WORLD MARKET OUTLOOK

A BULLISH LONG-TERM OUTLOOK FOR GAS TURBINES AMID MERGER MANIA

This market analysis of gas turbinepowered electrical generation is based on a review of gas turbines either currently in production or projected to be in production by the end of 2023. Consideration was given to such factors as order patterns, population growth projections, financing, environmental and fuel concerns, and geopolitics.

Accordingly, Forecast International (FI) projects worldwide sales of 1,083 gas turbines for electrical power production in 2014, increasing steadily to 1,354 units by 2023. The value of production will be $19.4 billion in 2014, increasing to $24.3 billion by 2023.

As a total worldwide, FI sees the annual growth of gas turbine unit sales falling from 2.3% in 2014 to 1.3% in 2017, then rebounding to 2% in 2018 and holding steady at 3% over the following three years. Value of production will average 1.7% over the next 10 years, with the least growth period being in the span from 2016 to 2018.

Market drivers

Nearly 60 % of the turbines produced in the coming decade will be of an output below 50 megawatts, corresponding to the needs of developing countries, as well as to distributed generation and peaking power requirements. These simple-cycle units are also likely to find use in renewable energy power plants, helping them keep their generating profile level. Larger-output gas turbine machines will typically be installed in combined- cycle service for power generation, industrial cogeneration, or combined heat and power (CHP) applications.

In the coming decade, FI projects construction of 12,111 gas turbine machines for electrical power generation, having a value of production in excess of $219 billion (in current U.S. calendar-year dollars). General Electric is projected to again be the leading market player in terms of value of production, with a 45.5% share.

In terms of machines to be produced, however, we project that Caterpillar’s Solar Turbines in San Diego, California, will be second only to GE. GE will account for 24.3% of unit production, while Solar Turbines will represent over 23%. However, because Caterpillar’s machines are much smaller than GE’s, sales of these units will account for only 5.2% of market value.

Although most of the recent mainstream media attention has been focused on the numerous joint ventures, mergers and acquisitions in the gas turbine generator industry, it is beneficial to first review the major factors contributing to the continued success of gas turbines overall.

Renewable energy resources are emerging as a logical choice in view of environmental concerns and the myriad implications of fossil fuels. In North America, coal is the most abundant resource, but carries along with it an environmental penalty. Therefore we are seeing retirements of coal-fired capacity, and a proportional increase in combined- cycle gas turbine generation.

Technical advances in horizontal drilling and hydraulic fracturing have led to a reliable supply of economical fuel gas. In fact, the U.S. Energy Information Agency predicts that consumption of natural gas by the U.S. electric power sector will grow by an average of 0.7% annually for the next 25 years. That growth accounts for 42% of the total increase in electricity generation over the period. While the coal-fired share of total generation in the electric power sector will decrease from 39% in 2012 to 34% in 2040, the natural gas share will increase from 29% to 33%.

Geopolitical instability in the Middle East continues to affect energy costs, but due to advances in gas recovery methods, its effect on electrical power generation costs has decreased by an order of magnitude. This is primarily a result of the tremendous growth in Natural Gas Liquids (NGL) production in North America, coupled with a relatively flat demand.

Liquefied Petroleum Gas (LPG) is the portion of NGL used primarily for fuel, cooking and heating, and is rapidly growing as an export from the United States. From 2011 to 2013, exports of LPG more than doubled from an average of 148,000 barrels per day to 330,000 barrels per day. May 2014 saw a record export of 525,000 barrels per day.

The growth in infrastructure has been a boon to sales of gas turbine driven compressors and generators. Currently, the U.S. has about 500,000 barrels per day of export terminal capacity. About 450,000 barrels per day of that is located in the Gulf Coast.

There are at least 13 announced projects that would increase this capacity by 940,000 barrels a day by the end of 2016. That makes a potential total of 1.4 million barrels a day of LPG export potential, nearly tripling current capacity.

Fuel oil consumption

A review of the world’s generation of electricity by energy and fuel source shows that oil accounted for about 17% of the fuel used to generate electricity in 1990. By 2000, it had dropped to only about 15%, and in 2020, it is projected to fall to 11% of all fuels used to generate electricity.

On the other hand, natural gas accounted for about 12% of all fuel used to generate electricity in 1990. In 2000, it had risen to about 17%, and in 2020, natural gas is projected to account for about 30%.

In terms of U.S. fuel consumption, natural gas accounted for about 17.9% of all fuel used to generate electricity in 2007, a slight increase over the percentage for 2005. Forecast International projects that natural gas’s share of the total will grow to 19% in 2015, 21.25% in 2020, and 23.5% in 2025.

With most renewable energy sources, even hydropower to an extent, energy output is highly variable and influenced by fluctuations in the day and night cycle, as well as weather and climate. Grid reliability must be maintained, in spite of the goal to replace 25% of generating capacity with renewables by 2025.

Gas turbines offset these reliability factors, which will be a major disadvantage for the industry until power storage technology achieves some major advances — there are no game-changers yet on the horizon, though vast improvements in batteries, fuel cells, and ultra-capacitors are being achieved through nanotechnology.

