U.S. POWER INDUSTRY 2012 FORECAST

SUNNY AND WINDY WITH A CHANCE OF LITIGATION

The U.S. power business underwent dramatic changes in 2011 that will shape tens of billions of dollars of fuel, construction and maintenance work for years to come.

In the U.S., Industrial Info Resources (IIR) is tracking 267 new-build generation projects with combined generating capacity of about 24.3 gigawatts (GW) that are scheduled to kick off in 2011. These projects represent $51 billion in total investment value (TIV).

The U.S. power business is extremely dynamic, particularly today. Regardless of the fuel, not all new-build power projects will start according to schedule: Some will be accelerated while others will be delayed. Next month, some projects will be cancelled while new ones will be announced. Predictions made one week have to be updated the next — just like weather forecasting.

A strategic trend that has continued in 2011, and we predict will extend into 2012 and beyond, is the greening of the U.S. electricity business. Although coal, gas and nuclear are still ranked 1-2-3 in terms ofmarket share of the electricity market, renewable generation continued its rapid growth in 2011. Over 15,000 megawatts (MW) of renewable generation valued at nearly $44 billion is scheduled to break ground in the U.S. this year, according to our data.

A relatively small but rapidly growing segment of the electric generation business, renewables like wind, solar, geothermal and biomass generation continue to change the face of the U.S. power business.

As shown in the figure (p.17), “NewU.S. Power Generation Capacity,” renewable generation accounts for about 65% of all generation projects scheduled to kick off in the 2012-2016 period, according to data tracked by IIR. Over the next five years, areas with particularly aggressive plans for renewable electric generation include the Rocky Mountains, West Coast, Midwest, Southwest and Great Lakes regions.

Renewable energy continues to enjoy wide support on CapitolHill, particularly for the construction jobs it creates.ButCongress has not yet enacted a federal renewable portfolio standard (RPS) because other, more pressing, issues have dominated the Congressional energy agenda in 2011.

Coal outlook

The coal-fired power business got some clarity on environmental regulations this year when the EPA finalized its Cross- State Air Pollution Rule in mid-2011, which covers power plants in 28 states east of the Mississippi River. This rule, previously called the Clean Air Transport Rule, replaces the Clean Air Interstate Rule (CAIR), which a federal court sent back to the agency in 2008. By 2014, the Cross-State rule will lower sulfur dioxide (SO2) and nitrogen oxide (NOx) emissions by 73% and 54%, respectively, from 2005 levels. Phase I goes into effect in January 2012. Phase II, due to go into effect in mid-2014, focuses more on NOx emissions than SO2 emissions. IIR is tracking 887 coal-fired power plants that will be affected by this rule.

In March 2011, the EPA released its draft Maximum Achievable Control Technology (MACT) rule for reducing power plant emissions of mercury and hazardous air pollutants (HAPs) for power stations larger than 25 MW. This rule, expected to be finalized later this year, will reduce power-plant emissions of mercury by 78% and particulate emissions by 31%as a co-benefit.Owners of coal- or oil-fired generation would have four years to comply with the new standards. The EPA estimated that about 1,350 generating units in the U.S. would be affected. This ruling replaces the Clean Air Mercury Rule (CAMR), which a federal court remanded to the EPA in 2008.

Weeks prior to the release of the draft MACT rule, the EPA asked a federal court for a 12-24 month extension to complete work on the rule. The agency wanted more time to address the over 4,000 comments that were still pending at the time. The federal court denied the EPA’s request and gave it a 21-day extension, until lateMarch. Since the denial and the release of the draft regulation, the EPA has been preparing itself for additional litigation on theMACT rule.

We are already seeing several generation owners not waiting for another court battle and taking measures to comply with stricter emissions standards. Others, however, are waiting until the dust settles. Once that happens, we may see just over $10.6 billion in environmental retrofit projects to bring affected generators into compliance over the next four to five years. TheMACT rule also could force the retirement of just over 10 GWof generation capacity by 2015, mostly smaller and less-efficient units predominantly located in theMidwest and Southeast.

