Distributed generation rules Powergen conference

The annual PowerGen International show has traditionally been the showcase for large power plants. Coal facilities and more recently, combined cycle and natural gas-driven peaking plants have been the focus. But that changed this year with distributed generation (DG) stealing the spotlight.

The concept is simple. Instead of large centralized plants (or to augment such facilities), localized pockets of power generation predominate. This includes wind, solar, combined heat and power (CHP), and battery systems. These resources can either operate as part of the overall grid, as a separate power island, and as backup power. Further, groups of DG assets are collaborating to create micro-grids to serve their own area.

This is turning the power market on its head. Yes, large plants will continue to be built, but their frequency will probably lessen. But DG is gathering momentum. A couple of years back, the idea was to support renewable resources with large, flexible gas turbine plants could come online rapidly as wind and solar capacity dropped off the grid. Now, it is up to the GT marketplace to find a role within DG. This will probably involve smaller GTs operating as either backup power, for rapid start and stop, or when favorable prices prevail.

Dr. J Patrick Kennedy, CEO and Founder of OSIsoft, took up DG in his keynote. He zeroed in on the data-intensive nature of trying to efficiently manage solar on the roof, battery storage, fuel cells, and traditional generation systems. To lower the cost of power, sophisticated systems are required.

“Things are heading towards the creation of community systems or grids,” said Kennedy. “But this trend is being held back by problems related to who owns the data.”

For example, is the data coming from a smart meter the property of the utility or the home owner/business owner? Is power plant data about turbine operation owned by the plant or the OEM?

“Ownership rights for data have to be established for distributed generation to realize its potential,” said Kennedy.

He ended with some perspective on IoT. Yes, billions of sensors are being added to components, equipment and facilities. But any analytics engines seeking to harness this information has to be cost effective. That requires the establishment of multiple tiers of data. Some tiers will be based in the cloud, others within the plant or fleet, and others will be in the hands of small DG assets.

“If everything comes to one point, you have be receiving too much data too fast,” said Kennedy. “You have to build a toolset that allows many different data sets to be analyzed at various points in the value chain. Cloud providers are already making these tools available in ways that may be more cost effective than building your own.”

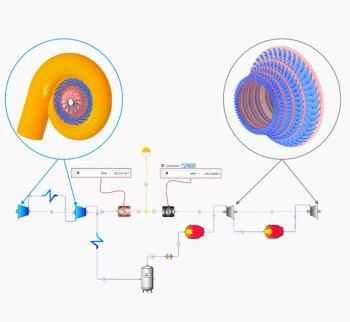

Blake Moret, CEO and President of Rockwell Automation, discussed the harnessing of the Industrial Internet of Things (IoT) to bring about increased productivity. He offered the Eight Flags CHP plant as an example. Its outdated infrastructure included legacy controls that provided historical data. By adding software tools, the plant became able to rapidly interpret data and boost efficiency.

"We are seeing the convergence of IT and Operational Technology (OT),” said Moret. “IT used to be separate from the processes on the plant floor, but that is changing.”

He doesn’t believe, however that everything should go to the cloud. Some functions will go there while others will remain on site. But he foresees analytics being done far more at the smart device level, and being able to add insight across multiple facilities. The benefits are said to include lowered downtime, being able to respond faster to market demand, improved plant availability, greater regulatory compliance, reduced operational costs and secure access to IT and OT systems.

“It all starts with real-time data on voltage, kWh, running time, temperature and vibration,” said Moret. “That is turned into useful information which has context in terms of energy. Only when you have that can analytics come into play.”

Next up, Paul Browning, President and CEO or Mitsubishi Hitachi Power Systems Americas (MHPSA), drew attention to big shifts in power with change occurring more rapidly than ever. In the developed world, the levelized cost off solar and wind have fallen dramatically. Over the past decade, he said wind power has experience a 12% per year drop, while utility scale photovoltaic (PV) solar down has been going down at 20% per year. Browning made the point that these numbers gain lots of attention. What has been largely unnoticed, though is that natural gas power has decreased 12% per year from combined cycle over the past ten years. 70% of that drop is due to the low price of gas, with the rest coming from efficiency gains. He cited a price for a 50-50 mix of gas and renewable power or $41 per MWh.

FIND OUT MORE OF THE HIGHLIGHTS OF THE POWERGEN SHOW IN THE JAN/FEB ISSUE OF TURBOMACHINERY INTERNATIONAL.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.