How the turbomachinery industry is responding in the time of COVID-19

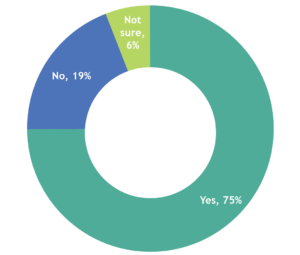

Source: SMB Group’s The Impact of Covid-19 on SMBs Study, 2020[/caption]

Beyond sectors such as Liquefied Natural Gas (LNG) and pipeline compression, the gas turbine marketplace has not been thriving of late. But everything turned on its head in the first quarter of 2020 due to two factors:

• The Covid-19 outbreak

• A precipitous crash in the price of oil.

Government officials around the world brought business to a halt in an attempt to slow the spread of the virus. While most turbomachinery companies and suppliers continued to operate, they faced postponement or cancellation of orders, and severe financial strain.

In tandem with the pandemic, oil producers jostled over output quotas. The resulting supply glut sent oil prices southward toward $20 a barrel.

A downturn, therefore, is inevitable. Casualties are likely, especially among the ranks of the many small business suppliers, service companies and specialists that support the industry. It is also possible that a few mergers and acquisitions may be in the cards among the larger players. That often happens after a downturn.

Experts, analysts, supply chain managers and OEMs including Siemens Gas & Power, Elliott, Man Energy Solutions, Atlas Copco Gas & Process, Baker Hughes, SoftInWay, Doosan Škoda Power, Capstone and LA Turbine are responding to the crisis in various ways.

"We’re in for a rough patch but turbomachinery technology isn’t going anywhere,” said Valentine Moroz, SoftInWay. “The turbomachinery industry is well positioned to weather this storm as it is a critical part of our everyday lives.”

Immediate repercussions

There is no escaping some of the immediate repercussions of recent events. A survey of business leaders in the U.S. by business consultancy PwC revealed that 67% are considering the deferment or cancellation of planned investments. Some 2% are looking to make cuts in cybersecurity and privacy budget. Another 53% plan to reduce spending on IT, and 25% may scale back digitalization programs.

Chief Financial Officers (CFOs) are particularly worried about cash liquidity and a potential global recession. The good news is that 61% of CFOs think they can return to business as usual within three months, according to PwC.

18% consider it more likely to take six months. But due to fear that 2020 revenues will be lower than expected, 81% are engaged in wide-ranging cost reduction measures. 26% have laid off or are planning to lay off workers, and 44% have furloughed workers or anticipate doing so.

Half are hesitant about attempting mergers at this time, but the other half intend to forge ahead with ongoing plans. It largely boils down to cash availability. Those that have money in the bank see the potential for aggressive action as the going rate is falling for potential acquisition targets in power and oil & gas. Almost 40% of respondents plan to engage in supply chain reorganization, which includes a heavier reliance on local sourcing.

Another report by market research firm IHS Markit found 75% of companies are already reporting some kind of supply-chain disruption due to the coronavirus. Some 938 of Fortune 1,000 companies said they have a tier 1 or tier 2 supplier that has been affected. 44% of companies surveyed admitted to not having a plan to deal with the disruption.

Some predictions place the global economic damage from recent events at $2.7 trillion. Others have speculated that it will rise as high as $12 trillion.

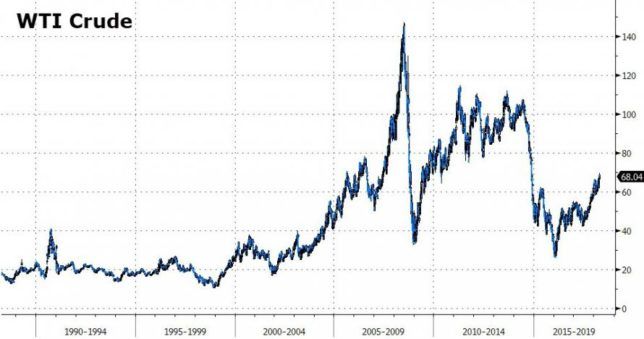

The oil & gas sector has an even more challenging situation due to the crude oil price per barrel hovering around $20 to $25. Such lows have not been approached since late 2001. That has placed a squeeze on the U.S. shale industry. Small drillers are struggling. Production is being ramped back. The boom days are over in some regions.

