DISTRIBUTED GENERATION RULES POWERGEN

By Drew Robb

The annual PowerGen International show has traditionally been the showcase for large power plants. Coal facilities and more recently, combined cycle and natural gas-driven peaking plants have been the focus. But that changed this year with distributed generation (DG) stealing the spotlight. The concept is simple. Instead of large centralized plants, localized pockets of power generation predominate to replace or augment these facilities. These include wind, solar, combined heat and power (CHP), and battery systems. These resources can operate as part of the overall grid, as a separate power island, or as backup power. Further, groups of DG assets are collaborating to create micro-grids to serve specific areas. This is turning the power market on its head. Yes, large plants will continue to be built, but their frequency will probably lessen. However DG is gathering momentum. A couple of years back, the idea was to support renewable resources with large, flexible gas turbine plants that could come online rapidly as wind and solar capacity dropped off the grid ( T u r b o m a c h i n e r y I n t e r n a t i o n a l , May/June 2017, p. 24). Now, it is up to the GT marketplace to find a role within DG. This will probably involve smaller GTs operating as either backup power, for rapid start and stop, or when favorable prices prevail. Companies, such as Mitsubishi Hitachi Power Systems (MHPS), OSIsoft, Rockwell Automation, Wärtsilä, Hydro Quebec, Beaufort Rosemary, Pacific Power and SVG Consulting had plenty to say about distributed generation during the show.

Keynotes

The 2017 PowerGen show took place in December in Las Vegas. A 1,100-vendor exhibition and 60 technical sessions an- chored the show. Several keynotes kicked things off. Dr. J Patrick Kennedy, CEO and Founder of OSIsoft, took up DG. He zeroed in on the data-intensive nature of trying to efficiently manage solar, battery storage, fuel cells, and traditional generation systems. “Things are heading towards the creation of community systems or grids,” said Kennedy. “But this trend is being held back by problems related to who owns the data.” For example, is the data coming from a smart meter, owned by the utility, or the home or business owner? Is power plant data about turbine operation owned by the plant or the OEM? “Ownership rights for data have to be established for distributed generation to realize its potential,” he said. Cost and data management are also serious concerns. Billions of sensors are being added to components, equipment and facilities, added Kennedy. But any analytics engines seeking to harness this information must be cost effective. That requires the establishment of multiple tiers of data. Some tiers will be based in the cloud, others within the plant or fleet, and others will be in the hands of small DG assets.

“If everything comes to one point, you receive too much data too fast,” said Kennedy. “You have to build a toolset that allows many different data sets to be analyzed at various points in the value chain. Cloud providers are already making these tools available in ways that may be more cost effective than building your own.”

Replacing outdated infrastructure and legacy controls increases productivity, according to Blake Moret, Rockwell’s CEO and President. By adding software tools to the Eight Flags CHP Plant in Fernandina, FL, for example, Rockwell Automation was able to quickly collect and interpret data, resulting in increased efficiency, he said. “We are seeing the convergence of IT and Operational Technology (OT),” said Moret. “IT used to be separate from the processes on the plant floor, but that is changing.” Moret does not believe everything should go to the cloud, however. Some functions will go there while others will remain on-site. But he foresees more analytics at the smart device level, and being able to add insight across multiple facilities. The benefits are said to include lowered down-time, faster response to market demand, improved plant availability, greater regulatory compliance, reduced operational costs and secure access to IT and OT systems. “It all starts with real-time data on volt- age, kWh, running time, temperature and vibration,” said Moret. “That is turned into useful information which has context in terms of energy. Only when you have that can analytics come into play.”

The power market is undergoing rapid change, according to Paul Browning, President and CEO of Mitsubishi Hitachi Power Systems Americas (MHPSA). In the developed world, the levelized cost of solar and wind have fallen dramatically, he said. Over the past decade, wind power has experienced a 12% per year drop, while the price of utility- scale photovoltaic (PV) solar has been going down at 20% per year. What has been largely unnoticed, though, is that natural gas combined cycle power has decreased 12% per year over the past ten years. Part of that is due to new drilling technologies that have resulted in a 70% reduction in the price of gas, part from a 30% reduction in the $/KW installed cost of large combined cycles, with the rest coming from significant efficiency gains. Browning cited a price for a 50%- 50% mix of gas and renewable power costing $41 per MWh and being 85% more carbon efficient than retiring coal-fired power.

