Baker Hughes Unfettered

Baker Hughes moves on from GE, pushes A.I., digitalization, 3D printing and carbon capture.

Baker Hughes merged with GE Oil & Gas a couple of years ago to form BHGE. That relationship is over. Baker Hughes has emerged as an end-to-end oil & gas giant in its own right. It has absorbed just about all the assets of GE Oil & Gas including a vast turbomachinery portfolio.

The recent separation did not impact attendance at the 21st Annual Meeting (AM). In fact, the opposite turned out to be the case. The AM boasted a highest ever turnout of 1,750, according to Lorenzo Simonelli, Chairman and CEO, Baker Hughes.

“These are challenging times with new attitudes and expectations,” he said. “The world needs more energy, and more from energy.” He added that the industry has to be competitive with alternatives while remaining reliable, safe and efficient.

The company is in the midst of lowering its carbon footprint. The answer, he said, begins and ends with technology. Baker Hughes, for example, has developed offshore directional drilling accomplished via a remote operations center situated onshore.

Another initiative revolves around digital transformation. The company is harnessing artificial intelligence (AI) to identify maintenance issues. One example cited by Simonelli was a large plant where AI detected 52 valves in critical condition.

“Digital is not easy so we are creating an ecosystem to address it,” said Simonelli.

A big part of this is partnerships with Microsoft Azure and an AI company called C3.ai. Baker Hughes’ joint venture alliance with C3.ai is called BakerHughesC3.ai. They recently launched the jointly developed BHC3 Production Optimization. It is an AI-based application that allows well operators to view real-time production data, better project future production and optimize operations for improved oil and gas production rates.

“Energy companies globally are being challenged to make operations more efficient, safer and more productive,” said Ed Abbo, president and CTO, C3.ai. “To do this, they will need to analyze massive amounts of data for actionable insights.”

This AI-based application continuously uses machine-learning algorithms to quickly aggregate historical and real-time data across production operations. It creates a virtual representation of production from individual and multiple wells to the pipeline, distribution and point-of-sale.

It also detects anomalies, forecasts production and prescribes actions to improve performance. Engineers can use it to pinpoint which injection wells to tune for higher output.

“BHC3 Production Optimization delivers the data visibility and optimization capabilities critical for upstream businesses to meet production targets during a time of growing energy demand,” said Derek Mathieson, Chief Marketing and Technology Officer, Baker Hughes. “It generates flow rate, pressure and temperature predictions of hydrocarbon production and flow across wells, pipelines, and network assets.”

Microsoft’s role in the partnership with Baker Hughes and C3.ai is to harness its Microsoft Azure cloud computing platform and AI microservices to host AI solutions. Shell, for example, is using the C3.ai platform on Microsoft Azure to accelerate digital transformation across its business, improve efficiencies, increase safety and reduce environmental impact, according to Jay Crotts, CIO of Shell Group.

Shell is also using AI to implement predictive maintainence of rigs and turbomachinery, and for reservoir modeling. One rig records 30,000 measurements a minute, and encompasses the monitoring of half a million valves.

IT guru

The Annual Meeting featured a keynote from legendary IT guru, Tom Siebel, now CEO of C3.ai. His credentials date back 40 years to being one of the original developers of the Oracle database, as well as the founder of Siebel Systems, a company that pioneered customer relationship management (CRM) software.

Siebel called the chance to partner with Baker Hughes and Microsoft Azure to address the world’s energy needs, “the professional opportunity of a lifetime.”

AI for maintenance is the “killer app” for the energy sector, he said. Predictive maintenance with high accuracy has the potential to save billions in terms of inventory and running costs, avoided downtime and overall productivity, he added.

One example: The U.S. Air Force has been using this technology to increase the availability of its fleet from 50% to 85%.

Siebel claims his company has reduced the complexity of AI from 1013 to 103. He labeled the power grid as the largest and most complex machine in the world, one that involves staggering data volumes. That data can be analyzed to initiate big changes in power and oil & gas management.

Take the case of European energy company Enel. It already operates 42 million smart meters in Spain and Italy. In addition, 75 million sensors feed data into the system. That adds up to 65 billion data updates per day, according to Siebel.