“Businesses of all sizes are feeling the pain of the pandemic,” said Laurie McCabe, an IT and business analyst at SMB group.

Her survey of organizations of 2,500 employees or less, highlighted that 75% of businesses are negatively affected by the crisis. Among those, however, smaller companies have generally been hit the hardest. Those with fewer than 20 employees are most likely to experience extreme hardship.

“Many of these companies lack the cash flow and capital necessary to see them through an extended period of reduced or no sales,” said McCabe. “38% of companies with 1 to 19 employees report that Covid-19 is having an extremely negative impact on their businesses.”

More than half of small and mid-sized businesses (SMBs) have already or are planning to lay off salaried employees, or reduce their hours. Worried about preserving capital, they are slashing spending on non-employee goods and services by an average of 37%.

This is a big problem for the business world in general, and in particular for power generation and oil & gas. These small businesses supply many of the goods and services that larger players rely on.

SMB Group said that Covid-19 is negatively impacting business in 75% of SMBs. 19% have not experienced a negative effect to date, and 6% are not sure. Close to two thirds believe revenues will drop by 30% or more over the next six months.

While all industries have been afflicted, the depth of impact varies by industry. Personal services, hospitality and manufacturing are taking the biggest hits, with 90% or more of businesses in these sectors reporting a negative impact, said McCabe.

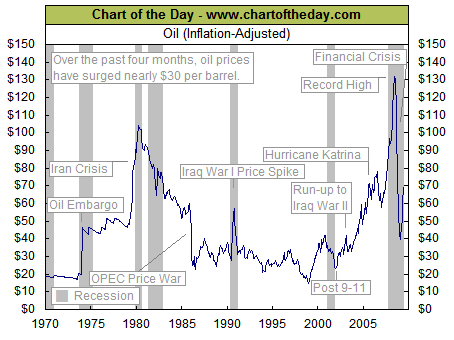

Crude oil price trends since the late eighties.[/caption]

Oil & gas fallout

Oil & gas is especially badly affected. The recent OPEC+ agreement to cut production by 9.7 million barrels per day (mainly from Russia and Saudi Arabia) has done little to arrest the decline of oil prices.

This is having a ripple effect across operations. Industry giants such as Schlumberger and Halliburton have announced furloughs, salary reductions and job cuts.

Refineries are coping with a supply glut at very low prices coupled with far lower demand from the transportation sector. Analyst firm ICIS said 26% of the Europe’s ethylene production capacity is threatened by oil refineries running at reduced rates or ceasing production entirely.

Ethylene is produced by crackers attached to refineries. But the collapse of demand for petroleum products, such as jet fuel and gasoline means some ethylene crackers may be closed as they rely mainly on naphtha or liquefied petroleum gas (LPG) feedstocks. That could add up to the loss of 6.6 million tonnes (m.t.) per year of ethylene, 5.9 million m.t./year of propylene and 4.0 million m.t./year of benzene.

Some refineries have scheduled stoppages due to reduced fuel demand from Coronavirus and associated lockdowns. As a result, European refineries are producing about 10 million barrels/day right now, which is down about 2.2 million per day compared to the expected throughput according to ICIS.

“The reduction is almost certainly even higher in reality and could be as high as 5 million per day when considering those sites which do not share such information,” said Michael Connolly, Senior Consultant at ICIS.

Case in point: Around 40% of Total’s refining and petrochemical operations are in France, the U.S., Germany and South Korea. In addition, over 70% of the company’s petrochemical plant capacity is based in South Korea, the U.S. and France. Its exposure in Covid-19 affected countries makes it susceptible to a fall in capacity utilization over the near term, said data and analytics company GlobalData.

