GET READY FOR A LOW-CARBON FUTURE

Caption: BHGE’s Simonelli announces a company net-zero goal for carbon by 2050

HGE COMMITS TO ENVIRONMENTAL RESPONSIBILITY FOR THE OIL & GAS SECTOR

BY DREW ROBB

The 2019 Baker Hughes GE (BHGE) Annual Meeting in Florence, Italy sounded more like a Green Party rally than a mainstream oil & gas event. Speaker after speaker stressed environmental responsibility and decarbonization. Giants such as Norway’s Statoil (now known as Equinor), BP, Shell, BHGE, QatarGas, Saudi Aramco, Tellurian, Anadarko, Petronas, Jera, Novatek, Venture Global, SIA Energy, Aker BP, Eni, and Great Western Oil & Gas, as well as oil & gas ministers from around the world spoke passionately about lowering emissions, doing their part to meet targets from the Paris Accord on climate change, and harnessing digitization to prepare for a future shared between their industry and renewable energy.

Notable, too, was a subtle shift from oil toward gas. With its lower emissions and less-tarnished image on the environmental front, natural gas is being voiced by industry executives as a production priority ahead of oil. Industry groups are singing a similar refrain. EUTurbines, an association of European gas and steam turbine manufacturers (composed of Ansaldo Energia, Doosan Škoda Power, GE Power, MAN Energy Solutions, Mitsubishi Hitachi Power Systems, Siemens and Solar Turbines) is advocating what it calls the transition to a decarbonized energy mix in line with the EU’s 2050 goal of a climate neutral economy.

“The gas turbine sector should offer solutions which will convert a large variety of renewable energy fuels to progressively replace natural gas,” said Ralf Wezel, Secretary General of EUTurbines. “By providing the technologies that will drive the transition to fast-adapting, cost-efficient and renewable-gas-based power generation, we ensure that investments in gas turbines will not become stranded assets.”

BHGE commits

“Oil and gas will continue to be an important part of the global energy mix,” said Lorenzo Simonelli, chairman and CEO of BHGE. “We are committed to reducing our CO2 equivalent emissions 50% by 2030 and achieving net-zero CO2 equivalent emissions by 2050.”

BHGE has already been making progress along this path. It has achieved a 26% reduction in emissions since 2012 through technology improvements and operational efficiencies. A 3% reduction year over year is required to meet the 2030 goal. 3D printing and artificial intelligence are ways to reduce cost, lower emissions, lower transportation needs and eliminate waste, said Simonelli. “Annually, 10% of CO2 emissions come from oil and gas; we have to do something about it,” said Simonelli. “Natural gas is the fuel for a low carbon future.”

To further industry and customer efforts to reduce carbon emissions, BHGE’s Gaffney, Cline and Associates has launched a Carbon Management Practice. This is the first oil and gas consultancy to offer quantitative assessment of carbon intensity, evaluation of carbon solutions, and the accreditation of emission reductions. This new practice helps governments, energy companies, and the financial community understand and solve energy transition issues related to oil and gas resources, assets and investments. BHGE backed these announcements with technology releases aimed at supporting operators’ efforts to reduce their carbon footprint.

Caption: BHGE Lumen technology for methane monitoring

Monitoring and inspections

BHGE’s Lumen is a suite of methane monitoring and inspection solutions capable of streaming live data from sensors to a cloud-based software dashboard. The platform consists of a ground-based solar-powered wireless sensor network, and a drone system for over-air monitoring. This delivers closer control of methane emission rates and concentration levels (PPM).

“Methane leak detection is one of the most pressing needs in the oil and gas industry today,” said Diarmaid Mulholland, CEO of BHGE’s Measurement & Sensing business. “Using sensors and industrial software, Lumen helps operators to protect the environment by detecting harmful methane leaks. Using data analysis, this technology helps identify and reduce emissions while also increasing safety for operators.”

