Europe’s energy world: More complex and changing

Keynote presenters at the PowerGen Europe conference and exhibition in Amsterdam last month touched on several pressing issues that, they maintain, must be addressed if Europe is to have secure, affordable and sustainable energy in the coming years.

Maria van der Hoeven, executive director of the International Energy Agency (IEA) debunked the theory that large utilities have no place in a low-carbon Europe. “Equating a low-carbon energy system with the demise of large-scale utilities is an over-simplification,” she asserted. “Large utilities are absolutely essential to fulfilling Europe’s energy demands.”

However, she added, there is no going back from the low-carbon energy transition. A holistic approach is needed if we are to tackle climate change. She urged a market that accurately reflects the physical reality of the electricity system in terms of when and where power is used. “National capacity markets are not the right solution in terms of an integrated European energy system.”

Van der Hoeven pointed out that siting low-carbon energy projects, such as wind farms, solar towers and geothermal plants is easier said than done. They face a growing number of challenges today, and a “new breed of syndrome,” known as NIMBY (not in my back yard), NUMBY (not under my back yard), NOMBY (not over my back yard) and NOMH (not on my horizon).

Van der Hoeven was joined by the European Commission’s Marie Donnelly, who echoed the IEA Director’s integrated energy approach. “Rather than continue to operate with 28 separate boxes of energy, we must collaborate across member states to deal with the challenges of energy ― security of supply, competitiveness, affordability and sustainability of our energy system,” said the Director for Renewables, Research and Energy Efficiency.

The EU spends 400 billion euros per year importing more than 60% of its energy needs, said Donnelly, yet has little or no impact on the security and price of oil and gas. “What happens globally affects Europe. We have a high level of exposure.” She provided three examples: The shale gas revolution in the U.S. has impacted EU gas and oil prices; Fukushima has led to the closure of German nuclear power plants; and Russia’s threat of shutting off EU gasis ever-present.

The good news is that on June 8, at the Energy Ministers meeting in Luxembourg, 12 member states signed a declaration of collaboration. For the first time, European energy ministers committed to jointly assessing generating adequacy outside their borders. And they committed to allow peak prices to be the market mechanism for moving electricity across borders.

(The European Commission’s Marie Donnelly)

The market should inform energy investors when and where they should spend their money, Donnelly said. Not delivering power at peak is just as valuable as delivering power at peak. Integration of renewables and storage suppliers should be rewarded.

“The EU is the first region in the world to decouple GDP growth and energy consumption,” she added. “In Europe, our first fuel is energy efficiency. The fuel that you don’t use is the cheapest fuel that exists.”

“Power generation and energy policies are becoming more and more complex,” proclaimed Wolfgang Konrad, chief executive of the Siemens Distributed Energy Unit in the Power and Gas Division, the last keynoter to present. “Conventional power generation will not go away in the coming years, but it must be augmented with intelligence ― how to match demand and availability.”

The status of the grid is a challenge, he said. In the past, energy was produced centrally and distributed out. Today we need a different grid because we need to collect energy generated afar by wind and solar and move it into the center.

“European energy demand is expected to double in the next ten years,” he added. And distributed generation will exceed 50% ―“an irreversible trend.” Flexibility will play a key role. But it will not be one answer. “There will be many answers to the challenge of the future, and I’m absolutely confident that gas turbines will be part of these answers.”

New products and services

A host of new products and services were introduced at PowerGen Europe.

Siemens presented SPPA-T3000 Cue ― the latest release of its instrumentation and control system for power generation. The Cue optimizes the Human-Machine Interface (HMI) using new tools, features and integrated applications. These are said to help personnel interact with the system more efficiently and more effectively.

SPPA-T3000 Cue also supplies the control room staff with context-based and targeted information “cues,” enabling them to react reliably and more quickly to all processes in the power plant, both in day-to-day work and in critical situations. This reduces the error rate, promoting smooth operation and high availability.

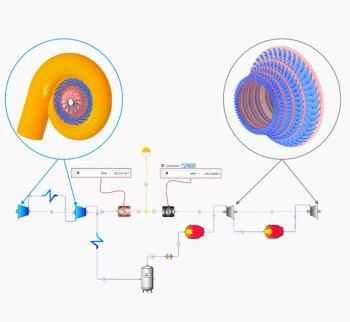

Siemens also presented the next upgrade of its model SGT-800 industrial gas turbine. This gas turbine is now also available with a power output of 53 MW and an electrical efficiency of 39% in simple cycle application.

In a 2x1 combined cycle configuration the power output is 150 MW at a net efficiency of more than 56% with the same robust dual-fuel Dry Low Emission (DLE) system capable of NOx levels below 15 ppm and CO emissions below 5ppm. This upgraded turbine will be offered in addition to the two current SGT-800 versions with power outputs of 47.5 MW and 50.5 MW, respectively.

GE announced the launch of its “Reliability Excellence” software solution at a 445-MW gas combined cycle plant near the city of Cork, Ireland. Powered by Predix, the software’s cloud technology unifies the flow of data across all plant and fleet assets. It detects operational anomalies, including combustion dynamics and parts degradation before they become serious issues that could force the plant offline for costly unplanned repairs.

Phase two of the project

Phase two of the project will include an operations module for process optimization and operational excellence, providing performance analytics to multiple levels of the facility. These analytics will help customers identify actions for lowering production costs, increasing plant capability and improving system reliability.

GE also introduced to Europe its OpFlex controls software. The steam turbine agility technology improves start times of legacy combined-cycle plants featuring GE gas and steam turbines. Benefits include:

· Up to a 50% reduction in steam turbine start times

· Reduced startup fuel costs and emissions

· More predictable and repeatable combined-cycle start times

· Reduced potential for missed dispatch commitments.

Reintjes unveiled its new high-speed gearboxes ― RTG 280 –1,000 and 1,400 – 50,000 kW. The RTGs have been developed for turbine drives in industrial applications. The units’ gearing is double-helical, case-hardened and ground; housing is cast or welded design; bearings are slide, offset halves and cylindrical; and includes monitoring for shaft and housing vibrations and temperatures. Accessories include a rotor-turning device, lube oil pump, and couplings.

Sulzer introduced to the power market its SJT/SJM CWP vertical pump. The SJT can be used as a cooling water pump in utility and industrial power stations, as well as for over-all water services. The SJT has a fabricated suction bell and bowl casing, incorporating swirl break for a stable pump performance curve. It is sized for maximum torque, and the line shaft is connected by split ring, key and sleeve couplings to ease maintenance.

Voith Turbo’s SelConLinear Actuator combines the advantages of hydraulic and electromechanical solutions. The hydraulics provides high-force density and dynamics; the electromechanical side contributes simple, cost-effective system integration. Large effective forces up to 500 kN and ATEX certification allow it to be used on turbines under virtually all conceivable ambient conditions.

MAN Diesel & Turbo introduced a new line of turbocharged gas engines. Both of the company’s models 35/44G and 51/60G are now also available with two-stage turbochargers. The 35/44G TS and the 51/60G TS are spark-ignited turbocharged engines. The 35/60G TS is available in 12V- and 20V-cylinder versions with mechanical outputs of 7.4 MW and 12.4 MW. The 51/60G TS can be delivered as an 18-cylinder version with outputs of 18.9 MW and 20.7 MW. While the 18.9 MW aggregate reaches a mechanical efficiency of more than 50%, the 20.7 MW machine is the most powerful gas engine currently available on the market.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.