Mitsubishi Hitachi Fossil Fuel Business Merger Means Heightened Competition in Americas

David M. Walsh was recently appointed as President and Chief Executive Officer of the newly formed Mitsubishi Hitachi Power Systems Americas, Inc. (MHPSA). In addition to his responsibilities for all aspects of the business in the Western Hemisphere, he is a Corporate Officer of MHPSA’s parent company, Mitsubishi Hitachi Power Systems, Ltd. in Japan. In this interview, he talks about the reasons for the joint venture (JV), the expanded product and service portfolio, and how customers are viewing efficiency versus flexibility.

What was your history prior to MHPSA?

I previously served the company as Senior Vice President of Sales & Marketing, Projects and Services, joining in 2001. Initially my responsibilities included Mitsubishi Power Systems Americas’ Western Hemisphere power generation service and manufacturing business, field and plant service, parts manufacturing, and marketing for services in the Americas. Prior to that, I had been a senior executive at Westinghouse in both power generation and industrial service roles responsible for global plant based service activities, and later their power joint ventures (JVs) in China.

How will the Mitsubishi-Hitachi partnership impact the turbomachinery space?

With a global workforce of 23,000 employees and annual revenues of $12.4 billion, we have collectively provided more than 6,000 gas turbines, steam turbines and boilers to the market. Our global presence when viewed on a combined basis is complementary: former Hitachi operations bring stronger localized presence and activity in markets such as Germany, Africa and South America. From the standpoint of products offered, a deeper global Air Quality Control Systems (AQCS) capability will emerge jointly as well as a broader steam turbine and boiler product line offering.

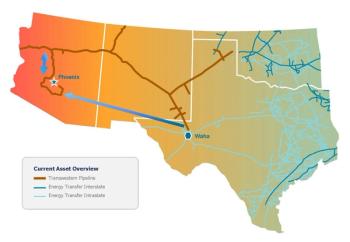

As an example, the JV’s expanded presence now possesses the largest distributed network of plant-based generation service capacity in North America, including operations in Orlando, St. Louis, Saskatoon, Savannah and Houston. In addition, our combined resources and assets within the Americas make us a larger competitive presence.

Tell me what the former Hitachi operations bring to the table?

MHPSA has a competitive product offering in the small to mid-range gas turbine market. We offer three turbines in the 15 MW to 100 MW range which complement our original product line spanning from 185 MW to 470 MW across 50 and 60 cycle simple cycle operation. Our greater range of steam turbine offerings, air quality and Selective David M. Walsh was recently appointed as President and Chief Executive Officer of the newly formed Mitsubishi Hitachi Power Systems Americas, Inc. (MHPSA). In addition to his responsibilities for all aspects of the business in the Western Hemisphere, he is a Corporate Officer of MHPSA’s parent company, Mitsubishi Hitachi Power Systems, Ltd. in Japan. In this interview, he talks about the reasons for the joint venture (JV), the expanded product and service portfolio, and how customers are viewing efficiency versus flexibility. Catalytic Reduction (SCR) products combine to allow us to provide more complete product solutions on a packaged basis.

The MD&A brand and franchise in North America will augment our existing service activity on Mitsubishi and Westinghouse technology with a broader presence across other OEM technology. Our MHPSA Energy and Environmental operations in Basking Ridge (formerly Hitachi Americas) provide a window for us collectively into the solid fuel AQCS and boiler service markets. Our MHPS Canada operations in Saskatoon and Calgary provide localized service, as well as a potential in-source opportunity for us relative to the manufacture of turbine island BOP and turbine stationaries.

How will operations and support be allocated?

Over the next several years, the goal is to integrate operations as much as possible, particularly where obvious cost, scope of supply and speed to market advantages can be provided. In the near term, the focus of our Orlando- and Savannah-based operations will remain primarily on new gas and steam turbines, and related services. Our Basking Ridge, NJ operations will focus on SCR and other air quality control technology, as well as boiler services. Our Saskatoon Manufacturing Plant has a history of providing gas turbine casings, other stationary components, pressure vessels, piping, turbine services and heavy fabricated components.

What can you tell me about your strategic direction?

Our objective in the long run is to be the largest and most competitive supplier of fossil generating equipment and related environmental technology and services, regardless of original boiler or turbine technology. Our wider range of turbines and associated equipment can now be manufactured within our North American factory network, which should translate into time and cost advantages.

The peaking and distributed generation markets will also be key areas of growth for us given the FT 8 and FT 4000 product line our MHI parent brings to bear via PW Power Systems activity, along with our smaller industrial frame gas turbines.

Where are you gaining most turbomachinery orders?

We have sold 30 J-class machines, 28 in 60 Hz and 2 in 50 Hz. We also introduced an air cooled J-class counterpart that is accumulating operating hours in Korea, and our T-point validation plant. Meanwhile, we have sold 27 air cooled G-class turbines worldwide, including 3 in 50 Hz. That takes our G-class fleet to 87 units either operating or ordered. On the steam turbine side, we are offering a single reheat turbine (SRT) with a 50-inch steel last stage blade for 60 Hz.

In North America we are adding to some 3,800 MW in aggregate combined cycle technology. This includes units under construction for Dominion Energy, PGE, and Enmax. Awards by ODEC, Tenaska, Transalta and our first U.S. based J at GRDA.

What technological elements drive efficiency?

Combined cycle efficiency is driven by two factors: The GT itself, and how it is integrated into plant elements such as the HRSG and steam turbine. In our case key technology differentiators for our GTs are: the ability of internal parts to endure higher and higher firing temperatures with no sacrifice to life and durability; and the ability to rapidly optimize tuning across ambient temperature swings. With respect to the bottoming cycle, our new SRT 50 steam turbine is designed to optimize the added exhaust flow, and resulting steam flow from these much larger CT’s. We are confident in our expertise and experience in plant integration. As for the GT, the firing temperature of our J-class is the highest demonstrated in the world, and that directly impacts achievable efficiency.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.