Adding AI to wind turbines, conventional generation and millions of kilometers of transmission network has enormous potential, he said. Enel is using AI for fraud detection in regions where the theft of electricity is commonplace. The system can help detect it at an early point.

“We are analyzing compressor operation in real time with models,” said Siebel. “This can help prevent leaks, reduce greenhouse gases and eliminate unscheduled downtime.”

At Baker Hughes, initial efforts are centered around the optimization of Bently Nevada systems.

“Baker Hughes is way ahead of others in oil & gas,” said Siebel. “We are witnessing a massive market shift as oil & gas businesses undergo enterprise-level digital transformation to improve efficiencies and increase safety, while simultaneously reducing environmental impact.”

Another area of marked technology shift is additive manufacturing (AM) or 3D printing. At its manufacturing plant in Florence, Baker Hughes produced more than 20,000 3D-printed parts last year.

In total, 450 parts are qualified for 3D printing within its catalog. Scott Parent, Vice President of Engineering and Technology, Baker Hughes said this includes printed parts for gas turbines, compressors and drilling equipment.

AM is used to enhance product design and reduce assembly through part consolidation. A CT scanner scans 3D parts during inspection. The gathered information is looped back to the design, engineering and production stages to improve components and equipment.

Most design tools are oriented to subtractive manufacturing, said Parent. With AM, it is now possible to print multiple materials with various geometries at the same time, i.e., plastic, metal and glass can be laid down on the same part rather than having other materials press-fit, bolted or welded.

“This capability enables us to go back to the design stage and make improvements,” said Parent. “AI allows us to consider better geometries, understand thermal constraints, develop far more rapidly and then print that part directly.”

He offered a drill bit example. These components suffer wear as they pummel through rock strata in search of oil. Typically, subjective evaluation is done to determine if a bit can continue to operate effectively, needs repaired or should be thrown away.

Methods are now evolving whereby the bit can be scanned and the digitalized information can be reviewed against operational wear patterns to determine the best course. That data can also be used to improve its design or to get another bit more fitted to conditions underground, which can vary significantly.

And if the bit needs repair, a printer can be used to return it to service within 24 to 48 hours. Additionally, Baker Hughes used AI to determine optimal bit design based on various constraints. That offered up a wide range of options, and each one used about 50% less material.

“We are refining technology to be able to reprint a bit to make it more optimal for a specific site,” said Parent

Luca Maria Rossi, Vice President Technology of Turbomachinery & Process Solutions, continued in a similar vein. He said Baker Hughes has a long-term plan to place more printers around the world to eliminate supply chain bottlenecks. If the Talamona plant in Italy becomes backed up, parts could be printed elsewhere and sent rapidly to wherever they need to be.

The latest effort is to reduce the number of hot gas path components and speed development time. A hot gas component prototype such as a fuel nozzle is now developed 50% faster. LM9000 and NovaLT turbine components such as fuel nozzles are currently being produced using additive manufacturing. Printing of legacy vanes has been added and limited series production has been introduced.

Rossi said the next chapter will be the development of gas turbine rotating components that require the overcoming of the strength limitations of current materials. But he expected technology to be able to solve those problems soon.

Casting of parts will not go away. The choice of one technology (AM) versus the other (traditional casting) is driven by economic analysis for a particular component or use case.

There are limitations imposed by the size of printers, though. A turbine casing is too big to print, for example. But machines are getting bigger. Even casting companies are turning to 3D printing to create molds, as well as tooling for casting.

Destination Gas

In recent years, some have tried to label natural gas as no more than a transition fuel between coal and renewables. Simonelli addressed the role of natural gas in our energy future.

“Gas is not a transition fuel, it is a destination fuel,” he said. “Gas demand is going to increase by 32% in the coming years.”

The switch from coal to natural gas has eliminated 500 million tons of CO2 in recent years, he added. Baker Hughes is also researching the use of hydrogen in gas turbines and has reconfigured its NovaLT gas turbine generator technology to operate 100% on hydrogen.

