COMBINED CYCLE POWER PLANTS: ARE TWO SHAFTS BETTER THAN ONE?

CHOICES DEPEND ON ECONOMICS, TECHNICAL CONSIDERATIONS, SPACE AVAILABILITY, NOISE REQUIREMENTS, CULTURAL PREFERENCES AND FAMILIARITY

A quick review of the world shows a marked contrast in tastes when it comes to combined cycle power plant (CCPP) designs. Single shafts rule in 50 Hz regions, such as Europe and parts of Asia, while multi-shaft units dominate in 60 Hz territories, particularly in North America.

A wide variety of factors are behind this. Drivers include economics, technical considerations, space availability, weather and regulatory climate, not to mention vendor marketing, cultural preferences and Engineering Procurement Contractor (EPC) familiarity.

Original equipment manufacturers (OEMs) such as Alstom, Hitachi, Mitsubishi Power Systems, Siemens and GE possess single-shaft and multi-shaft combined cycle designs for both their 50 Hz and 60 Hz product lines. However, two of them no longer offer a single-shaft product line in the U.S.

Pre-designed concept

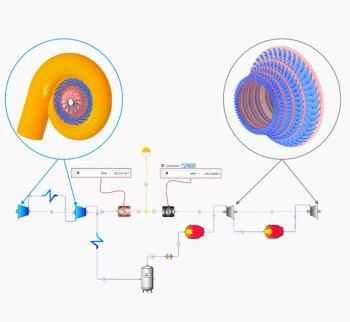

Single-shaft concepts are widely used in Europe and Asia due to the pre-designed plant concept, modularized approach, and a desired OEM turnkey approach, said Lothar Balling, Head of Gas Turbine Power Plant Solutions at Siemens’ Fossil Power Generation Division. A single-shaft F-class typically has a cost advantage compared with a multi-shaft 1x1 configuration due to having fewer generators, less electrical equipment and grid connections, as well as a more compact plant layout, he said (Figure 1). However, a multi-shaft 2x1 or 3x1 reduces the number of steam turbines and generators, which lowers the capital cost of the power train.

On the maintenance side, indoor plants are often set up with permanent cranes, which lift from above. For outdoor plants in the U.S., cranes are often rented for service. As a result, the cost and availability of the rental crane can offset some of the advantage in power train capital cost in certain areas, added Balling.

Siemens applies a clutch between the generator and steam turbine to improve flexibility and allow single GT-generator operation, as well. “Even in a multi-unit project,” said Balling, “many operators in Europe and Asia prefer the single-shaft design considering it more flexible in part-load operation and advantageous in commercial sharing.”

Siemens single-shaft orders from South Korea in recent years include the Bugok 3 (1x SCC6-8000H 1S), Andong (1x SCC6- 8000H 1S), Ansan (1x SCC6-8000H 2x1), POSCO 7, 8 and 9 (3x SCC6-8000H 1S) and Daegu (1x SCC6-8000H 1S). Siemens’ showcase Irsching and Dusseldorf plants in Germany as well as Samsun in Turkey are further examples. However, the company’s Flex-Plant and FACY (Fast Cycling) capabilities are offered in both single- and multishaft designs.

Single-shaft combined cycles are also popular in Japan due to the nation’s space restrictions and the design’s lower initial cost (only one generator), according to Carlos Koeneke, Vice President, Project Engineering & Quality Assurance for Mitsubishi Power Systems Americas (MPSA).

Mitsubishi provides single- and multishaft 50 Hz and 60 Hz CCPPs, with or without a clutch. Typical configuration without a clutch is CSG (combustion turbine, steam turbine, generator) while with clutch it would be CGS. The latter allows an operator to run the combustion turbine and generator before the steam turbine is brought up to speed.

Mitsubishi is installing six 486.5 MW single-shaft blocks in Japan using 60 Hz M501J turbines and single reheat steam turbines at the Himeji No.2 Power Station. The first block is under commissioning and has achieved full load. All units will be commercial by 2015, with a planned combined cycle efficiency of 61.5% and a collective output of 2,919 MW. Mitsubishi also has singleshaft plants operating around the world including Mexico.

In addition, single-shaft designs are preferred for power plants in or near high-population areas, many of which are in Asia, Europe and the Middle East. These plants have to comply with local noise requirements, conform to a compact footprint, and must be protected from adverse weather conditions (Figure 2).

When comparing one single shaft with one multi-shaft 1x1 F-class, the single shaft requires less in terms of generators and auxiliaries, electricals, lube oil system, bearings, civil works and instrumentation & control, according to Siemens’ Balling. In this case, a single shaft shows a 0.1% point performance gain due to greater generator and transformer efficiency and lower auxiliary power demand. For larger units the specifics might change.

However, he points out, two single shafts versus one multi shaft 2x1 shows an investment advantage for the latter, as well as comparable performance at full load. When operated frequently with less than 50% load, the single shaft has a higher net efficiency and better operational behavior.

“Typical construction lead time for both is nearly the same,” said Balling. “Two single shafts are put into operation in a staggered mode. Multi-shaft units can be equipped with a bypass stack which enables earlier power generation. This is often the case in the Middle East.”

Multi-shaft plants

The 60 Hz U.S. market demonstrates a preference for multi-shaft designs. EPC firm Sargent & Lundy LLC is one example. It conducts about 85% of its work in the 60 Hz market, which is just about all multi-shaft, said Bill Siegfriedt, Project Manager.