So far in 2011, the EPAhas not advanced another regulation, the Coal Combustion Residues Rule (CCRR). The agency proposed that rule in June 2010 to address the storage and disposal of coal combustion residues, commonly known as coal ash. EPA action on this issue followed an ash pond release at the Tennessee Valley Authority’s Kingston power plant in late 2008. EPA’s 2010 draft CCRR applied to over 500 coalfired power plants and their surface ash impoundments and landfills.

It classified coal ash as either aClass “C” hazardous waste (which would be phased out within five years) or a Class “D” hazardous waste (which would be phased out much faster).Although there was no specific date for finalizing this rule, in April 2011 Congress contested the EPA’s regulation of coal combustion residue by introducing the “Recycling Coal Combustion Residuals Accessibility Act of 2011,”whichwould prevent the agency from regulating coal wastes.

The EPA did move forward with a third major electric power rule in early 2011, proposing amendments to section 316(b) of the CleanWater Act, which governs powerplant water-intake systems. This regulation would apply to power plants and industrial facilities that use over 2 million gallons of water per day from bodies of water such as rivers, lakes, oceans, and use at least 25%of that water to cool their equipment. It sought to protect aquatic life by required installation of appropriate technology such as screens and bubble blankets. It also called for power plant operators to study the impact of potentially installing cooling towers for new generation, as well as unit additions. Scheduled to be finalized by July 2012, the CWA 316(b) rule will become effective around 2020. Coal and nuclear plants would be the generators most affected by this rule. It is estimated that it will cost $400 million to implement. IIR currently is tracking up to 9 GW of smaller generation that may be retired due to this regulation.

Against this busy backdrop of regulatory activity, AEP surprised most everyone this summer when it terminated construction of a commercial-scale carbon capture & sequestration (CCS) project at its Mountaineer Power Station in West Virginia. A smaller-scale technology validation of Alstom’s chilled ammonia carbon- capture process had been operating at that plant for about 20 months, and AEP said the technology was working fine. However, given the uncertain future of efforts to lower power-plant emissions of carbon dioxide,AEP pulled the plug on the commercial-scale project and returned an estimated $334 million in clean coal grants to the U.S. Department of Energy.

In June 2011, however, a 25-MW CCS project at Southern Company’s Plant Barry in Alabama began capturing carbon. It will sequester an estimated 150,000 tons of CO2 per year.Work continued on other CCS projects during the year, including the FutureGen project in Illinois.And a handful of other CCS projects also moved forward during 2011 as developers contracted with buyers for carbon dioxide, typically for enhanced oil recovery (EOR) projects.

The EPA’s work to develop and finalize rules governing power plants is expected to trigger a cycle of litigation. Over the next five years, we expect the outlook for coalfired power will gradually become clearer, driven by court and congressional action as well as EPA rule-making. The 2012 elections alsowill play a significant role in determining how broadly and deeply power plants will be regulated at the federal level.

During 2011, a number of utilities announced plans to prematurely close coalfired power plants. Each successive EPAregulatory action provided operators with additional data and details thatwould help decide which plants were worth saving and which ones were not.

One such premature closure was the Centralia Power Station, a two-unit, 1,340- MW generator located inWashington State. This year, Centralia’s owners agreed to close Unit 1 in 2020 and Unit 2 in 2025 — both about 10 years early. The station will have to install a minor amount of environmental control equipment in 2013, but in return it will receive millions of dollars of incentives and a guarantee that it will be exempt from further state environmental regulation. Centralia was the last coal-fired generator operating inWashington State,which aspires to become the nation’s first coal-free state.

On a more positive note, construction of one coal-fired power plant — the 750-MW J.K. Spruce Unit 2 — was completed late last year. Earlier this year, construction was finished at the two-unit, $2.1 billion, 1,354- MW Elm Road Generating Station in Wisconsin. And in Nebraska, work was completed this year on Unit 2 of theWhelan Energy Center, a 220-MWgenerator valued at $504 million.

Two integrated gasification combined cycle (IGCC) projects equipped with CCS alsomoved forward during 2011. In Indiana, Duke Energy’s Edwardsport Generating Station is scheduled to be completed later this year. Mississippi Power’s Kemper County project kicked off last year and has a planned 2014 completion date. A third IGCC project, Tenaska’s $3.5 billion Taylorville project, went on hold after Illinois lawmakers failed to approve a bill supporting construction of that generator.