“Total has postponed the restart of the Grandpuits refinery in France, which was shut down earlier for scheduled maintenance, due to lack of demand,” said Ravindra Puranik, Oil & Gas Analyst at GlobalData. “The company has also cut production at the Leuna refinery in Germany by around 25%.”

However, Total’s LNG liquefaction operations look to be less vulnerable to disruption. Similarly, its major exploration and production projects in the Middle East, Norway and Nigeria should not be unduly affected.

Small oil & gas firms may find it tougher to weather the storm. The shale boom would never have happened were it not for hundreds of small companies exploring and drilling for relatively small shale oil deposits.

Such work was not financially attractive enough for the oil majors to carry out. Yet the entire industry depended upon the work of these tiny operators. Unfortunately, there has been a severe drop in general shale activity as shown in rig count. More than a few are filing for bankruptcy, or have had to curtail drilling.

Pioneer Energy Services is one casualty. After 20 years of operation in the Bakken shale basin, it has ceased drilling there. A plunge in oil prices and the bankruptcy of a major customer in the region meant the closure of its six rigs in the Bakken.

Adding it up across the oilfield services sector, more than 50,000 jobs have been lost since the start of 2019. That equates to nearly 13% of the workforce. Fracking is probably going to face its worst year. Citigroup forecasts that at least half of all fracking work will end by late June 2020 due to lack of viability.

As well as greatly reducing drilling locations, producers are cutting costs by avoiding capital expenditure and even maintenance. Instead of repairing or replacing a faulty pump, for example, some companies are discarding the broken pump and grabbing an old one from an inactive site in an effort to minimize spending.

Power sector

In the power sector, small service shops are the backbone of the industry. These firms are typically composed of industry veterans with decades of highly specialized technical know-how. They are experts in areas such as rotor balancing, outage management, rotor replacement, filtration, maintenance, inspection, emergency repairs, coatings, water washing, chemical treatment, gearing and many other skills. Every one that disappears is a major loss.

Institutional knowledge, after all, is the backbone of any industry. The Clint Eastwood movie, “Space Cowboys,” gives a fine example of the importance of preserving knowledge, even of very old systems. In that film, retired NASA engineers are called back into action as they are the only ones with the know-how to repair an old Soviet satellite that is in danger of crashing. Similarly, the ability to support aging turbomachinery hardware and software must be preserved.

Consider turbomachinery controls. Controls vendors are generally most interested in selling, updating and servicing their latest software and controls. They may continue to service models dating back a generation or two. But after that, they sometimes withdraw support.

Parts become difficult to obtain and maintenance becomes a challenge. Several small suppliers make a living serving the needs of facilities that continue to use aging controls. The individuals that make up these businesses were often those who helped develop these controls – or spent decades at large organizations servicing such systems.

But it is not just small firms. Midsized and large suppliers in most regions are also noticing repercussions. The German association for the mechanical engineering industry (VDMA) asked almost 1,000 member companies about current operations. Supply chain disruptions are particularly prevalent in Italy (75%), Germany (55%), China (51), France (36%) and the U.S. (25%).

“The situation in China and South Korea seems to be easing slightly,” said VDMA chief economist Ralph Wiechers. “In addition, many mechanical engineering companies report a significant increase in orders from Chinese customers.”

But the fallout among German engineering firms is rising. In a two-week period in April, the number noting supply chain disruptions rose from 60% to 84%. Almost half said this amounted to serious disruption.

Across the board, turbomachinery vendors have taken seriously the restrictions imposed by government authorities. They have been cleaning and sanitizing their facilities rigorously, and going to great lengths to protect their workers, their suppliers and their customers.

MAN Energy Solutions

MAN Energy Solutions has not witnessed any major decline in orders for turbomachinery so far. However, Mathias Scherer André, Head of Sales & Execution Turbomachinery, understands that it would be naïve to believe that the Covid-19 crisis will not affect business.

