CAPSTONE TURBINE MOVES UP THE FOOD CHAIN

MICROTURBINE EFFICIENCY AND RELIABILITY DRIVE APPEAL, AS CUSTOMERS SEEK TO REDUCE EMISSIONS AND LOWER MAINTENANCE COSTS

Designed with just one moving part, no gearbox and the ability to operate without lubricants, Capstone’s microturbines offer a wide range of technology that can be simplified as follows: The C30 is 30 kW; the C65, 65 kW; and the C200 is a 200 kW machine. Capstone also acquired a 100 kW turbine from Calnetix. These are the basic machines, though the company widens their appeal by packaging them in larger modules.

This is done particularly with the C200, which it uses as the building block for modules ranging from 600 kW to 1 MW. Control software synchronizes them and allows an operator to treat the package as a single machine. “The customer doesn’t care if it’s one turbine or five inside as long as it is efficient, reliable, easy to maintain and has low lifecycle costs,” said Capstone President and CEO, Darren Jamison (Figure 1).

Known as the C1000 (1 MW) series, these larger modules can be piggybacked to provide even more power. At present, Capstone states 10 MW as the practical limit.

Models are available that operate on natural gas, propane, landfill gas, digester gas, diesel, aviation and kerosene fuels.The company cites their low emissions, minimal maintenance and downtime, and air bearing technology, which eliminates the need for lubricating oil or coolant. As a result, Capstone offers 5- and 9-year factory protection plans as a way to guarantee costs across product lifetime.

“We directly compete against GE and Caterpillar engines which are about 30% cheaper on first costs,” said Jamison. “However, within three years of operation, costs even out due to the higher operating and maintenance costs of the GE and Caterpillar engines.Over the entire lifecycle, ourmicroturbines provide lower cost and are more reliable, close to 99%availability compared to 85% for our competition when all scheduled maintenance is included.”

Best seller

The C65 has been the workhorse unit and Capstone’s best seller formuch of its history. Once the C200 was introduced in late 2007, it rapidly produced more annual revenue than theC65.However, theC65 continued to dominate in unit sales, and to this day accounts for the bulk of the 6,000 units the company has shipped worldwide.

C200 unit sales continue to grow. Much of this growth is coming from the oil & gas sector and at the expense of reciprocating engines, which Jamison said have about ten times more emissions. “The C1000 package is fully prewired and ready to plug in,” he said. “If one C200 inside requires service, the module can continue with 800 kWuntil it is repaired. But if you lose one spark plug on a reciprocating engine, you’ve lost your entire 1 MW.”

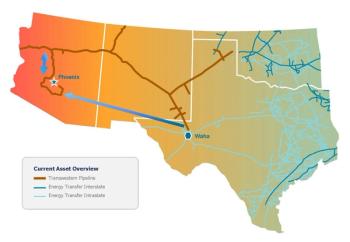

Oil & gas sales

A significant portion of Capstone’s business now comes from oil & gas, with shale gas being a huge driver (March/April12, p. 16). But it is not all shale gas. The company is also selling for offshore, pipeline, gas compression station and associated gas applications. On the latter front, Russia has become a big market due to regulations on burning flare gas. Companies such as Lukoil and Gazprom have been buying C65s and C1000s to harness flare gas as a source of power (either to run a substation or send it into the grid).

Similar regulations are cropping up in other parts of the world. Columbia, for instance, is cracking down on flare gas, as is Australia. Capstone is looking to move into newmarkets and regions with this technology, especially in remote areas (Figure 2).

YPFB Transporte S.A. Taquiperenda gas compression station in Bolivia, for instance, is a Capstone customer that uses four C65 microturbines to meet its power needs. This includes powering the station and supplying power for the compressors. This unmanned station, which pumps 350 MMcf/day of natural gas, is a six-hour drive from the nearest town. For YPFB Transporte, power reliability is critical.

“Capstone microturbines are easy to maintain and we can monitor them using their remote access software,” said Franz Romero, Maintenance Manager for YPFB Transporte. “In contrast, our recip engines are far more costly and time consuming to maintain.”

Lower cost and efficiency are two major factors driving a growing number of customers to switch from reciprocating engines to microturbines.Most engines experience a big drop off in efficiency as load goes down, said Jamison.With the C1000, power can be graded downwithout loss until you reach the 100 kWmark. “This feature has helped us in shale gas as 1 MW reciprocating engines want to run at near capacity. This worsens emissions and wastes energy as you can’t ramp them down.”

Other markets

In addition to oil & gas, Capstone plays in four other primarymarkets:Mobile products (such as buses), secure power supply, renewables and energy efficiency.

The company sees potential in each of these markets. In energy efficiency, for instance, some users find it cheaper to install a turbine than buy power from the grid. Large swimming pools, for example, find the economics of turbine ownership better. And they can sell power back to the grid as well.

A similar value proposition exists in secure power. Large diesel generators, uninterruptible power supplies (UPS) and banks of batteries are expensive and largely sit idle. By bringing in a gas turbine, Capstone believes that companies can use it to reduce their reliance on power from the grid and find other uses for it when it is not needed for backup power.

A packaged product known as Hybrid UPS is also available for this market. Syracuse University is the first customer deploying this system, and one other order is on the books. Alternatively, some data centers and telecom organizations are harnessing these microturbines to keep critical systems online and to sell excess power to the grid.

In the renewables sector, landfills and digester gas are common applications. One landfill site, for instance, uses Capstone to provide 12MWof onsite power.

Future products

Capstone is in the midst of a U.S. Department of Energy sponsored programto create two new products. The C250 will have a larger compressor than the C200 (Figure 3). It has been engineered with streamlined aerodynamics to provide an expected two or three points more efficiency (compared to 33% for the C200). Jamison said the overall C250 package should be smaller than that of the C200 while producing more power.

That will form the first phase of the C370 program, which will institute a two-shaft design using the C250 and C65 to achieve an estimated 42% efficiency and run at higher temperatures. An intercooler will operate between the two compressor stages. By adding an Organic Rankine Cycle generator to reuse exhaust gas, this unit could reach 50% efficiency (Figure 4).

“It will take us about 18 months to get the C250 to market,” said Jamison. “The C370 is about three years away.”

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.