The Grand River Dam Authority’s (GRDA) Grand River Energy Center 3 in OK is a 505 MW example of this mix of renewables and natural gas. It is a combined cycle power plant (CCPP) equipped with a MHPS M501J GT, operating at 62% efficiency. The plant replaces an aging coal facility and works in conjunction with the abundant wind energy resources that are present in Oklahoma. “Retiring old coal and adding a carbon- efficient combination of gas turbines and renewables, is the way forward,” said Browning. In the developing world, the picture is a little different. There, said Browning, buyers used to gravitate towards older technology. However, now they are opting for the newest and most efficient products available, including a big shift to more affordable Liquefied Natural Gas (LNG). Its price has dropped in some parts of Asia from $16 to $8 per million BTUs. While many carbon capture, projects have underperformed in Europe and North America, he highlighted the recent success of NRG’s Petranova project in Houston. Carbon capture will be a critical issue in Asia, due to the presence of newer coal plants in the region. Utilities in Asia need to recoup their investment, while in the developed world, they are more willing to re- tire aging facilities.

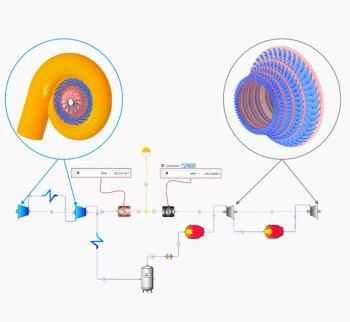

Browning sounded a positive note about the North American market, which is shifting from the F-class to next-generation turbines. Along with higher inlet temperatures and pressures, these machines are more intelligent and more connected. They include analytics functions and the ability to create digital turbines which are an exact mirror of their physical equivalent. “The physical and digital turbines travel together through the lifecycle of the machine to help predict what will happen in the future and to streamline maintenance,” said Browning. “Thus, we are transitioning from real-time monitoring to complete operations and maintenance support, as well as performance optimization at the fleet level. Eventually, we will arrive at autonomous operation across the entire generating portfolio, under automatic grid control.”

The cost of wind and solar is now comparable with coal and natural gas, said Stefan Bird, President and CEO of Pacific Power, He advocated regional diversity to lower risk from intermittent resource generation. The need for regional diversity is apparent when you consider that the grid is gradually becoming more unified. Pacific Power, for example, is partnering with the California Independent System Operator (CAISO) and others to create a unified western energy market (back in 2014, the Western U.S. consisted of 38 relatively independent balancing areas). By adding software, integration and analytics between the system nodes, greater efficiency is possible. California has invested heavily in renewables and at times, produces more solar or wind power than it consumes. With a unified grid, fossil facilities in Oregon could be throttled down with California handing off its excess power to the Pacific Northwest. Similarly, California could call on natural gas or coal resources out- side of the state due to a rapid drop in renewable generation. “Pacific Power is adding digital controls to make coal more responsive,” said Bird. “This will enable operators to fine tune its operating range, double its ramp rate and improve coal economics.”

DG investment

Traditional utilities should consider investing in DG assets, such as localized generation of solar and wind, instead of installing new substations or adding new circuits, said Subbarao Govindaraju, President of SVG Consulting. “Instead of building transmission lines and substations to bring the power to load areas, establish localized generation at the distribution level, beside or within the load areas,” he said. That means changing power generation from being a one-way flow from the provider to the customer, to being bi-directional. But, in turn, that brings up safety and reliability issues for the electric net- work that must be addressed.

