El Segundo Energy Center Opens

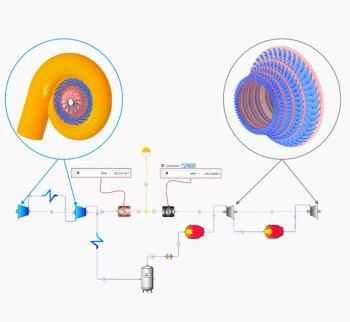

The El Segundo Energy Center in Southern California was officially opened in September. Consisting of two Flex-Plant combined cycle power islands from Siemens Energy, the new units have an installed capacity of 550 MW, with 300 MW being available in less than 10 minutes.

Owned and operated by NRG Energy Inc., this is the second Flex-Plant to open in California after Lodi in Northern California (Sept/Oct 2012, p.8)

“This plant is very different from our Flex-Plant 30 in Lodi as it has to load follow rapidly,” said Richard Loose, Marketing Director, for Siemens Energy Solutions Americas. “Each power block can provide 150 MW in 10 minutes from start.”

As well as SGT6-5000F gas turbines, Siemens supplied an SST-800 steam turbine, SGen6-1000A generator, SGen6- 100A-2P generator, a heat recovery steam generator (HRSG), and an aircooled heat exchanger for each power block. Siemens also provided electricals and an SPPA-T3000 power plant instrumentation and control system.

The gas turbine integrates with a single- pressure, non-reheat bottoming cycle and an air-cooled heat exchanger for steam condensing. Overall the Flex-Plant 10 provides a net efficiency of nearly 49%. Siemens said that compared to a conventional combined cycle plant, it offers a reduction of 90% in startup emissions. This is achieved by quickly starting the GT to its design operating range with no hold periods. Emissions are controlled via Siemens Clean-Ramp technology to reduce transient emissions when the gas turbines ramp up or down.

Prior to the upgrade, the El Segundo plant consisted of Units 1, 2, 3 and 4 for a total of 1,020 MW. Units 1 and 2 were erected during the 1950s and retired in 2002 to make room for the two new Flex-Plant 10s. Units 3 and 4 were built during the 1960s. Unit 3 has also been retired while Unit 4 continues to operate.

“Originally, we were going to continue using ocean water for once-through cooling for a new two-on-one combined cycle,” said Georg Piantka, Director of NRG’s Environmental Business for the West Region. “In 2007, we changed the license to two one-on-one air cooled heat exchangers using a Siemens Flex-Plant 10 arrangement.”

As part of this plan, NRG retired the aging steam boilers and eliminated 400 gallons per day of once-through cooling in compliance with Section 316 (b) of the Clean Water Act.

Providing up to 885 MW

With 550 MW added by the two Siemens units plus another 335 MW for Unit 4, the 33 acre site on the Pacific coast can provide up to 885 MW. Piantka pointed out the compact nature of the new additions; 550 MW are sited on less than 10 acres. The new gas turbines are known as Unit 5 and 7 while the new steam turbines are Units 6 and 8.

“We plan to replace Unit 4 down the road,” said Piantka. “We are permitted for 200 starts per year.”

The HRSG is a DrumPlus by NEM, which has several design features to allow faster ramp up. The two HRSGs are said to be the first of their kind in commercial operation.

The new boilers impose no hold points on GT start up. For example, peak stress is reduced, the result of the design’s smaller drum with a thinner wall. The external location of the water and steam separators and other features permit fast start while mitigating peak stress.

In comparison, typical drum-type HRSGs have a higher risk of reduced life time due to cycling stresses. The gas turbine is able to reach dry low NOx operating loads faster, thereby reducing NOx emissions during start-ups.

DrumPlus is available for single, two and three pressure HRSGs. These boilers need no special feedwater equipment, such as a condensate polishing plant. The output of NEM’s HRSGs is 172.7 lb/s with a temperature of 935.5°F at a pressure level of 1,444 PSIG.

“The NEM DrumPlus is a game changer for combined cycle plants as it gives them the startup profile of a peaker,” said Loose. “Instead of one very large drum, it is broken down into multiple thin wall pressure vessels to reduce stress.”

Loose added that the single-pressure HRSG at the site works out better than a three-pressure HRSG. At almost 49% efficiency, the Flex-Plant 10 is said to be up to 7% more efficient that an aeroderivative peaker.

Loose explained energy realities within California. In 2011 and 2012, the state added 1.8 GW of renewable capacity to the grid, three times more power than came online from fossil sources.