Lumen’s solar-powered sensor system known as Lumen Terrain is a wireless system that creates a digital mesh network around a facility, outdoors and indoors. Lumen Sky is the airborne portion which can provide high-definition aerial video streaming for data visualization. Data such as the location of a leak is available in realtime via a computer or smartphone.

Meanwhile, BHGE has signed an agreement with Australian hydrogen infrastructure developer H2U to configure the NovaLT gas turbine (GT) to operate on 100% hydrogen for the Port Lincoln Project, a green hydrogen power plant facility in South Australia.

Further announcements at the annual meeting also relate to lower-carbon technology:

• Modular gas processing at Nassiriya and Al Gharraf oilfields in Iraq will recover 200 million standard cubic feet per day of flare gas. The recovered gas will be processed into dry gas, liquefied petroleum gas and condensate, and will support domestic power generation as well as exports.

• The offshore Integrated Compressor Line operates with zero emissions. It is driven by a high-speed electric motor in a single sealed casing and its rotor is levitated by active magnetic bearings (AMBs)

• Flare.IQ provides accurate, near-continuous control of downstream flare performance by optimizing combustion efficiency, allowing operators to reduce flaring-related emissions.

Eldar Saetre

Ministerial view

Each year, top brass from oil & gas giants as well as government energy ministries gather in Florence. Many are featured on panels or deliver keynotes. Tarek El-Molla, Egypt’s Minister of Petroleum and Mineral Resources forwarded the message of environmental stewardship. His country has recently transitioned from being an LNG importer to an exporter of natural gas. “We have a lot of gas stranded in the Eastern Mediterranean and need to cooperate with others in the region to capitalize on it,” he said. “We are investing more in natural gas and LNG rather than oil.” However, he warned about too much of a pendulum swing. A big drop in investment in oil could lead to a potential shortage in the future.

Eldar Saetre, President and CEO of Equinor, began his keynote by saying the future would be markedly different for the energy industry. He counselled his peers to understand the drivers for change and to be prepared to be surprised. The transition in energy use is ongoing and that is disrupting the status quo, he said. “We must grasp the growing expectations concerning our ethical behavior, social engagement and environmental responsibilities,” said Saetre. “We are experiencing pressure from investors to produce oil and gas with increasingly lower emissions and add more renewable resources.”

He urged the audience to educate people on the industry, listen to young people, and stay relevant to future generations. He sees digitalization as a tool that can help meet these challenges and transform the industry. Potential benefits include lower development and operating costs, faster discovery and recovery, reduced emissions and improved safety. “Digitalization will enable increased sharing and cooperation within and along the value chain,” said Saetre. He listed key areas to address. Innovation is needed to bring oil and gas down to the lowest possible emission levels. Research must be stepped up to bring about decarbonization of energy, including the use of hydrogen as a fuel source. And alternatives must be found to coal in the short term and eventually for both oil and gas.

Mohammed Y. Al Qahtani, Senior Vice President Upstream for Saudi Aramco, provided a tangible example of the kind of gains Saetre calls for. His company cut inspection time by 90% in one of its gas plants using Artificial Intelligence (AI) and other technologies. “A single gas plant generates many terabytes of data every day, yet we only tap into a small portion,” said Qahtani. “Analytics allows you to sift through the data to extract features invisible to the human eye to aid discovery and production.”

Richard Frommer, President and Chief Executive Officer, Great Western Oil & Gas, explained that oil & gas companies are now operating under the microscope. His company has reduced its emissions by over 50%. “We have to work hard for our social license to operate,” said Frommer.

Neil Gilmour, Shell’s Vice President of Integrated Gas, Projects and New Energies, echoed the sentiment that an energy transition was ongoing, coupled with greater scrutiny. Energy Information Agency projections show natural gas use in the world increasing from 22% in 2017 to 25% by 2040. However, one scenario based on broad acceptance of sustainable development policies and stringent environmental regulations could curtail this growth.

“We are in the midst of a transition to low-carbon energy, driven by innovation and digitalization,” said Alessandro Puliti, Chief Development, Operations & Technology Officer, Eni.

