Digital transformation within the pump and compressor market

The global motor-driven equipment market has been extremely volatile during the past few years, due to the decline of global oil and commodity prices. Equipment manufacturers, including pumps and compressors manufacturers, are looking for ways to minimize profit losses amid these economic uncertainties. Topics such as Industry 4.0 and the Industrial Internet of Things (IIoT) are growing in prominence within the industrial automation community.

Manufacturers are seeing these as exciting opportunities, believing that they could drive future profits. The pump and compressor market has seen a growing trend to implement new technologies,creating an opportunity for manufacturers to innovate and provide full solutions, as opposed to merely adding a component to their overall equipment portfolios. This means that pump and compressor suppliers are improving their expertise along the whole supply chain in pump and compressor system applications.

Pump and compressor manufacturers are undergoing a digital transformation by embracing IIoT, big data, and artificial intelligence. These enabling technologies, and related transformational efforts, are providing equipment manufacturers with a competitive advantage.

Two main technological trends are having an immediate and near-term impact on the market for industrial pumps and compressors -- digitalization and additive manufacturing. Digitalization is expected to have the most immediate impact because end-users have already been collecting data from equipment in real-world applications by utilizing sensors to monitor their performance. Although this data has been collected for some time, technology is making advancements with how software can better utilize this to create useful information. Better data utilization means equipment maintenance has the potential to shift from scheduled maintenance to condition-based and preventative maintenance. Companies such as KSB, Sulzer, and WILO have developed connected equipment to enable real-time monitoring in the production line to improve productivity and reduce downtime.

On the other hand, technologies such as additive manufacturing and 3D printing are affecting the manufacturing process for pumps and compressors and spare part services. The ability to print equipment parts using3D printers will allow manufacturers to reduce the resources needed to manufacture and move components to the right places at the right time in the manufacturing process. Additionally, 3D printers have the capabilities to produce components and parts with varying topologies, thereby allowing for easier testing of experimental products. However, as the potential logistical and cost advantages to 3D printing technology are not likely to be seen for 5-10 years, casting and machining is expected to remain the predominant manufacturing method for industrial compressors in the short-term. Currently KSB is using 3D printing technology to reproduce spare parts that are difficult to obtain or have been discontinued. This enables continued operation of existing systems and eliminates the need for extensive modifications by end-users.

Servicing and procurement

Communication is key to digitalization in the world of IIoT. Due to the 2014 downturn in the mining and oil and gas industries, pump suppliers are pushing more than ever to become integrated solution providers. A recent IHS Markit study shows the numbers of connected nodes in pump (centrifugal pumps and positive displacement pumps) and compressor applications will grow substantially, with a compound annual growth rate (CAGR) of 45.6% from 2017 to 2022.

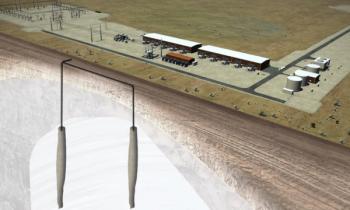

Connected pumps and compressors enable predictive maintenance, with the ability to monitor and regulate pump efficiency,improving both uptime and energy efficiency. In high-risk, high-cost, and error-prone industries, the use of connected pumps allows the transmission of important data that enablesa range of IIoT applications. For example, pump sensors cancapture the key parameters of a pump such as pressure, temperature, and liquid level to measure hardware performance and predict the need for downtime and the potential for failure through an analytical model. The oil and gas, water and wastewater, and commercial building sectors are the biggest adopters of connect equipment. These are already competitive and price-sensitive markets, which should spark the most innovation and ingenuity in the near future.

Another notable trend is the shift of the business and procurement model in pump and compressor industries.The current procurement model is one of capital expenditure (CapEx) supported by operating expenditure (OpEx).The end-users purchase the equipment for a new project using CapEx,whilst OpEx will be spent for subsequent maintenance and services. In the future, procurement is expected to transition to anOpEx-only model.Recent technological trends create a larger market for pilot programs that involve predictive maintenance. These programs seek out and replace, or service, end-of-life equipment before they present the potential for unscheduled downtime. In this scenario, end-users are expected to spend the OpEx and the equipment will be provided as part of a service package. This is a welcomed transition for manufacturers as they can rely on a specific manufacturing timeline as part of their contract with the end-user. Other elementsof an end-user’s environment that may be impacted by equipment as a part of a service contract model includeincreased overall environment efficiency and increased uptime. Larger manufacturing operations, with the capability to handle their own services and micro-manage their equipment environment, will most likely continue with the traditional CapExmodel of equipment procurement.

In summary, the pump and compressor market has been evolving with industrial internet of things (IIoT) and industry 4.0. The impact of this digital transformation is significant and can be seen across all areas of manufacturing, from the business model and equipment manufacturing process at the manufacturers’ end to the procurement model at the end-user industries. IHS Markit will continue to monitor the development of IIoT and smart manufacturing in motor-driven systems such as pumps, fans, and compressors.

Author: Joanne Goh is a Manufacturing Technology Analyst at IHS Markit, a market intelligence provider for industrial automation equipment, with an expertise in motors and motor controls.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.