Fatih Birol, Executive Director, International Energy Agency (IEA), continued the environmental theme. Global emissions have hit historic high, he said, because of the rise of the SUV. A decade ago, SUVs accounted for 18% of worldwide car sales.Now they account for 42%, and produce 25% more CO2 than the average car. Meanwhile, between 2000 and today, global coal consumption has risen by 65% despite the end of coal being widely publicized.

Birol noted that U.S. shale will continue to dominate oil markets for many years. Although its dramatic growth is set to slow a little, the resources are there to maintain output and reach almost 20 million barrels per day by 2030.

The worldwide combined market share of OPEC and Russian oil production has dropped from almost 55% in 2005 to 48% today and will fall to about 46% by 2030. This limits their ability to dictate market prices, added Birol.

“Oil will lose ground to electricity in terms of consumed energy, and oil demand growth will slow as a result,” he said. “Oil use for road transportation will gradually flatten off.”

Natural gas demand, on the other hand, is predicted to be strong for some time. This, said Birol, will be mainly driven by China, SE Asia and India. Food processing, textiles, fertilizers and other industries are further drivers.

To reduce emissions, he recommended a switch from coal to gas in power plants, more renewables and the implementation of carbon capture, utilization and storage (CCUS).

“Fossil fuels are stubborn: they are likely to have a stable 63% share of the market for another 20 years despite cheaper renewables,” said Birol.

His belief is that all energy technologies are needed to solve the world’s energy. As a result, it would be a mistake to cut investment in oil and gas.

“We need oil and gas and we need more investment to keep fields productive, efficient and with their emissions lowered,” said Birol. “Reducing methane emissions, for example, can be easily done without the need for new technologies.” BP, for example, is implementing Baker Hughes FlareIQ solution to reduce methane emissions from its oil and gas facilities.

U.S view

Steven Winberg, Assistant Secretary for Fossil Energy, U.S. DOE, outlined his nation’s, “All of the above” energy strategy.

“We don’t think it is necessary to pick one energy source over another,” said Winberg. “Technology development has in the past, and will in the future, take us where we need to be.”

He dismissed the latest wave of environmental forecasts, saying that technology has always stepped up to the plate and solved the problem. He sees CCUS as being vital to meeting any emissions goals, but it needs more investment in demonstration projects.

He touted the U.S. as a leader in this area, having spent $200 million a year for more than a decade.

“We need to reduce the cost of carbon capture from $60 a ton to $30 a ton to achieve broader adoption,” said Winberg.

He thinks we have not yet climbed the learning curve on unconventional oil and gas. AI and other technologies can be used to see what is really under the shale plays. That could be a game changer that doubles production, he predicted.

Naomi Boness from the Natural Gas Initiative at Stanford University challenged the ongoing narrative to eliminate fossil fuels, particularly natural gas. She explained that there is quite a difference in emissions between the various fossil fuels, with natural gas being by far the cleanest.

“Natural gas has a big role to play in our energy future,” said Boness.

In the state of California, solar farms, rooftop installations, and wind can provide about half of the electrical energy consumed at noon. However, fast forward to the evening and it drops to less than 20%. Natural gas generation takes over.

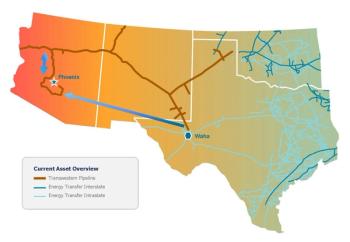

To eliminate the large amount of flaring of natural gas in places like Texas and North Dakota, the Natural Gas Initiative calls for more pipelines to be built to channel that gas to the Northeast and other areas which are subject to seasonal gas shortages.

As a result of current bottlenecks and scarcities, gas prices routinely spike in New England and New York despite the nation having an abundance of gas. A year ago, the spot price of natural gas in New York rose to $140 per million per Btu (it averages around $4).

Yet that state has begun outlawing new natural gas installations in residential new-builds and is largely opposed to new pipeline projects.

The solution to methane leakage and flaring (a major contributor to greenhouse gas emissions) is well within existing technologies ― better valves, efficient maintenance and more pipelines. Yet some states are actively preventing their implementation based on local environmental considerations. The Natural Gas Initiative believes a wider view is necessary.

