COVER STORY: CENTRIFUGAL COMPRESSORS

ENERGY EFFICIENCY AND LOW MAINTENANCE ARE THE DOMINANT MARKET TRENDS. BUT OPINIONS ARE SPLIT WHEN IT COMES TO STANDARDIZATION VERSUS CUSTOMIZATION

Drew Robb

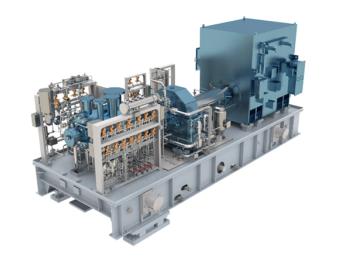

FS-Elliott standard centrifugal compressor

Dominant trends in the centrifugal compressor marketplace include the drive for higher energy efficiency while eliminating costs and downtime. Also a factor, the demand for smaller maintenance windows and lighter, more-compact equipment.

While these trends are common to most OEMs, opinions are split on standardization and customization. Some see a clear move towards standardization, reasoning that standard compressor designs lower costs, make life easier for engineering, procurement and construction (EPC) contractors, and simplify parts management and maintenance.

Others note that many applications require customization and see this market segment increasing. In fact, they are experiencing renewed demand for large-scale customized machinery.

Whichever trend dominates in future, companies such as Elliott, Hitachi, FS-Elliott, Sullair, Atlas Copco Gas & Process, Siemens Dresser-Rand (D-R), Kobelco, GE Oil & Gas and Cryostar are in the forefront of innovation.

Hitachi

Hitachi previously focused on downstream markets, especially chemical plants, e.g., ammonia, urea and methanol. More recently, it has added more upstream business to its repertoire.

Downstream trends include bigger plant sizes, greater energy-saving, and large compressors powered by electricity, said Koki Kato, oil and gas marketing specialist, Industrial Components and Equipment Division of Hitachi. On the upstream side, Hitachi is seeing more compressor service for sour gas, such as H2S, CO2 and chlorine.

“This trend is due to more sour oil and gas field development in the Middle East and advances in technology, such as corrosion-resistant alloys,” said Kato.

Common to all markets, he sees more use of magnetic bearings in remote sites as they tend to require less maintenance. Other trends are modularization to reduce the labor cost at site and shorten delivery period of the plant, and localization. This last one, he said, is particularly the case in Brazil and many African countries.

Hitachi has been trying to approach the said modularization. However, compressor standardization is not proving popular among users. “Centrifugal manufacturers tend to recommend standardization, but the customers prefer customization to his unique demand,” said Kato.

FS-Elliott

FS-Elliott focuses on the engineering and manufacturing of centrifugal air compressors. Flexibility of the company’s compressor packages make them suitable for a variety of industries, with industrial manufacturing as the primary market, followed by downstream oil and gas and air separation.

“The industrial manufacturing segment is replacing more traditional positive displacement installations,” said Neil Owen, Manager of Global Marketing at FS-Elliott. “Energy efficiency is such a key driver in everyone’s balance sheets these days that it invariably requires some investment to make a leap forward.”

The company has observed a trend towards a more configurable product, as opposed to a customized solution. Owen said that as capital investments are being carefully scrutinized, OEMs who can offer a more standardized solution that closely meets user needs can be more competitive in the marketplace.

Within the downstream oil and gas segments, especially, FS-Elliott is seeing a more cost-conscious approach to the application of specifications along with a more collaborative approach to ensuring best value engineering of packages.

“We have seen a stronger push towards a larger return on capital investment in terms of energy efficiency and reduction of operating and maintenance expenses in multiple segments,” said Owen. “Purchases are often aided by energy-efficiency grants offered by utility suppliers. These grants are typically tied to the scale of the energy reduction, which further drives demand towards a more optimized solution.”

The recent introduction of the FS-Elliott R1000 Control Panel, for example, was driven by the need for optimization of centrifugal compressors operating in heavy industrial environments. Its energy-saving features include ambient compensation control, pressure band optimization and integrated compressor control algorithms, all in a standardized package with an 11-inch tablet style interface.

Sullair

In the centrifugal compressor sector, Sullair primarily serves general manufacturing, as well as food and beverage companies. Like others in the industry, dominant market drivers are greater energy efficiency and lower maintenance costs.

“Companies are beginning to look at the total lifecycle system cost instead of just the total capital cost,” said Brian Tylisz, Vice President of Sales, Commercial & Industrial, Sullair. “This has driven general manufacturing, and food and beverage companies to focus their attention on centrifugal compressors versus other types of compressors.”

