summary

The EPA’s 111(d) ruling heavily impacted coal fleets in the United States, with the projected coal power generation market share plummeting to all-time lows by 2030. Elevated GHG emissions and carbon output put coal-fired power plants directly in the crosshairs of the EPA ruling, but natural gas fleets continue to operate at near-full capacity. As coal fleets retire and natural gas becomes subject to stringent emissions regulations, hydrogen and ammonia firing may emerge as a potential alternative.

The power industry may not be interested in the use of hydrogen or ammonia for generation applications currently, but new technologies can transform the economics and technical feasibility of their integration. These fuels are not very popular due to their high burn temperatures and lack of available infrastructure, yet smaller industries, such as utilities and refineries, are beginning to utilize hydrogen and ammonia on a smaller scale with documented success.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.