Industry News: January/February 2014

Siemens, Wood Group JV

Wood Group and Siemens have formed a joint venture (JV) consisting of the maintenance and power solutions businesses of Wood Group GTS (excluding its Rolls Wood Group, TransCanada Turbines and Sulzer Wood JVs), and Siemens’ TurboCare business unit.

The JV hopes to bring together two organizations with complementary strengths and customer bases. Shareholding will be split 51% - 49% Wood Group : Siemens. It will service Siemens turbines, GE industrial frame machines, some aeroderivatives, as well as equipment from Solar Turbines, MHI and Alstom/ABB.

“Our joint ventures with OEM relationships typically deliver stronger performance, and, as we look ahead, we see good potential for the JV,” said Bob Keiller, CEO of Wood Group.

The deal brings together Wood Group’s capabilities in the areas of asset operations, maintenance, risk management and life-cycle optimization with the aftermarket design, repair and manufacturing capabilities of TurboCare. Combined, these companies represent about $1 billion in revenue and around 4,500 employees around the world.

Mark Dobler, CEO of Wood Group GTS, noted that a dialogue on some kind of partnership has existed between both parties for a decade, and that they rarely bump into each other as competitors. While TurboCare has invested more in facilities and repair shops around the world, Wood Group has focused on the long-term management of assets. As such, it has approximately 10,000 MW under contract currently.

“Our GTS division has been dissolved,” said Dobler. “Wood Group’s JV with Pratt and Whitney is included in this agreement.”

Meanwhile, work continues to be done to figure out the best way to brand the two. Whether the names GTS, Wood Group or TurboCare will be used remains to be seen.

Cameron offloads recips

Cameron is selling its reciprocating compression division to GE Oil & Gas for $550 million. This division provides reciprocating compression equipment and aftermarket parts and services for oil & gas production, gas processing, gas distribution and independent power. It generated sales of about $355 million in 2012, has around 900 employees and operates from 20 locations around the world. The acquisition is expected to close later this year subject to regulatory approval.

GE Oil & Gas intends to add these recips to its gas gathering, gas lift and injection, transmission and storage equipment portfolio as part of its downstream technology solutions business. This GE Oil & Gas unit provides products, packaged solutions and services for refining, petrochemical, industrial and natural gas users, including compression, power generation, pumps, valves, smaller-scale CNG and modular LNG plants.

GE Oil & Gas is also acquiring Allen Gearing Solutions (Allen Gears), a privately held designer, manufacturer and service provider of gears for industrial and marine applications. The move comes two years after GE acquired a 35% minority interest in the business.

Allen Gears employs about 160 people and has one manufacturing facility in Pershore, UK. The company produces high-speed, high-power gearing, specializing in epicyclic gears that are lighter, more compact and typically have a higher power density than more traditional parallel shaft gear systems.

Book review

Gas Turbine Powerhouse: The development of the Power Generation Gas Turbine at BBC-ABB-Alstom, by Professor Dietrich Eckardt digs into the historic archives of BBC-ABB to capture the early developments that preceded the birth of the first industrial gas turbine in 1939. Engineers young and old, technical historians and engineering students will find this work a valuable acquisition.

The book chronicles the humble beginnings of two men. Charles Brown was an electrical engineer born in Switzerland and the son of an English steam engineer. Walter Boveri was a mechanical engineer from Bavaria. The synergy of Brown as inventor and Boveri as entrepreneur and businessman blossomed into Brown Boveri Corporation (BBC), a company responsible for developments such as the transmission of AC power over long distances and the step-up transformer to increase the voltage as high as 15 kV. These breakthroughs sparked the rapid application of electrical power.

In an age of reciprocating steam engines, Brown wanted a high-speed driver for his high-speed AC generators. He signed an agreement with Parsons for the axial flow steam turbine, with the first unit built in Switzerland in 1901. This model accounted for 50% of the company’s sales volume by 1905.

The author incorporates many anecdotes, such as how a paraffin turbine-driven compressed air naval torpedo triggered engineer Walter Noack of turbocharger fame to grasp the potential of compact turbomachinery and how it would be far less complex than the predominant steam turbines drivers and steam engines of the day. The post-war period is also covered in detail with section on liquid fuels, intercooled reheat recuperative designs and combined GT and steam cycles for greater efficiency. By Septimus van der Linden

Centrax units at Ust Teguss field in Siberia[/caption]

Siberian GT package

Commissioning has begun on 12 Centrax packages, each comprising a single 5.2 MW Rolls-Royce 501-KB7 gas turbine, for service at the Ust Teguss field in Western Siberia. With a total generating capacity of 62.4MW, the Centrax units will run on gas recovered from oil drilling operations, which would normally be flared.

Texas power

The future of the Texas electric market will very likely include substantial amounts of renewable energy and gas-fired power, economists with The Brattle Group found in a report prepared for the Texas Clean Energy Coalition (TCEC) titled, “Exploring Natural Gas and Renewables in ERCOT, Part II: Future Generation Scenarios for Texas.”

With over 12,000 megawatts of installed capacity, Texas is the largest state producer of wind-powered electricity in the U.S. Texas is also the leading U.S. producer of natural gas, and the state generates over 40% of its electricity from natural gas plants. No new coal plants are anticipated.