“Some turbomachinery customers are already reducing their aftersales expenditures on maintenance or overhaul activities,” he said. “The current situation and the uncertainty about the future could also dampen appetite for new projects and subsequently weaken the turbomachinery market.”

As a result, the company anticipates a business reduction compared to 2019, especially in the second half of the year. The decline in the downstream oil & gas, and the industrial segment is expected to be smaller than in the oil & gas upstream and midstream segment.

“I don’t think we will see a significant decline in the power generation market,” said André. “I remain optimistic about the turbomachinery business outlook for 2020 and beyond.”

MAN’s turbomachinery factories are producing at normal capacity, except in India. Remote customer interaction has been made easier by earlier steps taken by the company in digitalization.

Its remote support tool PrimeServ EyeTech is an assisted-reality application. It allows mobile video conferences to be set up via data glasses, or other video-capable terminal equipment like smartphones or laptops.

Technical experts in the MAN Remote Operation Centers or from their home offices can take the customer perspective without having to be on site. This has enabled the company to conduct remote audits, factory acceptance tests, assist remotely with repairs and commissioning.

In addition, MAN is continuing a strategy to regionalize and decentralize its turbomachinery operations. “Being present in our main markets, close to our customers, has proven to be a valuable asset and key to support our customers when no international travel is possible,” said André.

Additionally, the company is building digital tools into its turbomachinery. Examples include its high-speed, oil-free HOFIM compression system that allows for the remote control and unmanned operation for onshore and offshore applications. Its ATU Box (Analytics Telemetry Unit) collects and evaluates operating and sensor data and enables the customer to monitor machine operation around the clock and request advice for remote support.

“Changes in digital habits will outlast the lockdowns that caused them,” said André. “Some of them will become the new normal for some business activities.”

Siemens

Siemens Gas and Power expects a severe impact in Q2. In the meantime, management has prioritized the safeguarding of employee health & safety, the continuity of the business, a focus on cash and working out how to reduce costs.

In terms of its global supply chain, Siemens thinks the impact will be mainly demand-driven as opposed to suppliers being unable to provide components. But the company is closely monitoring its supplier base.

Gianluigi Di Giovanni, Siemens Head of Power Generation Services Middle East and North Africa, said keeping the lights on is a top priority. The company aims to achieve this in power plants and other critical infrastructure operators using its turbomachinery via Omnivise Remote Services (ORS) which enables the delivery of field service expertise anywhere.

The ORS concept came about in 2015 when a power plant in North Africa was overdue for maintenance. Due to ongoing conflict in the region, Siemens employees were barred from entering the country. It provided training and remote support to successfully complete the outage.

“That experience prompted us to think differently about service, especially how we can use the latest and most secure communications tools,” said Di Giovanni. “Containing live audio, video and augmented reality software, ORS enables collaboration with our global network of experts, helping operators monitor, maintain and repair assets.”

Capstone

Capstone Turbine is concentrating on near-term earnings. Accordingly, it has expanded its long-term microturbine rental fleet with another 1 MW C1000 Signature Series microturbine rented for a site in the Permian Basin.

It is being operated by a large oil and gas company seeking to improve cash flow. Secured by Capstone distributor Lone Star Power Solutions, the microturbine is expected to be delivered later this summer and commissioned in the fall of 2020.

“Like most companies, we are seeing a downturn in new product shipments as a result of the Covid-19 virus pandemic, but that should be offset by the reduction in expenses,” said Darren Jamison, President and Chief Executive Officer of Capstone Turbine.

“Capstone’s long-term rental program, multi-year service contract business, and distributor support system program all continue to grow according to plan despite the Covid-19 pandemic.”

This most recent deal increases the company’s long-term rental fleet to 8.6 MW. During fiscal 2020, Capstone’s rental fleet revenue grew 230% compared to fiscal 2019. The company intends to expand its long-term rental fleet to 10 MW as part of management’s focus to achieve sustainable positive earnings in the June quarter and beyond.