That is why the units at El Segundo are scheduled for peaking and intermediate load operations. With the SGT6-5000F gas turbine as the main driver, the plant’s fast start capabilities can be used to back up wind and solar power which are increasingly being added to the California grid, with the power sold to Southern California Edison.

California is known as that nation’s leader and proving ground in clean energy. So it is no surprise that the El Segundo Energy Center now represents some of the lowest levels of emissions in the country. In fact, this facility is so low on emissions that it becomes difficult to measure according to a representative from California Air Quality Control.

“You are complying with the most stringent emissions standards in the nation,” said Robert Weisenmuller, President of the California Energy Commission. “Renewables are an increasingly large portion of our energy mix and we have to complement that with gas plants.” But the tenuous nature of the relationship between gas and renewables was revealed by Mike Peevey, President of the California Public Utilities Commission.

“We are not real enthusiastic about gas, but it is vital if we are to achieve what we want in the field of renewables,” said Peevey. “While the state statutes call for 33% minimum renewables by end of the decade, we can’t get there without plants like El Segundo to provide the ramping capability.”

Accordingly, the Flex-Plant 10 makes use of Clean-Ramp to lower transient emissions while ramping up and down. Loose said that the facility maintains 2 ppm or less of NOx and CO while operating.

Wood Group - Turbocare JV

Wood Group GTS and Siemens AG’s Turbocare Unit have formed a joint venture to create a global integrated service provider for rotating equipment. The JV consists of the Maintenance and Power Solutions business of Wood Group and Siemens Turbocare Unit, which provides aftermarket gas turbine, steam turbine and generator design, repair and manufacturing services.

Wood Group’s gas turbine activities have typically delivered stronger performance when in a relationship with an OEM, according to Siemens. The JV, therefore, will be designed to improve the performance of the Wood Group businesses, including cost reduction and efficiency initiatives and the reduction of risk in Power Solutions.

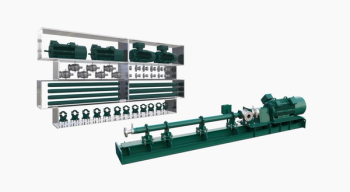

CNG and LNG orders

GE Oil & Gas continues to make headway with its Compressed Natural Gas (CNG) and Liquefied Natural Gas (LNG) products. Chelsea Natural Gas in Canada has purchased 20 GE CNG-In-A-Box fueling systems as part of efforts to develop the natural gas fueling infrastructure. The plan is to use them for shared fueling stations by smaller truck and bus fleet owners.

CNG and LNG are seen by GE as an expanding market in transportation and as a cheaper and more environmentally friendly alternative to gasoline and diesel. In CNG, the gas is compressed to high pressure and is best suited for cars, light trucks and fleet vehicles. LNG makes use of chilling and refrigeration to produce a liquid 600 times more dense than natural gas, suitable for long-haul trucks, rail, and other uses, said Rafael Santana, President and CEO of GE Oil & Gas business.

He breaks this market down into two sections. Smaller-scale-LNG deals in quantities ranging from 50,000 gallons per day to 500,000. The full-scale LNG sector entails larger amounts to transport gas in huge vessels. LNG is loaded onto ships and delivered to a regasification terminal, where it reconverts into gas.

Santana pointed out the potential for smaller- scale LNG in North American shale oil and gas fields. Many of the current sites are reopened wells that were previously thought to have extracted all the oil possible. Many will be viable for a couple of years. That makes modular LNG units a good choice as they can be placed near drill sites and can monetize the gas. They can then be moved from well to well.

“The wells might not be close to a gas pipeline so smaller scale-LNG units can be brought in and later moved elsewhere,” said Santana. “The LNG itself can either be consumed locally or trucked to where it is needed.”

Siberia LNG project

On the large-scale side, GE has received a contract to provide turbomachinery equipment for the Yamal LNG project that is being developed in Russia’s northern Siberia region. It will have a production capacity of 16.5 million tons per year.

Three trains will each have the capacity to produce about 5.5 million tons of LNG a year. Each train will consist of two main refrigeration units that turn natural gas into a liquid for transportation. Both refrigeration units will feature an 86 MW Frame 7E gas turbine; three main refrigerant centrifugal compressors (two mixed refrigerant and one propane); a 24 MW variable speed drive (VSD) starter-helper; waste heat recovery units (WHRU), and auxiliary equipment. In all, GE will supply six Frame 7E gas turbines, 18 centrifugal compressors, six VSDs and six WHRUs. The turbines will be manufactured at GE Power & Water’s plant in Greenville, S.C., and the compressors will be manufactured at GE Oil & Gas’ facility in Florence, Italy. Delivery is in the second half of 2015.