LNG growth

Liquefied Natural Gas (LNG) is one of the biggest growth areas within oil & gas. Rajnish Goswami, General Manager of LNG Marketing at Anadarko, discussed the Mozambique LNG Project. With about 75 trillion cubic feet of recoverable natural gas discovered offshore, the country is well positioned to meet the needs of customers in the Atlantic and Asia-Pacific markets, and to tap into the growing demand for energy in the Middle East and Indian sub-continent.

Anadarko and the other participants in Mozambique LNG are collaborating with the government on this 12.8-million-ton plant on the Afungi peninsula. Testing demonstrated flow rates of 90 to 100 million cubic feet per day (MMcf/d), which supports well designs of 100 to 200 MMcf/d. As a result, Anadarko has signed multiple supply contracts. It recently inked a deal with Indonesia’s Pertamina to sell 1 million mt/year of LNG from the Mozambique LNG project for 20 years. That brings the total of deals signed to seven for more than 9.5 million mt/year. Other customers include India’s BPCL, China’s CNOOC, Shell, UK’s Centrica and Tokyo Gas. These contracts highlight an ongoing shift in the LNG market.

Hendrick Gordenker, Chairman of Jera, a major buyer of LNG, said that traditional LNG buyers in developed markets, such as EU, Korea and Taiwan, will not be major growth areas for LNG. While China gets all the attention as a booming market, he pointed out that there are dozens of emerging markets that also should be given attention. Each one may not compare well against China, but collectively they are likely to amount to a large slice of future LNG consumption.

Novatek’s Arctic LNG 2 in Siberia is another big LNG project under development. Once operational, it will have a production capacity of almost 20 million tons. Owner Novatek is working with Italy’s Saipem to build offshore platforms for Arctic LNG 2. The facility is being assembled on gravity-based platforms and production is scheduled by 2023.

Mark Gyetvay, Chief Financial Officer & Deputy Chairman of the Management Board, Novatek said the company launched train two and three last year for the Yamal LNG project. That takes the Yamal plant to its planned capacity of 16.5 million tons per year less than a year after the first shipment of LNG from the project. It is operated by the Yamal LNG Company, owned by Russian independent gas producer Novatek (50.1%), Total (20%), CNPC (20%) and Silk Road Fund (9.9%). It includes an integrated gas treatment and liquefaction facility with three trains of 5.5 million tons per year capacity each, storage tanks, and port and airport infrastructure. An additional small-scale 0,9 Mtpa train is under construction with a start-up planned early 2020.

Yamal LNG’s production is sold under long-term contracts in Asian and European markets. LNG will be supplied to the markets all year round through a fleet of iceclass LNG carriers that travel the Northern Sea Route to Asia through the Bering Strait in the summer. “If we can achieve LNG cost competitiveness around the world, demand will be there,” said Gyetvay. “Ice tankers for Arctic projects can halve the time to deliver LNG to Asian markets.”

Michael Sabel, Co-CEO, Co-Chairman and Founder of Venture Global, a supplier of LNG, argued that it was necessary to shrink the scale of LNG liquefaction trains and re-size equipment to achieve savings of as much as 30% in project costs. BHGE has been the recipient of LNG-based orders from these and other companies. It will supply turbomachinery equipment for the construction of the Golden Pass LNG export facility in Sabine Pass, TX. The project is expected to produce around 16 million tons per year of LNG. It is 70% owned by an affiliate of Qatar Petroleum, with ExxonMobil and ConocoPhillips affiliates owning the remaining shares.

BHGE will provide three LNG trains, including six MS7001 EA heavy-duty GTs driving 12 centrifugal compressors. The MS7001 EA is a large industrial gas turbine available in the LNG market, with 77 units in operation in 13 countries. ExxonMobil and Qatar Petroleum plan to proceed with construction in the first quarter of 2019. The project’s goal is to be the lowest cost LNG supplier on the U.S. Gulf Coast through optimized maintenance cycles.