While some manufacturers favor customization or believe the market prefers it, others such as Sullair take the opposite stance. It is seeing more and more customers choosing standardization over customization, with shorter lead times on standard units being one reason.

Sullair offers two families of high-performance centrifugal compressors, the T-Series and f-series. The T-Series is aimed at the general manufacturing and the food and beverage sector and includes the T2, TX, TRA, TRE, TRX and T3 units. These compressors come in standard packages ranging from 175 to 2300 HP and producing flows from 550 to 11,750 scfm.

“The T-Series compressors offer oil-free air, an efficient design to reduce energy use, and a horizontal-split gearbox to allow easy access to all moving parts,” said Tylisz.

Dresser-Rand

The Dresser-Rand business (D-R) is best known as a supplier of centrifugal compressors to the oil and gas market, especially LNG, pipeline compressor stations, FPSO topside, and onshore oil and gas production (upstream). D-R also has been receiving more requests for package standardization as a means of reducing cycle time and cost.

“Due to low oil prices, national and international oil companies are experiencing reduced cash flows and have less capital to invest in new projects,” said Dan Lowry, Vice President of Client Services for D-R. “Many potential new projects are being postponed due to projected diminished return on investment or lack of potential buyers and clients for their products.”

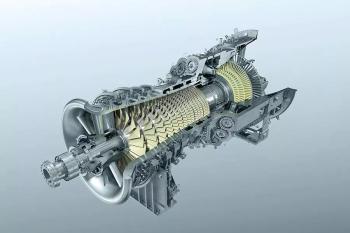

As a part of Siemens, D-R can now look beyond compression by adding elements, such as industrial and aero-derivative gas turbines (GTs), steam turbines, electric motors, variable frequency drives, and control systems. D-R compressors, for example, are being twinned with the Siemens SGT-750 GT.

This twin-shaft GT with a free, high-speed power turbine has a power output of 38.1 MW for power generation and 39.3 MW for mechanical drive.

“The modular package with single-lift capability is well suited for both onshore and offshore applications, such as floating LNG,” said Lowry. “The turbine was specifically designed for long operating times with extended overhaul intervals, and features easy maintenance, high availability and reliability.”

D-R said the best solution for a specific application or process may often be a highly customized and specified compressor. However, in an increasing number of scenarios, such as the power generation market, users demand a more standardized, CAPEX-friendly compressor approach.

Rather than favoring one approach or the other, D-R is happy to meet both of these general requirements. “In integrally geared compressors for process gas, customization enables us to more precisely address exact process needs, or other requirements such as API specifications,” said Lowry.

More standardizing

“However, we are also increasingly driving the development of standardized compressor packages. In this current market climate, our recommendation would be to strongly consider products that are more standardized and have high reliability.”

Lowry added that integrally geared (or gear-type) centrifugal compressors are a good fit for a large range of gases. This technology is also used in its eight-stage 200 bar CO2 applications, such as urea fertilizer that require a heavy-specified, highly customized compressor.

On the standardization side, however, D-R has used its experience of more than 420 hot-commissioned fuel gas booster (FGB) units to introduce a standardized FGB for gas-fired turbines. It supplies a discharge pressure up to 50 bar and handles volumes from 1,000 to 6,000 m3/h.

Atlas Copco’s eight-stage CO2 compressor package

Atlas Copco

Atlas Copco Gas and Process centrifugal compressors are used mainly in industrial gases, the hydrocarbon business and power generation. The company provides compressors for air separation, oil and gas midstream, LNG, chemical & petrochemical, fertilizer and newer fields, such as supercritical CO2.

In the realm of CO2, for example, its compressor range covers pressures up to 200 bar. In the air separation segment, its single-shaft compressors can provide flow volumes of up to 480 000 m3/h. Its centrifugal compressors can operate up to 45 000 HP.

The effects of low oil and gas prices and high crude oil inventories have put on hold most upstream investment. Consequently, the company has seen a drop off in investment in larger custom-engineered centrifugal turbocompressors and an increased demand in standardized compressor solutions.

“Sectors benefitting from low fuel costs include gas turbine-driven power generation, fertilizer production, chemical & petrochemical or CNG,” said Tushar Patel, Marketing Manager at Atlas Copco Gas and Process. “As challenging as the situation may be in some areas, it creates opportunities for new projects or product solutions in other segments.”

