FT4000: UP AND RUNNING BY THE END OF 2013

Peter Christman, President Pratt & Whitney Power Systems, spoke about industry trends, company developments and future plans.

Where are your strongest markets?

The Middle East and South America. We had recent success in Algeria with a company called Sonelgaz, a distributor of electricity. It purchased 22 of our FT8 MobilePacs for distributed generation in remote areas of the country. They install MobilePacs in areas where they may have plans for central stations. In a few years, after the central station gets built, they switch over. We also continue to see activity in Argentina and Brazil.

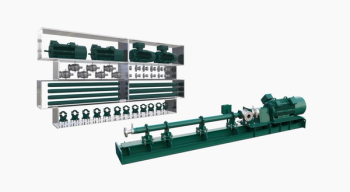

What is the status of the FT4000 SwiftPac?

We’re in active development and plan to have a unit up and running by the end of 2013, and full production in 2014. These machines will mostly be used for peaking, intermediate and backup operations, running 1,000 to 1,500 hours per year.

We’re pleased with the evolution of the program. We’ve been talking to our FT8 customers, who are scattered around the world. They embrace the FT4000 concept. Development work is being done in East Hartford.

Are you targeting India?

It’s an interesting and difficult market. UTC opened an office in Delhi a couple of years ago and we took a chunk of it for Power Systems. We’ve had successes repairing industrial gas turbines for reputable Indian users, and we see near term potential for our Organic Rankine Cycle products, particularly in geothermal, waste heat recovery, and biomass applications. We know we can help solve some of the power infrastructure challenges created there by rapid economic growth. The power sector in India is evolving, but the need for dedicated peaking generation isn’t as robust as it should be. The country should value electricity reliability the way the rest of the world does.

Are you producing parts for other OEM’s heavy frame machines?

Yes. Specifically, the GE Frame 7FA. We have parts for the full hot-gas path, plus combustion. We’ve also designed parts for low-temperature E class machines, but not to that extent. We like the high-temperature area — the more advanced machines. Our technology is better suited, when based on materials and engineering capability. Our objective isn’t to make a part that meets OEM specs, but to exceed them.

It takes about 18 months to develop a part from start to finish. We’re in the process of adding a couple of parts families — moving to the 9F and a Siemens machine.

Our segment of the aftermarket has held fairly constant through the recession. Most gas turbines are getting more runtime now than before, given the low price of gas. We expect that business to grow with the high utilization rate.

Update us on the Wood Group alliance.

So far, so good. We supply the parts and repair capability and technology, and Wood Group provides the worldwide network of onsite services facilities. We’ve had a historical relationship with Wood Group that dates back to 1998. We felt this was a natural expansion of our relationship. They have day-to-day management responsibility.

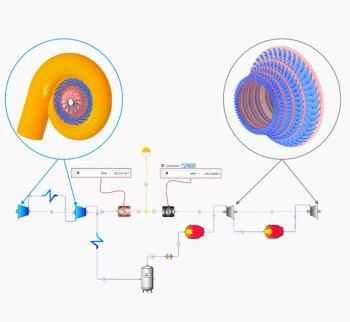

How is Turboden’s business?

Turboden had 30% sales growth last year and 70% this year, driven mostly by European incentives for renewables. We’re expanding the product line — making larger units, many in biomass applications. We’re delivering our first Organic Rankine Cycle biomass, waste-heat unit to Nechako Green Energy in British Columbia, Canada, and just announced another biomass ORC sale for West Fraser Timber Company, also in B.C. We recently entered the UK market with a sale for Heathrow Airport and the headquarters building of British Sky Broadcasting.

What is the status of Pratt & Whitney RocketDyne?

In March, UTC put Pratt & Whitney RocketDyne, Clipper Windpower and three of Hamilton Sundstrand’s industrial businesses on the block to help finance the acquisition of Goodrich Corp. Three different vendors will be involved. Rocketdyne is the most advanced deal. Coal gasification as well as solar power will go with the Rocketdyne business. I expect an announcement later this year.

Why Clipper Windpower?

The wind market is very crowded. There are 10-to-15 companies in this sector and not enough market for them all. They all jumped in and thought the world would go hard on renewables. It didn’t. In the long term, wind and renewables won’t go away, but they will be far less than anyone expected. Look where natural gas prices are. You are far more cost effective with a gas plant than a wind turbine. It’s hard to compete. Gas will be a stable fuel for the foreseeable future. The wind industry has to readjust, but Clipper will be a good fit for a company that has wind as its core.

Looking ahead?

Right now we have a nicely balanced portfolio of products and services. We are looking forward to having the FT4000 up and running. Once we introduce that our company will take the next step in its evolution.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.