Though wounded, coal is not dead. There are eight new-build coal plants under construction today. In addition, over the next two years, we are tracking 145 upgrade and uprate projects worth over $4 billion that are scheduled to take place at existing coal-fired generators in the U.S. And EPA rulings are expected to create up to $12 billion of environmental retrofit work at the nation’s coal-fired generators.

In late 2010, the nuclear power industry suffered a setback when the federal government proposed to charge an $880 million fee for a construction loan guarantee for the Calvert Cliffs Unit 3 (CC3) project. Still, 2011 began with the potential of a nuclear renaissance moving onward and upward in the U.S. But rising construction costs, lower natural gas prices, loan guarantee uncertainty, and the political, financial, and public-relations fallout from the Fukushima Daiichi nuclear accident, combined to make 2011 a particularly difficult year for nuclear power.

Uncertainty over the cost of federal construction loan guarantees was only one problem confronting nuclear power this year. After receiving a federal loan guarantee, a nuclear developer was then expected to go toWall Street and obtain commercial loans to cover actual construction costs. The federal loan guarantees were meant to backstop commercial lenders, not replace them. The costs and complications of obtaining billions of dollars of commercial loans to build a nuclear generator caused some owners to reconsider their role in the nuclear renaissance.

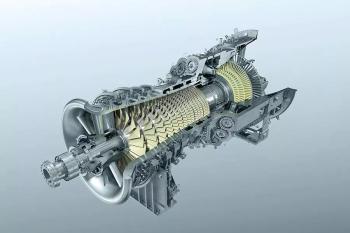

To be sure, new nuclear plants are the highest-cost generation option for utilities. At an estimated $9 million per MW, the installed cost of a nuclear generator is about six times the cost of a natural gas-fired combined- cycle unit and about four times the cost of building a new coal-fired generator with traditional environmental controls for SO2, particulates and NOx.

In the weeks and months that followed the Fukushima Daiichi nuclear disaster, confidence in nuclear generation wavered. Owners and operators began plans for safesystem inspections of the operational fleet. Reviews of dry-cask storage of spent nuclear fuelwere started.Requirements for additional storage plans were implemented. The TennesseeValleyAuthority (TVA) started to review its decision to complete construction of some partially built reactors. And other nuclear operators were forced to think long and hard about their plans to develop new nuclear generation.

As a direct result of these reassessments, and the loss of its partner Tokyo Electric Power Company, the owner of the Fukushima nuclear generators, NRG Energy in April terminated funding for the two-unit, 2,700-MW expansion of the South Texas Project.

That left two nuclear projects as standard bearers for the U.S. nuclear renaissance: Units 3 and 4 of the Vogtle Plant in Georgia and units 2 and 3 of the V.C. Summer plant in South Carolina.

Southern Company subsidiary Georgia Power has been performing pre-construction work at the Vogtle site for more than two years. The Vogtle project received an $8.3 billion federal construction loan guarantee in early 2010.Despitemid-year rumors that the project was running over-budget and behind schedule, Georgia Power officials insisted that the first new unit would come online as scheduled in April 2016, with the second coming a year later.

Meanwhile, SCANA Corporation continued pre-construction activities for units 2 and 3 of the Summer plant. Like the Calvert Cliffs, STP and Vogtle expansions, the Summer project was short-listed by the DOE to receive construction loan guarantees in 2009. There is no indication of whether or when DOE might forward a loan-guarantee term sheet to Summer’s owners—orwhether theywould need it.As South Carolina has not restructured its electricity market, the output of the two new nuclear units would be paid for primarily by the electric customers of Summer’s owners — SCANA subsidiary South Carolina Power & Light and Santee Cooper.

Nuclear power uprates continued at a brisk pace this year: Work progressed at eight projects to add 963 MW of generation. These projects are valued at $1.9 billion. And more than a dozen uprate applications are sitting at the U.S. Nuclear Regulatory Commission, awaiting approval. We see this as a robust business for the next three to five years as utilities add incremental capacity at a known cost to their existing nuclear generators.