SSS Clutch Company President Morgan Hendry reported that out of the more than 200 single-shaft units provided with SSS clutches since 2000, about 20 were in the U.S. “Despite this, there is evidence of single- shaft projects being done in the U.S.,” said Hendry. “For example, Moxie Energy’s Patriot and Liberty plants have been announced with Siemens SGT6-8000H single- shaft generating sets.”

From a cultural perspective, Siemens has noticed that architect engineers, who tend to execute power projects in the U.S., prefer to assemble components from different suppliers in a multi-shaft arrangement.

Further, they may not be familiar with single-shaft designs, which can be more complex, require more coupling, and are often provided as a turnkey power train by an OEM. Multi shafts also have separate steam turbines. This allows for flexibility in choosing a steam turbine, which is attractive for customers who choose to use supplemental firing to cover peak demand.

In the U.S., plant size may play a factor in choice. Klaus Brun, Machinery Program Director at the Southwest Research Institute (SWRI), said that empirical evidence suggests that the majority of plants built in the U.S. are in roughly the 400 MW to 600 MW range. “Thus it is, for example, either a 207ºF in the U.S. market (2+1 multi shaft) or a 109ºF in the European market (1+1 single shaft),” said Brun.

Financial strain

A 500 MW greenfield CCPP will cost about $700 million, he said, which is within the economic realities of a utility or major Independent Power Producer. Anything larger tends to add strain on the financing side. Additionally, that size range often seems to match power transmission capabilities using standardized cable sizes and transformer stations, and probably matches base load requirements of small to mid-size towns.

GE has observed similar phenomena. “GE’s focus is on multi shaft in the U.S. because our customers there are requesting it as it offers a balance of performance, installed cost and operating flexibility,” said Tom Dreisbach, product manager, GE FlexEfficiency Combined Cycle Power Plants. “In 50 Hz countries, we tend to see more customers asking for single shaft.”

He said that EPCs operating in the U.S. have experience integrating GT and ST equipment into a 2x1 multi-shaft plant in the 550 MW-to-750 MW range. Due to differences between 50 Hz and 60 Hz, 1x1 singleshaft configurations in the U.S. can fall below that 550 MW mark. Thus a larger plant single-shaft footprint may be required to hit the desired size.

Take the case of the GE FlexEfficiency combined cycle architecture. The FlexEfficiency 60 (60 Hz) has a 2x1 multishaft configuration and provides 750 MW output with a promised 61% net baseload efficiency using GE 7F 7-series gas turbines, a D17 steam turbine and H26 generators. A FlexEfficiency 50 plant (50 Hz), on the other hand, such as the one being built in Bouchaine, France for utility EDF, is a 510 MW plant which uses a GE 9F 7-series gas turbine, a D-14 steam turbine and a W28 generator in a single-shaft configuration.

MPS’ Koeneke disputes that power blocks need to fall within that bracket. “There is absolutely no technical advantage for this size other than transmission limitations in case the new plant is replacing an existing facility of a similar size (for example, a 600 MW coal plant),” said Koeneke. “Mitsubishi offers upgraded F and larger frames; therefore, depending on the configuration (1:1, 2:1, and so on), our MW range can be substantially larger than 600 MW.”

Changing course

For the 50 Hz market, Alstom has both the 1-on-1 single-shaft and 2-on-1 multi-shaft offerings, said Amy Ericson, Vice President of Alstom’s Gas Product Platform. For the 60 Hz market the company has a 2-on-1 multi shaft, which matches the block-size some desire in the 60 Hz market. This is a change from the company’s earlier history. The 300 MW Agawam plant in Massachusetts is just one example of Alstom’s KA24 CCPP plants in the U.S., which to date have all been single shafts.

One reason Alstom gave for gravitating toward multi shaft in the U.S. is the difference in rating size. 50 Hz engines, stated Ericson, have been of a size that tended to suit 1-on-1 single-shaft block sizes (400 to 500 MW); in the U.S., the smaller MW rating has meant a preference for 2-on-1 multishaft configurations (500 MW to 650 MW). “There are no particular technical issues favoring one or the other.”

In Alstom’s experience in Europe, if space or grid dispatch capabilities suit something on the order of 400 to 500 MW or 1,200 to 1,500 MW, then one or multiple 1- on-1 single-shafts tend to be a better fit economically. The 800 MW to 1,000 MW range, however, may suit a 2-on-1 multishaft CCPP. “Where there is a need for daily stop and starts,” said Ericson, “a 1-on-1 single- shaft may allow greater operational flexibility, whereas in base-load markets a 2-on- 1 or 3-on-1 multi shaft may prove to be the best technical and economic choice.”

Looking ahead

Each configuration has its advantages and disadvantages. SWRI’s Brun does not believe that a cookie cutter approach to plant selection is the right way ahead for U.S. operators. Generally speaking, he said, single shaft reduces space requirements for a combined cycle plant by as much as 15%, plant costs by a few percent and a fractional improvement in efficiency. “But they are not as flexible as having the gas turbine and the steam turbine each on their own generator.”

Vendors believe that change is coming. “As equipment evolves, we also see the popularity of particular configurations changing,” said Siemens’ Balling. “The modular approach of multiple single shafts has become attractive to some U.S. customers.”

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.