“Utilities need to be able to monitor, predict and control distributed generation sources,” said Govindaraju. “Each type of DG has different parameters.” Such assets installed on the grid will provide additional intelligence to planners, engineers and operators to help them manage the grid more efficiently. This control is feasible through added automation that helps manage the precise orchestration of various assets to manage emerging grid conditions. Large amounts of data must be processed to make automated decisions or rapidly provide options to the operator on possible next steps. Ultimately, however, many of these decisions need to be automated. “Data must be collected and communicated to back-office systems in near real time for proactive control,” said Govindaraju. “Technology needs to be revamped to accommodate and act on the additional intelligence being obtained from grid assets.” He called for greater investment in planning and operations system, load and DG forecasting, power flow optimization, high-speed communications, cybersecurity, integration of customer and grid technologies, and substation modernization.

The DG theme continued with Kevin Casey, Managing Director at energy consultancy at Beaufort Rosemary. He covered the challenges inherent in expanding the quantity of small distributed energy re- sources, such as solar, wind, batteries, CHP, hydro, fuel cells, microturbines and the microgrid. They add value that goes beyond the MW they produce: ancillary services, grid independence, and lower or more predictable costs in some cases. However, traditional large-scale power developers typically do not do well developing resources, such as residential solar. Despite steadily falling prices, existing regulatory constructs and financing options can hamper the expansion of DG. Take the example of microgrids. Facilities, such as data centers, hospitals, military bases, research labs, and fire stations are among the leaders because they value energy independence, redundancy and reliability. “They are on the cutting edge as they are willing to pay more for reliability and redundancy,” said Casey. “But microgrid reliability may require potentially complex integration and that probably requires utility assistance.”

Market shifts

“The American utility industry is in the midst of an energy transition,” said Matti Rautkivi, Director of Marketing and Sales at Wärtsilä. “Traditional baseload capacity (coal and nuclear) is being replaced by renewables and flexible gas capacity.” Two-thirds of added capacity last year came from renewables, he said. While that was mainly wind, solar is coming on fast and will probably take the lead. The dominance of renewables should continue as the price per MWh continues to fall. This is causing havoc with fossil generation, particularly coal. PSEG, for example, has shuttered its last coal plant, said Rautkivi. Similarly, Luminant has recently shut down some of its large coal plants, and the coal plants in Arizona are finding it almost impossible to operate profitably. It boils down to simple economics, as the coal plants are running less and not able to cover their costs. And with renewables becoming “the new baseload,” coal plants have to deal with a lot more cycling. “Even combined cycle gas is struggling,” said Rautkivi.” PNM, a utility in New Mexico found the cost of CCGTs would have to be less than $250 per kW to make economic sense. Most CCGTs come in at anywhere from three to four times that. Wärtsilä, meanwhile, is hoping to gain from these market forces by offering flexible power options using its reciprocating engines, while also expanding into energy storage business via its subsidiary, Greensmith. Wärtsilä and Tucson Electric Power have agreed on 10 x Wärtsilä 18V50SG natural gas engines to be installed at the H. Wilson Sundt Generating Station in Tucson, AZ. The project will provide 200 MW of flexible capacity to integrate more renewable energy. The utility is also investing in solar power resources. Greensmith is helping Tucson Electric with the development of a solar plant combined with batteries to produce power at a cost of 4.5 cents per kWh. “We see ourselves more as an integrator to gain flexibility rather than as a company that is selling engines,” said Rautkivi.

Sacramento Municipal Utilities District (SMUD) is also investing in solar and battery power. According to Nancy Bui, Member of the SMUD Board of Directors, it in- tends to install 75 MW of battery storage over the next ten years as well as more solar resources. While battery technology still has a way to go in terms of cost, reliability and time of storage, Hydro Quebec believes it has the solution. It is positioning its hydro- electric resources as the battery for the East of Canada and the Northeast U.S. “We offer a huge reservoir of power which can act as the battery for New Eng- land, Ontario and New York,” said Gary Sutherland, Director of External Relations, Hydro Quebec. “We are able to provide electricity at a cost of 6 cents per kWh.”

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.