It advocates that the best thing for the environment, public health and the climate is to move away from coal and toward natural gas as quickly as possible. Dismissing fossil fuels from the energy mix at an arbitrarily rapid rate would be destructive to the global energy system.

Carbon capture

With coal and natural gas unlikely to disappear from the global scene anytime soon, CCUS is receiving more attention. CCS Stefano Maione, Chief Development, Operations & Technology Officer at Eni, views CCUS as a necessity in achieving emissions goals. His company, for example, has set an upstream net-zero emissions target by 2030.

Currently, the worldwide capture capacity is 35 million tons of CO2 per year (30 of that is in the U.S.). Maione called for a 15% per year capacity growth in CCUS to achieve 3 gigatons per annum of carbon capture by 2050.

That, in turn, requires 30 to 60 storage facilities to be added per year, as well as pipelines that can feed CO2 to those centralized storage facilities.

Eni has developed the eCCS-lens platform encompassing capture, transportation, subsurface modeling, monitoring and more. The company is involved in five CCUS projects with one already operating in Norway with Equinor (Sleipner). Others under development include two sites in UK, one in Libya and one in United Arab Emirates.

In tandem with CCUS innovation, some are pushing the development of hydrogen-fueled turbines. Marco Alvera, CEO of European gas utility Snam, is promoting the use of hydrogen produced from renewable sources.

Snam is experimenting with up to 10% hydrogen mixed with natural gas in its pipeline network. According to a study commissioned by Snam, hydrogen could cover almost a quarter (23%) of the Italian energy demand by 2050.

“In the long term, gas is no longer seen only as a fuel for the transition but as a pillar of a decarbonized world, particularly in the various sectors with limited possibilities for electrification,” said Alvera. “This role will be strengthened thanks to the rapid development of renewable gases, particularly the biomethane supply chain.”

Further, Snam is working to reduce methane emissions by 40% by 2025 (based on 2016). This is being achieved through the application of a methane leak detection and repair campaign, component replacement, and the adoption of the latest technologies.

“Italy is positioned to be a hub for green hydrogen from North African solar fed into Europe,” saic Alvera.

Snam is working with Baker Hughes to prepare compressors and other assets for hydrogen use. The idea is to harness renewables to generate renewable gases that can be fed into the pipeline network.

Another environmental initiative touted at the show is green ammonia (CO2-free ammonia). Sam Muraki, Chairman of the Green Ammonia Consortium explained the difficulty in using renewables as they are often far from major markets.

Current thinking is to use renewables to produce hydrogen and transport it in liquid form. Muraki thinks ammonia is the most economical way to do this, and it can be combusted without CO2 emissions. Large players in the fertilizer industry, such as Yara and OCP have launched green ammonia pilot plants.

Specific to the power sector, Mitsubishi Hitachi Power Systems, is involved in ammonia co-firing with coal in thermal boilers, i.e., a coal-burning power plant replaces some of its fuel with up to 20% carbon-free ammonia.

Another MHPS initiative entails the extraction of hydrogen from ammonia. If made economically viable, this could solidify the business case for hydrogen-fueled gas turbines. Ammonia is much easier to store transport than hydrogen.

Digitalization

What does Formula 1 racing have to do with oil & gas? A lot, it turns out, when you factor in digitalization and analytics. Mark Gallagher, a Formula 1 Data Scientist, delivered a keynote at the AM on the power of this technology.

For the first 20 years of the sport, it was all about speed: how to make the cars go faster. The second twenty were mainly devoted to lighter aerospace materials and aerodynamics. Now it is all about digitalization and data science.

“The first 40 years saw 45 driver deaths,” he said. “The last 25 years have witnessed only a single fatal outcome.”

Data enables better decisions, engineered systems and integrated systems. Digitalization has empowered engineers, maintenance staff and drivers.

World champion Lewis Hamilton is a case in point. He finished every race last season. Drive too fast and you risk wearing out the tires. It is optimized driving that wins races. And so it is in power generation and oil & gas: optimization of gas turbines and compressors. “Data minimizes human error,” said Gallagher.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.