Baker Hughes

Baker Hughes has taken several actions in response to the decline in oil and gas prices and Covid-19. This includes a write down in value of $15 billion from two business units, restructuring to right-size operations for anticipated activity levels and market conditions, and a more than 20% curtailment in net capital expenditures for 2020 compared to the previous year. But it reports liquidity of $3 billion.

In its most recent earnings call, the company cited orders of $5.5 billion for the first quarter of 2020, down 20% sequentially and 3% year-over-year. Revenue reached $5.4 billion, down 15% sequentially and down 3% year-over-year.

“Despite a volatile macro-environment driven by a significant decline in oil prices and the Covid-19 pandemic, we produced solid results in our Turbomachinery & Process Solutions (TPS) and Oilfield Services (OFS) businesses and generated over $150 million of free cash flow despite typical seasonal headwinds in the first quarter,” said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive Officer.

“Looking forward, the outlook for oil and gas demand and supply appears equally uncertain, and it will largely be driven by the pace of economic recovery from the Covid-19 pandemic and the supply response that ultimately materializes.”

The company’s massive turbomachinery manufacturing, assembly and testing facilities in Italy remain open. That’s where the TPS segment conducted the first ever remote string test to ensure the engineering, functionality and performance of turbomachinery prior to installation.

This test replicates actual site conditions. Every component is validated to ensure functionality and performance. This includes a mechanical running assessment as well as the measurement of equipment vibration and bearing temperatures at full speed and full load.

The test was done on the first compression train for the Venture Global Calcasieu Pass LNG project using virtualization technology to connect 21 people in five cities to facilitate, run and observe the test. The 10 million m.t./yr Calcasieu Pass LNG project employs a process solution from Baker Hughes that uses mid-scale, modular liquefaction trains. After manufacturing and testing, these units are shipped to Cameron Parish, Louisiana.

TPS also secured six contracts to supply turbomachinery for three floating production, storage and offloading (FPSO) units offshore Brazil. This includes a combined cycle solution with high-pressure compression. Supply includes LM2500+G4 gas turbines, steam generators and turbines, electric motor-driven compressors and related turbomachinery equipment.

The company’s Turbomachinery Training Centre has had to shift from onsite training onto virtual training for industrial turbine operations for LNG plant operators. One customer in the Russia and CIS region received two webinars on turbine operations from lecturers based in Italy. Each class lasted five days.

Further remote services harness remote collaboration tools, such as smart helmets, smart pads, smart phones, and remote-monitoring centers in Florence, Houston and Kuala Lampur. This enables the company to provide virtual site assessments, remote inspections, spare parts remote assessments, remote monitoring of running units and technical outage support.

Atlas Copco Gas & Process

The Covid-19 situation has impacted the turbomachinery business of Atlas Copco Gas & Process, according to company President Robert Radimeczky. “Due to looming uncertainty, investment in our industry is coming under scrutiny as companies are looking to conserve cash,” he said. “With Capex strongly decreasing, orders are affected.”

He cites economic projections that global GDP and national GDPs will shrink by at least 1.5% to 2% this year. But a delivery and order backlog from 2019, and manufacturing and delivery cycles of about a year mean that the company does not foresee many immediate issues.

“In case business activity does not resume to normal levels in Q3 and Q4, we expect to experience a deeper impact in 2021,” said Radimeczky. “Our supply chain has been cooperative in achieving high utilization of our factories.”

He envisions companies in the industry localizing more production facilities as well as their supply chains. Digitalization of processes can also help to speed processes, along with remote monitoring and diagnostics.

LA Turbine

Danny Mascari, President of turboexpander manufacturing and servicing company L.A. Turbine, reported that most new projects in the proposal stage have been placed on hold. Engineering work has continued for newly sold projects. But delivery timelines have been extended.

“We are seeing an increase in activity for international project work,” said Mascari. “Our aftermarket equipment repair, evaluations and field service work remain active.”