Kobe Steel (Kobelco)

Kobe Steel supplies internally geared centrifugal compressors of under 20 MW that typically serve petrochemical plants, air separation plants, and other manufacturing facilities. As demand for large integrally geared centrifugal compressors is increasing, the company has expanded into that sector.

“As manufacturing facilities grow larger, they require compressors of large capacity or high pressure with high efficiency,” said Gary Tsuchida, a spokesperson for Kobe Steel.

All Kobe Steel centrifugal compressors are custom engineered to meet customer requirements based on their specifications. “Customers benefit from compressors that are custom engineered for optimum performance for process gas services,” said Tsuchida.

To meet the demand for larger centrifugal compressors, the company is building a 40 MW test facility at its Takasago Works in western Japan. Compressors made there will be sent to a test facility within the same complex to confirm their mechanical stability and design performance prior to shipment. Plans call for the test facility to go into operation in the first quarter of 2017. An existing test facility can handle compressors up to 20 MW.

Elliott

Elliott Group serves a broad spectrum of centrifugal compressor applications in the downstream and midstream markets, including LNG and excluding traditional gas transmission. John Rann, Vice President or Engineered Products at Elliott, said that in the olefins market segment there are still some plants in developing markets being specified in the 500 kilotons per annum (KTA) to 800 KTA range. But the predominance of new ethylene plants is above 1,000 KTA, and there are studies underway to recognize the economy of scale by increasing capacities to over 2,000 KTA.

The primary driver for increased olefin plant capacity is the economy of scale to be derived from an increase in plant capacity, said Rann. This is achieved by maximizing capacities of the rotating and static process equipment without proportionally increasing the plant footprint and EPC costs.

“The propane dehydrogenation segment continues to develop globally with larger capacities also being the trend,” said Rann. “These increased capacities require large frame centrifugal compressors with the accompanying experience, particularly in the refrigeration services, which significantly narrows the competitive field.”

Elliott’s markets often demand customization over standardization. With the exacting process requirements as defined by the various process licensors in the downstream market segments, the majority of centrifugal compressor applications are engineered to order as opposed to the gas transmission or air separation markets, for example, where standardized centrifugal compressors are more commonplace.

“Many customers have their own compressor specifications, which commonly require modifications or additions to API specifications, and which demand customization of the product with regard to manufacturing, inspection and testing procedures,” said Rann. “For certain standard processes, however, it has been possible to work in conjunction with the process licensor to pre-engineer standard centrifugal compressor solutions.”

An example is the cooperative agreement recently announced between Linde Engineering and Elliott Group for standardized centrifugal compressor solutions for the Linde Star LNG process. This level of standardization requires a committed collaboration between the process licensor and the centrifugal compressor OEM, added Rann.

Drivers in favor of standardization include cost competitiveness and speed to market (process licensors and EPCs), and reduced cost and lead time (centrifugal compressor OEMs), said Rann. Likewise, standardized products are attractive for the end user and operator with regard to commonality of spare parts and familiarity of operation and maintenance.

Elliott Group has expertise in large capacity centrifugal compressors for the olefins and LNG market segments, especially in refrigeration duties. Its product range covers capacities up to 315,000 CFM (535,000 M3/h). Its 10M/10MB to 70M/MB frame sizes meet most downstream and midstream applications. Its 70M to 110M frame sizes meet the capacities specified for new baseload LNG refrigeration plants.

GE Oil & Gas

The GE Oil & Gas centrifugal compressor line covers upstream, midstream, transportation, LNG, petrochemical, refinery and natural gas onshore applications. “There is a trend towards optimization and reduction of space and weight of products, along with shorter delivery time and a simplification of the overall turbomachinery system,” said Nicola Marcucci, Gas Turbine & Compressor Product Leader, GE Oil & Gas.

One example is GE’s high-pressure ratio compressor (HPRC), designed for up to 50% reduction in footprint and 30% reduction of weight. Adapted from GE Aviation aerodynamic experience, this HPRC is finding favor in onshore and offshore natural gas duty. Its architecture combines shrouded and unshrouded impellers on a single, high-speed shaft.

Cryostar

Cryostar serves the LNG and hydrocarbon processing fields. The company is experiencing a demand for greater variety of product specifications. Neil Wilson, Commercial Manager, LNG TT at Cryostar said the company only deals with customized orders, not standardization. For example, the Cryostar 4-stage LNG boil-off gas compressor is tailored to many different needs.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.