Tarek Souki

Chinese LNG

China has high demand for LNG and natural gas. Yao Li, Founder & CEO of SIA Energy, said that for the second year running, gas consumption in the nation rose by 16%. LNG imports, meantime, grew at 41% last year to 54 million tons per year. In 2016, China’s coal use was 30% of the total. A concerted effort to switch to natural gas, renewables and geothermal energy has brought down pollution. But a lot more LNG imports are required to further reduce coal consumption.

“We have to be realistic about how much gas can reach end users,” said Li. “We have major infrastructure constraints, such as lack of underground storage, pipelines and transmission lines.” China has 5% of the underground gas storage capacity of the U.S., for example. This curtails the volume of LNG imports the country can accept. But despite that, China will soon overtake Japan as the largest importer of LNG.

Tarek Souki, Senior Vice President of LNG Marketing and Trading at Tellurian, views the expansion of LNG production as a driver of commoditization in the natural gas market. This will help to stabilize prices around the world and ease the transition from coal.

“Natural gas and renewables should be viewed as partners, not adversaries,” said Souki. “We need both to effectively lower coal consumption and must work together.” He mentioned that the combined LNG storage of Japanese and Korean terminals is 697 bcf. But the largest LNG vessels can now provide 821 bcf of floating storage. Thus, as more LNG vessels are built, this will lead to further commoditization.

His company is also involved in reconfiguring the pipeline network in the U.S. to cope with the massive infusion of natural gas. The network is set up to move gas from offshore sites in the Gulf of Mexico to major markets in the Northeast. But some of the flow is now being turned to new export terminals. “The U.S. has far more shale gas than it can consume, but we needed a huge investment to build the pipeline network to cope with 60 million tons of liquefaction capacity,” said Souki.

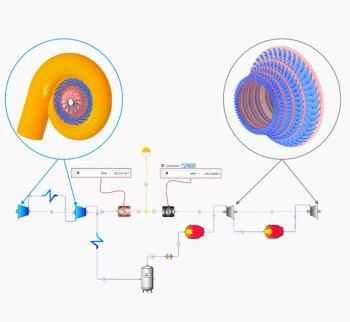

Caption: LM9000

LNG turbomachinery

The latest GT developments were summarized by Luca Maria Rossi, CTO of BHGE’s Turbomachinery Processing Solutions. The company’s newest aero derivative, the LM9000, is a 70 MW class GT being co-developed with GE Aviation. The unit is currently in testing at BHGE’s Massa facility in Italy.

The LM9000 has been designed from the beginning with LNG in mind. Its free power turbine design will allow an LNG train to startup in a fully pressurized condition without venting process gas or requiring an electric helper motor. Its Dry Low Emissions (DLE) combustion system with flexible fuel technology reduces emissions while eliminating water needed for NOx abatement. The LM9000 is also said to deliver 50% longer maintenance intervals, 15% more power and 40% lower NOx emissions compared to competing GTs.

“The LM9000 offers the highest efficiency and power in its range, as well as the longest maintenance interval,” said Rossi. These factors maximize production and lower Total Cost of Ownership (TCO). Its attractiveness to the power generation market is mainly in simple cycle for peak delivery to the grid. The LM9000 is a variation of the core of the GE G90 jet engine. The free power turbine and auxiliaries came from BHGE. This project is helping to establish the methodology for how both companies work together.

Perhaps the largest area of change is in the incorporation of mechanical drive-specific design requirements into the initial phases of a GT development program. Traditionally, the original design requirements of an industrial GT would be primarily for power generation. Then after some time, the system would be modified for mechanical drive purposes which could cause delays of adoption of the gas turbine into the oil and gas market. Rossi said there is much closer collaboration between BHGE and GE to enable GT architectures to be designed from the onset to maximize value for the oil and gas market.