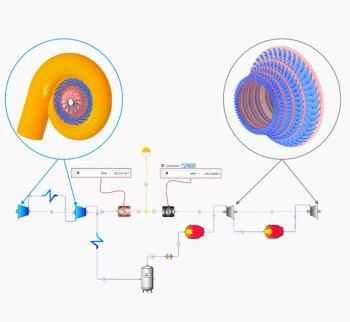

Gas turbines are ideal for compensating for the fluctuations of renewable energy; however, the machines are currently being called on to exhibit much greater operational flexibility, resulting in increased thermal stresses on the machines due to quick and frequent stops and starts, as well as decreased maintenance intervals due to increased equivalent operating hours. Thus maintenance, repair and overhaul will become a greater concern, and will account for a larger share of the operational budget.

Though larger machines are preferred for economy of scale in the Americas and most of the developed world, distributed generation is popular in regions such as Africa and much of Asia. Thus full-service packagers such as APR Energy, Centrax and FlexEnergy are enjoying success. Their smaller machines can deliver 10-to-100 or even more megawatts when installed in parallel groups practically anywhere worldwide in a matter of weeks. Even microturbines have found a niche in hydraulic fracturing among the major North American shale plays, with no end to production envisioned over the next 25 years.

MHI and Hitachi

Over the last year, even the popular press has been following the progress of joint ventures, mergers and acquisitions in the gas turbine manufacturing industry. Some of the deals are leveraging divergent core competencies to produce an amalgam that is more of a full service provider over all machine power ranges, or in broader geographic regions.

Several of the larger mergers will provide the resulting corporations with enhanced bargaining power over both suppliers and clients. Other motivators of this trend include increased access to new or desirable technologies, and the potential for the merger of business models to decrease inefficiencies.

Near the end of November 2012, Mitsubishi Heavy Industries (MHI) and Hitachi reached a basic agreement on integrating businesses centered on thermal power generation systems and jointly managing these operations. The two companies consolidated their respective businesses within a joint venture company in January 2014.

MHI and Hitachi took equity interests in the company of 65 % and 35 %, respectively. Based on their extensive partnership, the two companies have agreed to address buoyant global demand for thermal power generation systems by harnessing their joint technical skills with the aim of prevailing against intensifying global competition.

Over the years, MHI and Hitachi have established partnerships harnessing their technical skills and expertise in a variety of fields. Examples include an alliance and subsequent establishment of a joint venture in the steel production machinery field; a collaboration in the overseas railway systems business; and joint work on the integration of a hydroelectric power generation system business. They have also provided joint support for the Fukushima Daiichi Nuclear Power Station of Tokyo Electric Power Company.

The global market has continued to expand, driven by the growth engines of China and various emerging countries. Further, heightened environmental awareness around the world has presented a major opportunity for MHI and Hitachi to expand where they both excel — as businesses that solve global energy and environmental issues at the same time.

These organizations have expansive product lineups in the thermal power generation field. In gas turbines, for example, MHI has focused on efficient large models in recent years. Meanwhile, Hitachi sees its mainstay products as small and medium- size models.

Regionally, MHI has a major presence in Southeast Asia and the Middle East, while Hitachi has harnessed its strengths in markets, such as Europe and Africa. The two partners will strive to leverage their complementary capabilities. Moreover, the companies will further enhance their ability to address customer needs and provide services by taking advantage of their respective strengths in providing total solutions across all aspects of thermal power plants.

MHI and PWPS

In mid-May 2013, MHI completed its acquisition of Pratt & Whitney Power Systems (PWPS). The acquired company will now be known as PW Power Systems. As a part of MHI’s continuing growth initiative, the acquisition will enable MHI, which focuses on large-capacity systems, to reach a broader range of customers through PWPS, which offers small to medium-size power generation packages.

MHI’s resources and operations will also provide the essential synergy to allow PW Power Systems to grow in parallel with increasing demand for flexible generation solutions.

PWPS customers will continue to benefit from the cutting-edge technology Pratt & Whitney offers with turbine engines as well as the company’s manufacturing, engineering and supply chain expertise. PW Power Systems will be headquartered in Glastonbury, Connecticut.

Siemens and Rolls-Royce

Siemens is acquiring the Rolls-Royce Energy aeroderivative gas turbine and compressor business, and thereby strengthening its position in the growing oil and gas industry as well as in the field of decentralized power generation. The purchase price is £785 million, or about $1.32 billion. The transaction is expected to close before the end of December 2014, subject to regulatory approvals.

As part of the transaction, Siemens will get exclusive access to future Rolls-Royce aero-turbine technology developments in the 4- to 85-megawatt power output range as well as preferred access to supply and engineering services. For this 25-year duration agreement, Siemens will pay Rolls-Royce an additional £200 million, or about $337 million.

By acquiring Rolls-Royce’s small and medium-size aeroderivative gas turbines with a power output of up to 66 megawatts (ISO/wet-rating), Siemens will close a technology gap in its extensive gas turbine portfolio.

