Oil & Gas industry goes from feast to famine

Just a few months ago, the oil & gas industry wallowed in the comfort of oil priced well over $100 a barrel, a range it had enjoyed for many years. Fast forward to early February 2015: those attending the GE Oil & Gas Annual Meeting (AM) in Florence, Italy faced prices below the $60 mark. The shockwaves from this tectonic shift were still reverberating as the conference began.

The consensus among the giants of the oil & gas industry is that they had gotten complacent during the years of feast. Projects had become bloated, budgets overinflated, environments more extreme and engineering overly complicated.

To make matters worse, most speakers believe that crude oil prices won’t rise significantly in the near future. With several years of famine likely to face these organizations, many voiced the need to tighten their belts, increase efficiency and lower costs. Some demanded better equipment at lower cost from the turbomachinery sector.

Mexican gas reform

While the industry is in turmoil, the likelihood of a lengthy period of austerity was not reflected in the attendance – over 1300, well up on previous years. Despite the backdrop of low rates per barrel, the mood of the conference was far from pessimistic. Emilio Lozoya, CEO of Mexico’s national gas company PEMEX briefed the audience on the massive changes that have swept across the Mexican energy sector over the last 18 months.

PEMEX burns fuel oil at most of its facilities, but it is in the midst of switching to natural gas and cogeneration. This will help the company transform itself from being the largest consumer (6% of Mexico’s energy) to being its largest supplier (10%).

The big news for the turbomachinery sector is that Mexico is building thousands of miles of natural gas pipeline over the next five years, expanding its current infrastructure by 75%. Lozoya called for partners to assist in this endeavor.

Key challenges

Competitiveness and carbon efficiency were among the challenges outlined during a keynote by the CEO of Statoil. The recent price collapse made him realize that the company had to choice but to improve cost effectiveness. This includes optimizing how they work with suppliers while simplifying relationships and lowering emissions.

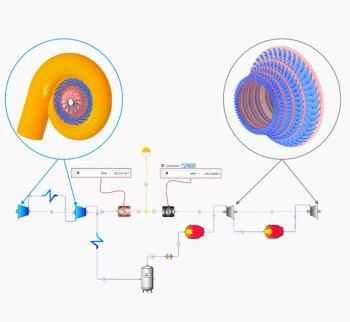

Statoil has launched a partnership with GE to develop lower cost, low-carbon and more fuel efficient compressors, GTs and others equipment. A joint venture of GE, Ferus Natural Gas Fuels and Statoil is developing a Last Mile Fueling Solution for the Bakken oilfield operations in North Dakota. It captures flare gas, using it to power Statoil’s drill rigs and fuel its hydraulic fracturing operations. This enables Statoil to comply with new flaring regulations at a time when approximately 30 percent of natural gas produced in the state is flared as waste.

Another example is collaboration with GE on its CNG in a Box technology. By capturing natural gas that would otherwise be burned, it can be converted into Compressed Natural Gas (CNG) and used to fuel rigs, vehicles and other equipment. A side benefit is to lessen the need for diesel and gain revenue from the sale of gas. Further, Statoil has ongoing programs to develop floating wind turbines as well as Carbon Capture and Storage (CCS) facilities.

Cutbacks

Prepare, then, for significant change in the oil & gas exploration landscape. Deep offshore rigs, oil sands and other higher cost environments will probably be phased out. The Middle East, meanwhile, is increasing efficiency and strengthening its infrastructural backbone. Kuwait Petroleum is assisting Iraq to lower flaring. As well as lowering emissions, this will spur more petrochemical projects.

Neil Duffin, President of ExxonMobil Development Company, said the cost basis of the industry had gotten too high. He cited over $800 billion spent in 2014 throughout the North American oil and gas industry. Far too much of this, he said, was consumed in such things as contractor backlogs which have soared over the last few years as producers went after larger and more complex projects.

He enumerated several reasons why the cost of such projects had become prohibitive. On the design side, the industry tends to take the last configuration and work from it. He gave the example of a 2003 offshore platform which is more than three times lighter than a current one with a similar basic design due to the addition of more safety features, more space for greater numbers of personnel, better alarm systems, and so on.

His hope is for greater simplicity in turbomachinery and balance of plant (BOP). By getting the first phase right, you can then get into repeatable execution of a successful design. That, in turn, makes it easier to train the contractors and the workforce.

You can read the full article as well as two more stories on trends and new turbomachinery in the March/April issue of Turbomachinery International.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.