Meanwhile, the forecast for relicensing existing nuclear generators, unclouded before Fukushima, became a little unsettled during 2011. Entergy, the nation’s secondlargest nuclear generator, ran into stiff opposition frompolitical leaders inNewYork and Vermont as nuclear licenses in those states neared their expiration dates.

Vermont has denied Entergy the water permit it needs to continue operating the Vermont Yankee plant after its license expires in 2012. And in New York, Governor Andrew Cuomo announced his intention to close the two-unit Indian Point Nuclear Plant, located about 40 miles north of New York City, when its licenses expire in 2013 and 2015. Like Vermont, New York said it would use its veto power over water permits to close the nowunwanted generator. Cuomo’s threat gained strength over the summer when a state power board streamlined power-plant siting rules.

The 2,000-MW Indian Point plant supplies about 25% of the electricity to New York’s five boroughs and close-in suburbs in Westchester County. But nuclear observers said that transmission constraints, not a lack of generation, were the most significant variable in determining whether New York City will be plunged into the dark if Indian Point is closed.

Dash to gas not slowing

It seems that nothing—aside from $10 per MMBtu gas, which no one is predicting— can stop gas-fired power development:

• Demand for gas-fired generation increases because intermittent resources like wind and solar need back-up power for reliability and dispatch ability

• Demand for gas-fired generation increases because EPA actions add costs and operational restrictions to the nation’s aging fleet of coal-fired generation

• Demand for gas-fired generation increases because the risks and costs of newbuild nuclear power are, for many companies, unacceptable

• Demand for gas-fired generation increases because gas prices are projected to remain low for some time, thanks in large part to the significant resource additions from shale formations

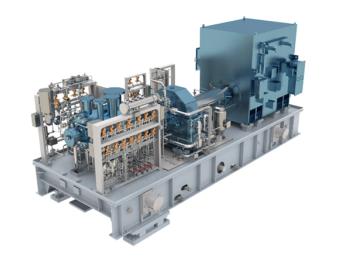

About 8.6 GW of new gas-fired generation valued at about $6 billion are scheduled to break ground this year. By contrast, according to IIR data, about 6.9 GWof new gas-fired generation valued at $4.8 billion, were scheduled to break ground in 2010.

That’s a far cry froma decade ago, when 77.2 GW of new gas-fired power projects were scheduled to break ground, reflecting about $54 billion in investment value. But given the financial crises and drop-off in electric demand resulting from the Great Recession, any growth is welcome among power developers, equipment manufacturers and service providers.

Over the next five years, IIR expects continued growth of gas-fired power development, driven mainly by the need to replace coal-fired generation closed by environmental regulation. Over the 2012- 2016 period, IIR’s data show that developers plan to break ground on about 38GWof new gas-fired generation in the U.S. Regional markets expecting to see the strongest growth in gas-fired power development over the next five years include the Northeast, Southwest and West Coast. Development of gas-fired generation will be more modest in the Rocky Mountains, Southeast and Mid-Atlantic regions.

Wind and solar

According to IIR’s data, about 8.7 GW of new wind energy projects valued at about $17.4 billion are scheduled to break ground in the U.S. this year. An additional 4.4 GW of solar power projects (photovoltaics and concentrating solar power) valued at about $17.6 billion are scheduled to kick off across the country this year. Within the solar business, developers have been moving away from Concentrated Solar Power (CSP) technologies and back to the more familiar photovoltaic (PV) technologies.

Based on historical averages, more than 50% of these renewable energy projects will not begin according to schedule. Some will get deferred. Others will be cancelled outright. Inability to secure power purchase agreements and a lack of transmission capacity remain two big obstacles to the development of utilityscale renewable energy.

The Federal Energy Regulatory Commission (FERC) took a significant step toward breaking the logjam over construction of new transmission projects when it issued Order 1000 in July. The order, which establishes cost-allocation principles for new transmission projects, was cheered by renewable-energy developers.

Renewable projects relying on Section 1603 cash grants have a strong financial incentive to procure major equipment and break ground this year, as that is the cutoff for eligibility under the grant program. However, shortage of equipment or skilled craft labor, or an inability to procure space on existing transmission lines, will push the start date of some of these projects into 2012 and beyond. For projects dependent on Section 1603 grants, missing the 2011 start datemaymean some projects won’t be built.