He expects to see more budget cuts and, in some cases, new equipment spending may be frozen within the midstream and downstream sectors. In contrast, he predicts companies will start making more aftermarket investments to maintain, upgrade, repair and service existing turboexpander equipment, especially within the midstream sector.

Mascari said it is especially important to be responsive to customer needs.

“We have endured whirlwinds of uncertainty before and understand that damage and casualties will result,” he said. “This is a time to reassess company goals, eliminate the superfluous, and place greater focus on core competencies, and the delivery of those products, services and expertise.”

Doosan Škoda Power

Doosan Škoda Power reports that the Covid-19 situation and related government measures mostly impacted its on-site services and construction operations, which are, to a large extent, temporarily suspended.

Since the Czech Republic is under an effective lockdown including closed borders, onsite technicians and sales representatives are grounded until the authorities decide it is safe to travel again.

“We have been able to maintain uninterrupted manufacturing production to minimize the impact to our projects,” said Daniel Prochazka, Chief Operational Officer of Doosan Škoda Power.

“We are doing our best to keep our supply chain working as well as possible, so the manufacturing process in our factory in Pilsen can continue without major interruptions. To achieve that we had to review our sourcing plan for the main components to avoid delays on deliveries from the most restricted countries.”

He has some concern about the development of several ongoing and future projects which rely on governmental subsidies. He hopes this support will be maintained.

Like many in the field, recent events have made him realize that a sizeable portion of global business can be operated and managed remotely. Prochazka believes there is likely to be increased market demand for remote control systems for power plants in the future to ensure continuous operation during a crisis.

Daniel Prochazka, Doosan Škoda Power.[/caption]

Elliott

Elliott Group’s business has been designated as essential and is exempt from orders to close operations. Its two main equipment factories in the U.S. and Japan are open with many non-manufacturing personnel working from home. Field service crews remain available and on call.

In China and Italy, Elliott facilities were closed but have since reopened. Service locations around the world in Singapore, Lachen (Switzerland), Abu Dhabi and other parts of the world are working alternative schedules to protect the well-being of employees and their families while continuing to address customer needs.

SoftInWay

Valentine Moroz, Chief Operating Officer at turbomachinery design and R&D software vendor SoftInWay, has noted definite impact in terms of order timing. He works with turbomachinery OEMs, aftermarket services providers and end-users, and sees each segment reducing expenses.

“We’re in for a rough patch but turbomachinery technology isn’t going anywhere,” he said. “The turbomachinery industry is well positioned to weather this storm as it is a critical part of our everyday lives.”

With many in the industry joining the unemployment ranks, SoftInWay has launched a campaign “No Turbomachinery Engineer Left Behind”. The mission is to provide free software and E-learning resources to engineers across the world who lost their job.

For its customers, the company created flexible payment and financing options. But it does not plan any major shifts in strategy. It is strengthening the alliances it has forged with companies such as Avio in Italy, and Siemens Digital Industries Software in the U.S.

As companies cut head count and senior engineers retire, Moroz foresees heavier use of virtual design and simulation, digital twins and the use of artificial intelligence. With fewer hands on deck, companies are going to need intelligent simulation software and technology to make up the difference.

History repeats

Some historical perspective on current events is in order. Market crashes and recessions have happened before. A quick review of the last fifty years reveals:

• The Arab oil embargo and the Iranian hostage crisis in the seventies

• An oil price collapse during the eighties

• The Gulf War and sustained low oil prices through the nineties

• 9/11, the Enron bankruptcy and financial market turmoil in the 2000s

• A recession in the middle of the last decade.

In between there have been purple patches too:

• 1978 Public Utility Regulatory Policies act (PURPA) opened the door to non-utility power producers and cogeneration

• Late nineties experienced an unprecedented boom in gas turbine generation sparked by deregulation.

• Shale oil & gas expansion over the past decade.

The next few months promise to be interesting. But oil prices will eventually revert. And as technology evolves and alternative fuel sources emerge, the vast amount of know-how resident within the industry will develop new ways to harness turbomachinery and propel it into the future. ■