TURBOMACHINERY TRENDS IN OIL & GAS

Prady Iyyanki, Vice President Turbomachinery, GE Oil & Gas, discusses LNG, trends in turbomachinery technology, and the process of preparing gas turbines for mechanical drive duty.

What trends are you seeing in oil & gas with regard to turbines and compressors?

The offshore side of the business is growing faster than onshore. I’d estimate that the offshore sector could double in the next 10 years. In South America, for example, Petrobras is moving forward with floating oil production, storage and offloading (FPSO) vessels, as are others, such as OGX (The largest private sector company in the Brazilian oil industry.)

How about LNG?

The LNG market has largely been driven by gas needs in the Far East. The cost of the gas in Japan and Korea is $12 compared to less than $3 in the U.S. So there will continue to be big demand for LNG in Asia. That’s why you are seeing lots of Australian projects being developed at the same time. That may result in some labor constraints, which could slow things down a little — but not much.

How might this trend impact the U.S. market?

There is now a business case for the U.S. to become an exporter of LNG due to the cost of gas in certain parts of the world, such as Europe and the Far East. The LNG process adds cost to gas production and it only becomes viable when the price of gas can justify it.

What are your thoughts on the role of unconventional sources of oil and gas?

Unconventionals are in large supply in the U.S. There is plenty of oil shale, shale gas and coal bed methane, for instance, and these will play an important role in the evolution of the North American market. If their promise is realized, we will see a lot of gas being exported from the U.S. When it comes to shale gas, it can be transported along natural gas pipelines.

But there are variables that are hard to predict such as price when there is an abundance of gas or regulatory changes.

Are there any notable projects you care to mention?

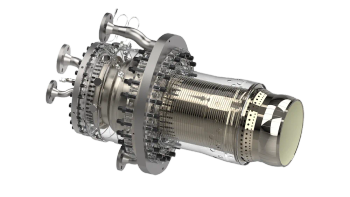

The Wheatstone LNG project in Australia is the first installation of an LM6000 mechanical drive aeroderivative gas turbine. It will have a total of 16 LM6000PFs, 12 for mechanical drive and 4 to drive generators. The mechanical drives, at 41% efficiency, will be used in the main refrigeration compression trains of the LNG facility.

On the heavy duty side, we scaled up our technology from the Frame 5 to the Frame 9. The LM6000 represents a similar scale up on the aeroderivative side. That is why it is being used in many of our oil and gas projects where light weight and high power output are in combination.

What are the challenges in transitioning a gas turbine from power generation to mechanical drive?

Converting a gas turbine to mechanical drive is complex. The combustion system, controls and overall operability characteristics are different. In power generation, efficiency is the most important factor. But with mechanical drive, it is reliability you are after. Due to that shift in emphasis, there are plenty of adaptations that become necessary, and that takes time.

Can you give some idea of what is involved?

There are only minor tweaks required to move the combustor into mechanical drive service. But far more work is needed on the controls. That means changing the software logic. It can typically take several years to convert a gas turbine for duty in mechanical drive. The LMS100, for example, is being worked on but it will take a couple more years before you see it being used for mechanical drive.

Just as an additional peculiarity involving the LM6000 mechanical drive, the load (centrifugal compressor in this case) had to be moved from the cold end to the hot end, which means from the inlet area to the exhaust area of the gas turbine. This is necessary in order to avoid the risk of the gas turbine injecting gas possibly leaking from the compressor.

Where do you see the separation between aeroderivatives and industrial frame models in oil & gas applications?

In offshore applications where footprint is a big constraint, you want lightweight technology. That’s where aeroderivatives are a much better fit. But in LNG, it can come down to customer preference. There we have some heavy duty machines and some aeroderivative turbines. The GE Frame 7, for example, is a workhorse and many customers are more comfortable with it than an LM6000 as they have had experience with it in their operations.

Can you provide a few highlights of LNG projects under development?

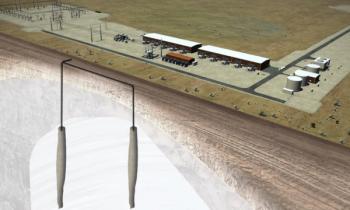

Shell Prelude will be the first time LNG will be liquefied offshore. GE Oil & Gas will supply two steam turbine-driven compressors. It will go live around the 2014-2015 timeframe. There is so much gas stranded under the ocean where you simply can’t feed in pipelines. So the gas will go straight up to the LNG terminal and will be shipped to various markets.

How about Gorgon in Australia?

Chevron Gorgon includes the world’s first 100 MW compressor (we tested it at 110 MW). This will be the biggest CO2 injection project in existence, and utilizes the largest compressor in a single casing. We see a lot of growth in CO2 injection.

Due to Australian regulations, we had to institute a quarantine zone at our Avenza site in Italy which severely restricts access and guarantees security during construction of the modules. Chevron preferred a modular solution due to environmental constraints in Australia so we are giving them ‘plug and play’ technology. This will be one of the largest LNG trains ever built.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.