- January/February 2023

- Volume 64

- Issue 1

Q&A: Boosting Turbomachinery Utilization in LNG Liquefaction Processes

Troy O’Steen, Director of Sales at L.A. Turbine, a provider of turboexpander compressors for LNG, talks about how the market is growing due to increased demand from power and public utilities.

TELL OUR READERS ABOUT L.A. TURBINE.

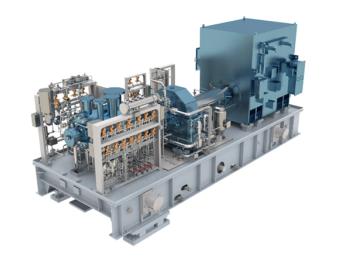

L.A. Turbine provides turboexpander compressors for use in small-scale LNG applications. The knowledge and experience from LNG applications is being applied to new turboexpander designs for clean energy solutions involving hydrogen liquefaction. Chart, our parent company, provides liquefaction solutions. These run all the way from the smallest liquefiers collecting and repurposing bio-methane to large-scale units. Chart’s involvement in natural gas liquefaction enables much collaboration between our companies.

WHAT DOES L.A. TURBINE BRING TO TURBOMACHINERY?

This year marks our 20th anniversary working with turbomachinery equipment. Our product range features a wide range of applications with specific use cases. L.A. Turbine also provides turboexpander-compressors for use in small-scale LNG applications.

CAN YOU SPEAK ON TURBOMACHINERY PROJECTS L.A. TURBINE IS CURRENTLY INVOLVED IN?

L.A. Turbine is currently building a two-stage turboexpander-compressor unit to support Chart’s Nitrogen Refrigeration Cycle Liquefaction System project at an existing U.S. LNG peak shaving facility. This project will see the replacement of the original plant built with modernized liquefaction. The configuration includes two L.A. Turbine L2000 turboexpander-compressors with one expander acting as a warm unit, the other as a cold unit. Theturboexpander is coupled to the compressor as part of the nitrogen loop.

Another is an expansion of the Atlanta Gas & Light LNG facility in Cherokee County, which will double the facility’s liquefaction and storage capacity. The project includes the installation of a second tank, allowing Atlanta Gas Light to store and access gas during peak periods. Construction is currently underway and will be completed in phases over the next three years, including the expansion of their adjacent liquefaction production facility. LNG is growing in areas where inclement weather events are common, such as the Southeastern United States, to alleviate grid instability.

WHAT ARE SOME TRENDS IN THE LNG MARKET?

Up until recently, the large-scale LNG market on liquefiers or export/import shore size facilities has seen little to no activity. Large-, mid-, and small-scale opportunities have increased due to macro tailwinds influenced by geopolitical and economic factors. Previous financial hurdles and lengthy approval cycles are reduced, with plant development and construction hurrying. There is significant activity among power and public utilities looking to upgrade aging plants along the coasts especially within mid-Atlantic and Northeastern states. In the last decade, request-for-quote activity amounted to two to three a year with typically one plant awarded annually. Now, it has increased to eight to ten a year with three to four awarded annually. For mid-scale LNG, due to Europe’s need to import LNG, there are opportunities to bring liquefaction capacity to support LNG production, transport, and storage.

HOW DOES LNG IMPACT GRID STABILITY?

Although population growth has slowed, the residential demand for electricity is increasing. Add to this heightened awareness among consumers and demands for safeguards to ensure availability and access to energy sources due to recent blackout and shutdown events. Utilities must ensure energy availability and access to the populations they serve. Investments are needed primarily in upgrades and replacements. Upgrades are often planned in the form of expansion. However, LNG facilities typically endure a lifecycle of 40 to 50 years with proper maintenance, and replacement is ultimately critical to grid sustainability.

WHERE IS LNG HEADED?

Until recently, natural gas was predominantly liquefied in expansive base-load facilities, with an exception being smaller peak shavers that are deployed during periods of high load. However, with modular mid-scale designs, instead of a single, large custom-built facility, total plant capacity can be achieved through a series of replicable modules. Chart refined the small-scale liquefaction model to provide a feasible solution for production and distribution of smaller volumes of LNG, enabling power delivery to off-grid locations. Additionally, this provides an alternative transport fuel for trucks, ships, and locomotives. The ability to move LNG to wherever it is needed is the key. The LNG market for carrier ships, for example, is growing so fast that shipbuilders are unable to fulfill orders. As a result, vessels are being retrofitted to accommodate increased demand.

Articles in this issue

almost 3 years ago

Myth: Methane Leakage Cannot Be Avoidedalmost 3 years ago

Hydraulic Actuator Tipsalmost 3 years ago

Vendor Spotlight: Riverhawkalmost 3 years ago

How PTC-10 Has Evolvedalmost 3 years ago

Recycle Gas Compressor Challengesalmost 3 years ago

LNG Sparks Turbomachinery GrowthNewsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.