“The Yamal equipment will be able to operate in temperatures as low as minus 50°C,” said Santana. “As this is a remote area, the modules will be assembled and tested in Italy before shipping to the site in order to reduce the manpower needed in Siberia.”

Power generation in Texas

The Electric Reliability Council of Texas (ERCOT) has provided retail choice and competition for residential, commercial and industrial electricity customers since 2002. About 70% of Texans are allowed to select their provider. During the past twelve years, the price of electricity has fallen and the level of customer satisfaction has improved in large part due to choice and competition.

But an important shortcoming has emerged in the Texas competitive market: demand is growing at about 3% per year but new generation plants are not being constructed rapidly enough to keep up (Figure 1).

Conventional wisdom says that enough power generation capability should be available to meet 120% of the peak load during the highest 15-minute demand period during a year. This would be called a 20% reserve margin. In a market served by regulated monopolies, power plant owners are guaranteed a rate of return (typically 10% to 12% per year) on their capital investment.

Regulated generation companies are sometimes accused of overbuilding the “rate base” to earn higher profits. This is justified by the logic that a higher reserve margin means more reliability and a lower likelihood of power shortages during times of peak demand. The reserve margin in Texas today stands at about 13% with predictions that it will fall to less than 8% by 2016 unless power plant construction is accelerated. So why are they not being built?

Investors say generating stations do not make adequate profit because the market is designed to pay only for electricity actually produced. This is known as an “energy only” market. While the cap on allowable price has been revised upward and will be set at $9,000/MWh in 2015, there just have not been enough hours of high price to make up for the average wholesale price of $30 per MWh.

Texas generators argue that other competitive markets such as in Pennsylvania, New Jersey and Maryland (PJM) allow plants to earn a monthly payment simply by being prepared to run even if no electricity is produced. The PJM “capacity payment,” awarded to winning bidders in an annual capacity auction, provides a more steady cash flow to generators. If demand for electricity is soft, the generator still earns a capacity payment. In PJM, the cost of providing capacity payments to generators is cranked into the delivery charge of the monthly bill and passed along to the consumer. The reserve margin in PJM is approximately 16%.

But capacity payments are not the only solution being considered. Another aspect of managing the electric grid known as demand response (DR) has recently leapt to the forefront. By compensating customers who agree in advance to be curtailed during periods of high demand, supply and demand can be matched by disconnecting load instead of cranking up the next peaking power plant.

ERCOT is just now getting its head around demand response. On the hottest summer days, more than 50% of the total electricity demand is from residential air conditioning. By using the existing smart meter network, demand response could be aggregated to offer incentives to participating customers. Some think that DR could be ramped up to 10,000 MW from the current level of more than 2000 MW.

Meanwhile, political pressure is mounting for ERCOT to institute a capacity market now and not wait to see if DR can solve the problem. Forced disconnection of load, even if infrequent and at low MW levels, leads to public outcry. The word on the street is that before the end of 2013, the Texas Public Utility Commission will instruct ERCOT to set a mandatory reserve margin and some form of capacity market. To the extent that the ERCOT reserve margin is determined administratively instead of by market forces, the annual cost to electricity consumers could exceed $1 billion.

-Mark Axford

Warming up the planet

“Human influence on the climate system is clear. This is evident in most regions of the globe,” a new assessment by the Intergovernmental Panel on Climate Change (IPCC) concludes. The IPCC believes that human influence has been the dominant cause of the observed warming since the mid-20th century.

Each of the last three decades has been successively warmer at the Earth’s surface than any preceding decade since 1850, reports the Summary for Policymakers of the IPCC Working Group I assessment report, Climate Change 2013: the Physical Science Basis, approved by member governments of the IPCC in Stockholm, Sweden.

“Our assessment of the science finds that the atmosphere and ocean have warmed, the amount of snow and ice has diminished, the global mean sea level has risen and the concentrations of greenhouse gases have increased,” said Qin Dahe, Co-Chair of IPCC Working Group I.