In the more likely scenarios postulated, wind and solar grow from their current 10% generation share to levels between 25% and 43%. Natural gas-fired generation provides all of the remaining incremental generation, adding 12 to 25 GW of new combined-cycle capacity, a 38% to 80% increase in the current installed base. Nearly all future additions are likely to be combined-cycle gas turbine (CCGT) plants rather than traditional gas turbines.

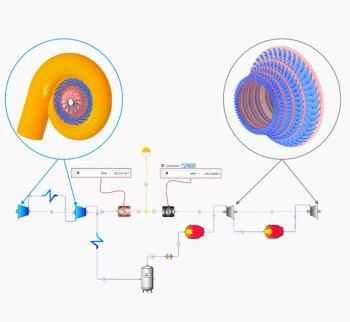

Combined cycle LNG ships

A combined gas turbine and steam (COGES) plant for merchant vessels it to be built as an LNG carrier. It will feature one LM2500 25 MW gas turbine, one steam turbine generator-set and two dual-fuel diesel generator-sets for low power operation and backup. The vessel will allow for flexible configuration of prime movers, offering a total installed power of more than 50 MW if required. The GE gas turbines can be equipped with a GE Dry Low Emissions (DLE) or single annular combustion system.

Oil-free sealed compressor

MAN Diesel & Turbo in Zurich was awarded a contract for a HOFIM compressor (High-Speed, Oil-Free, Integrated Motor), the first such model to be installed on an offshore production platform — the Ivar Aasen in the North Sea, run by Det norske oljeselskap ASA.The HOFIM compressor unit is similar to MAN’s subsea compressors. It uses a high-speed motor and active magnetic bearings.

There is no need for dynamic seals which makes the compressor system hermetically sealed. The absence of the dry gas seal system and of the complete oil system reduces the complexity and this leads to the improved system reliability. The required footprint shrinks by 60% and mass weight on the compressor installation drops by 30% compared to traditional compressor designs. The order for Ivar Aasen comprises a multistage radial compressor arranged in tandem configuration around a centrally positioned 9.5 W high-speed electrical motor.

Assembly of a Siemens SGT6-8000H gas turbine[/caption]

More Siemens H-class orders

Siemens Energy has received an order to supply two integrated power islands fitted with H-class gas turbines for the Patriot combined-cycle power plant (CCPP) in Pennsylvania. It will have a generating capacity of 829 MW in combined-cycle duty. This is the second project awarded by Panda Power Funds in Pennsylvania following the Liberty order announced in August of 2013.

The complete power plant is to be erected by Gemma-Lane Patriot Partners, an Engineering, Procurement, and Construction contractor in the U.S. The order volume for Siemens, including a long-term maintenance and service contract, is approximately $400 million. Commissioning of the plant is scheduled for 2016. This order marks the 27th H-class gas turbines sold by Siemens worldwide.

Patriot CCPP, which will fire local shale gas, is to be erected in Clinton Township in Pennsylvania. Like its sister plant Liberty CCPP, Patriot will also be comprised of two power islands, both designed as single-shaft configurations, meaning that the gas turbine and steam turbine are arranged on one shaft and drive the same generator.

Single-shaft units offer economic advantages due to lower investment costs, efficiency and flexibility during operation. Each power inland will consist of one SGT6- 8000H gas turbine, one SST6-5000 steam turbine, one hydrogen-cooled SGen6- 2000H generator, and one heat recovery steam generator, along with the complete electrical system and SPPA-T3000 instrumentation and control system.

Shale boom

U.S. natural gas & oil production has boomed in the past few years. Not too long ago many skeptics thought that oil & gas produced from shale fracking was only a bubble about to pop, but experts now all seem to agree that U.S. gas and oil production is here for the long run.

Oil & gas production has risen to the point where it is predicted that the U.S. will become oil & gas independent within 10 years. The general consensus is that fracking, if handled prudently and closely monitored, can be accomplished safely.

There are three major producing areas for shale oil & gas in the U.S.: Texas, North Dakota and Pennsylvania. Another highpotential area in Arkansas has recently been announced, but it will take several years to become a reality. The Texas Eagle Ford region runs deep into northern Mexico, but Pemex, the Mexican national oil administration, does not have the funds or knowhow to move forward with shale fracking. That government has passed a law to allow foreign companies to frack drill in Mexico.

To beef up distribution, a 700-mile, 40- inch diameter gas pipeline has been approved to pump gas to Mexico. Natural gas liquefaction plants are also being built to ship LNG globally.

This sets the scene for more combined cycle plants to be installed in the U.S. For example, a 540 MW combined cycle plant is being built at Marble Falls, Texas. It is using two GE HD Frame 7 FA units and is expected to start up this summer. By Ivan Rice

Kingsbury’s

New Repair Facility

Kingsbury has broken ground on a 33,000- square-foot bearing repair and service facility in Yuba City, California to be complete in September. The location was chosen because of the proximity to hydroelectric, steam and gas power plants in the Western states. The facility is purpose-built for repair and field service of all types of fluid-film babbitted bearings

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.