Some of the largest windfarms scheduled to move forward in 2011 include:

•Rolling Hills Windfarm, in central Iowa (444MW, value: $890 million)

• Logan County Windfarm, in North Dakota (368MW, value: $736 million)

• Ocotillo Express Wind Project (315 MW, value: $725 million)

In addition to new windfarm construction, IIR is tracking billions of dollars of aftermarket opportunities in wind power equipment maintenance and replacement. Over the next three years, at least 8,000MW of windpower per year is coming off warranty. Companies that manufacture and service wind turbine gearboxes, rotors, turbines and othermachinery are expected to be chasing maintenance and overhaul projects for the next several years.

Some of the largest solar projects scheduled to move forward in 2011 include:

• Hualapai Valley Solar Energy Plant, in northwest Arizona (340 MW, concentrating solar power, value: $2.1 billion)

• Desert Sunlight Photovoltaic Solar Park, in southern California (550 MW, photovoltaic, value: $1.9 billion)

• Topaz Solar Farm, also in southern California (550 MW, photovoltaic, value: $1.2 billion) Much of this growth is driven by state renewable portfolio standards (RPS). California will get 33%of its electricity from renewables by 2020while Colorado’s RPS is 30% by 2020. Illinois’ RPS is 25% by 2025 while NewYork’s mandate is 29%by 2025.

In recent years, the Pentagon has emerged as another powerful driver of renewable electricity development. Energy consumed by the military makes the Pentagon the world’s largest single energy consumer.

Troops in war zones rely on diesel-powered generators, and refueling that equipment comes at a high cost, both in human lives and financial outlays. All armed services are installing some kind of renewable generation on their domestic bases. According to one study, Pentagon spending on renewable energy totaled about $2 billion in 2010, but is expected to increase by about $25 billion over the next 20 years.

Aside from military applications, the federal government has supported, in one way or another, development of a lot of utility- scale renewable electric generation. Through a combination of construction loan guarantees, grants, production tax credits, mandates and other means, the federal government has spent tens of billions of dollars on renewable electricity this year.

But that cash spigot likely will be turned off soon. Congress extended the Section 1603 cash grants for renewables for one year at the end of 2010.Another extension is unlikely for both budgetary and political reasons. In fact, renewable power developers may lose financial support as a cashstrapped Congress looks to lower budget deficits by cutting programs — particularly programs that have not spent their authorized budget dollars.

Looking forward

TotalU.S. electricity consumption increased 4.3% in 2010 following two years of falling consumption, according to the U.S. Energy Information Administration. But a weak economy and high unemployment are expected to push down electric demand growth to a fraction of 1% this year before rising by nearly 2%in 2012.Declining electricity demand in 2008 and 2009, and a near-flat consumption growth in 2011, has enabled utilities to continue deferring investments in new generation.

Compared to this time last year, there is more clarity about the path forward for the electricity business: Renewable generation, gas-fired power, nuclear uprates and environmental retrofits. But it remains to be seen how renewable generation fares once the Section 1603 cash grant program ends.

During 2011, the U.S. electricity business was critically shaped by the results of the 2010 election, Japan’s Fukushima Daiichi disaster, and the prolonged fight in Washington over federal budgets and increasing the debt ceiling. All these forces will continue to shape the power business in 2012 and beyond. Some see silver linings in the dark clouds that today hang over the power business. But others, less optimistic, see 2012 as a prolonged series of cloudbursts that soak the industry.

Author

Britt Burt is vice president of Power Industry Research at Industrial Info Resources (IIR). Brock Ramey is IIR’s manager of Power Industry Research for North America, while Shane Mullins is IIR’s vice president of Product Development. IIR, with global headquarters in Sugar Land, TX, provides global market intelligence for companies in the power, heavy manufacturing, and industrial process businesses. IIR’s databases, market forecasts, and custom analytics are used by EPC firms, power developers, utilities, financial services firms, equipment manufacturers, and professional services firms to build their business around the world. For more information see www.industrialinfo.com or email powergroup@industrialinfo.com.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.