Originally developed for use in the aviation industry, Rolls-Royce Energy’s aeroderivative gas turbines have a compact, weight-optimized construction and are highly efficient. These characteristics make aeroderivative gas turbines an attractive power supply option in the oil and gas industry, in particular for the operators of offshore oil platforms where space is limited.

Due to their efficiency and fast start-up capabilities, aeroderivative gas turbines are also used to provide dependable decentralized power generation; their flexibility helps meet peak electricity demands, provide emergency power reserves, and stabilize the power grid.

Rolls-Royce Energy’s gas turbine and compressor business is one of the leading providers of aeroderivative gas turbines. In this segment, the acquired business has around 2,400 employees, delivered revenue of $1.4 billion and earnings before interest and tax (EBIT) of $121 million in fiscal year 2013. With an installed base of about 2,500 gas turbines, Rolls-Royce Energy’s business has the world’s second-largest fleet of aeroderivative gas turbines.

GE and Alstom

GE has updated its April 2014 offer to acquire the power and grid businesses of Alstom in connection with discussions with Alstom management and the French government on jobs, decision-making in France, access to nuclear steam turbine technology and support for Alstom Transport. GE’s valuation for Alstom remains unchanged at $13.5 billion ( 9.9 billion) enterprise value and $3.4 billion ( 2.5 billion) of net cash, totaling $16.9 billion ( 12.35 billion).

GE and Alstom will establish two 50-50 joint ventures to strengthen France’s and Alstom’s presence in energy and support Alstom’s energy transition. These JVs will deliver advanced technology and services worldwide in the fields of grid and renewable power.

Specifically, GE and Alstom will create a global grid business based in France by combining their grid assets, each taking a 50% ownership stake in the new business.

GE and Alstom will also create a joint venture in renewable energy based in France. This JV will consist of Alstom’s offshore wind and hydro businesses, and each company will own 50%. GE and Alstom will create a 50-50 Global Nuclear and French Steam Alliance to ensure the security and growth of nuclear steam technology for France. Under this alliance, Alstom will produce and service equipment for nuclear power plants.

Alstom will also develop and sell new nuclear equipment around the world, and will provide steam turbine equipment and servicing for applications in France. The French government will hold a preferred share in the alliance, giving it veto and other governance rights over issues related to nuclear plant security and technology.

In addition, the intellectual property related to Alstom’s Arabelle nuclear steam turbine technology will be transferred to a special purpose vehicle wholly owned by the French government, which will allow the government to license the technology to third parties if GE were not to supply Arabelle technology to an EDF/Areva nuclear project. GE has made a long-term commitment to ongoing development of the Arabelle technology and to servicing of the EDF-installed nuclear base.

French connection

The GE-Alstom energy businesses will select headquarters and appoint leadership teams for four global businesses in France pertaining to the following types of power: grid (which will include GE’s current grid business), offshore wind, hydroelectric, and steam turbines.

This is in addition to GE’s European Power headquarters, which has been in Belfort since 1999. In addition, Alstom’s transport business will be enhanced by the addition of GE’s signaling business. The Alstom brand will continue through its transport business and in the energy industry.

MHPS and Babcock-Hitachi

Effective October 2014, Mitsubishi Hitachi Power Systems (MHPS) is integrating with Babcock-Hitachi K.K. (BHK), a Yokohama-based group company handling boilers and air quality control systems (AQCS). The aim of the merger is to bring enhanced speed to business management and achieve greater efficiency and cost competitiveness in order to more swiftly and securely realize benefits from the business integration in February 2014 of MHI and Hitachi. Also effective October 2014, MHPS Engineering, based in Yokohama, merges with Bab-Hitachi Industrial Co Ltd (BHIC), a group company of BHK based in Kure, Hiroshima Prefecture.

BHK’s products consist of thermal power generation systems such as boilers and air quality control systems, and, like MHPS, the company has functions within Japan related to development, engineering and manufacturing. Since its inauguration, MHPS has pursued the integration of the technological and sales capabilities it took over from MHI and Hitachi, and it has also strengthened the ties among group companies in its global network.

MHPS has now decided that a full merger with BHK is indispensable to MHI and Hitachi’s business integration because it will bring BHK’s functions for core equipment into MHPS’s organization, proceeding beyond the links among group companies.

Following the merger of MHPS Engineering and BHIC, MHPS Engineering will continue as the surviving company. Through the integration of the two companies (which target the same user markets in Japan and have mutually complementary product lineups), MHPS Engineering will aim to offer improved response to the needs of a broad range of industrial users. It will also carry on the two companies’ strengths in the design, procurement, construction and after-sale servicing functions. MHPS Engineering will be a wholly owned subsidiary of MHPS.

Author

Bill Schmalzer has been active in the operations and maintenance of power plants since 1982. He began his career as a Machinist’s Mate in the U. S. Navy, and was Engine Room Supervisor on board the ammunition and logistics ship USS Flint (AE- 32). As analyst for Forecast International’s Industrial & Marine Turbine Forecast, Bill’s primary focus is on gas turbine engines used for electrical generation, mechanical load drive duty, and surface transportation — and on large steam turbine machines used in combined-cycle installations. For more information call 203-426-0800.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.