Global surface temperature change for the end of the 21st century is projected to be likely to exceed 1.5°C relative to 1850 to 1900 in all but the lowest scenario considered, and likely to exceed 2°C for the two high scenarios, said the report.

www.climatechange2013.org

U.S. to beat Saudi oil

The U.S. Energy Information Administration estimates that the U.S. will be the world’s top producer of petroleum and natural gas hydrocarbons in 2013, surpassing Russia and Saudi Arabia.

Since 2008, U.S. petroleum production has increased 7 quadrillion Btu, with dramatic growth in Texas and North Dakota. Natural gas production has increased by 3 quadrillion Btu over the same period, with much of this growth coming from the eastern U.S. Russia and Saudi Arabia each increased their combined hydrocarbon output by about 1 quadrillion Btu over the past five years.

German coal boom

The share of coal in Germany’s power generation mix has risen to 52% in the first-half of this year amid a drop in output from gasfired power plants and wind turbines, said research organization Fraunhofer Institute (ISE). Coal-fired plants stepped up electricity production by about 5% to 130.3 TWh in the first six months of 2013 as output from gas-fired plants fell 17% to 21.9 TWh, said ISE. Wind power production dropped 10% to 22.4 TWh, while solar output was unchanged at 14.3 TWh. Hydro output rose 3% to 9.2 TWh, with nuclear output up 1.8% to 46 TWh.

Kazakhstan-China pipeline

Rolls-Royce has won a $175 million contract to supply Asia Gas Pipeline LLP (AGP) with equipment and related services to power the flow of natural gas through Kazakhstan’s Line C Gas Pipeline, part of the vast 1,833km long Central Asia-China Gas Pipeline network. Rolls-Royce will supply AGP with twelve RB211 gas turbine driven pipeline compressor units which will operate at four compressor stations along the 1,115km Line C Pipeline.

Emerson control contracts

Emerson Process Management has been awarded contracts to modernize controls of multiple hydropower plants and a dispatch center for AES Tietê in Brazil. Adopting Emerson’s Ovation control and SCADA technology is said to boost reliability, flexibility and efficiency. Emerson also replaced aging controls with its Ovation control system at Westport 5 Generating Station in Baltimore, Maryland. The power plant is owned by Exelon Generation. This 116 MW simple-cycle peaking unit consists of eight Pratt & Whitney aircraft GG4-7 gas generators coupled with four Worthington Model ER-224 doubleflow expander turbines.

Pump orders

Sulzer Pumps will supply 42 pumps for installation on two Floating Production Storage and Offloading (FPSO) vessels that will operate off the coast of Rio de Janeiro, Brazil. They contain API 610 BB5 pump models driven by a 5.5 MW electric motors while the seawater lift pump packages consist of vertical pumps driven by 960 kW submersible electric motors. The pump packages are scheduled for delivery in 2014. Sulzer will also supply 69 pumps to Daewoo Shipbuilding and Marine Engineering for installation on an FPSO vessel for Western Australia, scheduled for delivery in several phases between mid-2013 and mid-2014.

South Africa plants planned

A consortium led by GDF Suez has awarded Ansaldo Energia a 440 million euro contract for the turnkey construction of two open-cycle, peak-power generation plants in South Africa. In about two years the Avon plant will generate 670 MW in the Durban area, whereas the Dedisa plant will provide about 335 MW to the Port Elizabeth area. Ansaldo Energia will supply six AE94.2 gas turbines plus generators and auxiliary systems.

Turboexpander to Russia

L.A. Turbine has shipped its first Russian turboexpander-compressor order to a Lukoil gas processing plant in Perm. Commissioning is scheduled for mid-summer 2014. The L2000 expander-compressor unit with lube oil and seal gas system, and a PLC panel was manufactured within L.A. Turbine’s Valencia, California facility.

Book review

Following his 1993 book, Turbomachinery Rotordynamics; Phenomena, Modeling and Analysis, Dr. Dara Childs, Director of the Turbomachinery Laboratory at Texas A&M University, follows up with Turbomachinery Rotordynamics with Case Studies. Dr. Childs has worked for over 50 years on rotordynamic issues related to rocket-engine turbopumps and commercial turbomachinery.

This book is a compilation of 33 rotordynamic case studies from centrifugal pumps, compressors and steam turbines. The book updates relevant test data related to component models for seals, bearings and rotors, and identifies new effects including Morton Effect synchronous response instabilities and excitation of rotors to identify natural frequencies and damping factors. This volume is recommended as an introduction for those with vibration backgrounds or as a reference for working engineers. It is available from amazon.com.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.