“We are driving a culture where we design a gas turbine that can be immediately used for oil and gas,” said Rossi. “Both the LM9000 and the NovaLT series were designed for oil and gas.” Under development is a 130 MW-class two-shaft GT designed for mechanical drive LNG applications. One shaft drives the power turbine and the other drives the compressor. It is designed for optimal performance throughout the wide operability range needed by the compression train to deal with changing process conditions and production needs. This concept is a fit for large LNG trains producing 4 million tons per year. It is likely to be a twin configuration so every train has two GTs. Rossi thinks this approach could replace old one-shaft Frame 7 machines in LNG that required a helper motor for the start-up. No helper motor will be needed with the two-shaft GT.

Digitalization

Digitalization, too, was a constant theme at the Annual Meeting. Datuk Md Arif Mahmood, Executive Vice President & CEO Downstream of Petronas, said digitalization can help increase value by growing volume at higher margins, as well as improving safety, quality and efficiency.

“Business strategy can no longer be kept separate from digital strategy,” he said. “Digitalization must be the number one agenda for the CEO.” This must include a change in the supplier and manufacturer relationship to improve collaboration and heighten results. Digital, said Mahmood, brings insight and competitive advantage. The winners will be those that are agile and can act on digital insights. Those who act fast will come out ahead. The sheer scale of oil & gas operations is another reason for the rush toward digitalization.

Pavel Federov First Vice President of Rosneft, explained that his company has one field that comprises 10,000 wells and 50 data streams per well. Such a huge volume of data requires digitization to analyze data, detect incipient trends and take the appropriate action. “Our industry is a laggard in the management and application of data science,” said Federov. “Digitalization is now at the top of our agenda. It can be applied to every stage of the production process.”

It is all about survival of the fittest, according to Karl Johnny Hersvik, CEO of Aker BP. Companies must change their business processes and slash costs. “Digitalization is at the heart of this change agenda,” he said. “More than implementing new software, it is about applying digital technology to change processes.” He cautioned those designing digital solutions to understanding oil & gas operating environments. Offshore is cold, messy and complicated. Those realities must be faced when devising digital solutions. Aker BP has a fully digitized rig in the North Sea. Data is taken from all compressors, all turbomachinery, and all systems to the cloud in real time for compilation, analysis and management.

Another company that is delivering real world digital value is Italy’s Eni. Shanker Trivedi, Senior Vice President of Enterprise Businesses at chip maker Nvidia said his company has been working with Eni on the world’s fastest supercomputer that is designed for seismic, reservoir and basin simulation and analysis.

Lubrication monitoring

BHGE’s Mulholland also announced a new lubrication condition monitoring system known as VitalyX in conjunction with Emirates National Oil Company (ENOC). It can be deployed in multiple industries using large machinery. This cloud-based system detects and measures lubricant properties in realtime. As well as being the co-developer, ENOC signed the first order. This offers users and equipment operators a new level of predictive maintenance to enhance efficiency, reduce downtime and improve asset lifetime. VitalyX can measure chemical and physical properties across a fleet while simultaneously using analytics to convert the data into alerts and alarms to identify potential issues. The dashboard can show fleet-wide data down to the individual asset. Data can be stored either in a shared cloud or locally.

“This will play a key role in revolutionizing lubricant quality testing and physical asset management,” said Saif Al Falasi, ENOC Group CEO. “Digitization is driving the transformation of the energy sector and has contributed significantly to enhancing operational efficiency.”

Mulholland explained that VitalyX works by adding sensors to critical assets. The data from these sensors is harnessed to enable condition monitoring, testing and lab work to be done simultaneously. “The oil tells you something is going on before you notice any vibration,” said Mulholland. “You would usually deploy one sensor on a major asset, such as in a gearbox, turbine, engine or on the lube oil mainline.”

Instead of waiting days or weeks to hear results from a lab, this system provides immediate results to owners and operators. In the case of ENOC’s large fleet of vessels, for example, this means maintenance actions can be done during short time windows where ships are in port. Sending samples to labs has proved unworkable as some vessels had already sailed by the time the results were received. This cloud-based system is wired into the asset and tied into Bently Nevada SystemOne. Data can be used for trending or micro analysis.

“We track 13 parameters as well as metal particles to offer lab quality analysis on a continuous basis,” said Mulholland. “We eventually plan to extend this capability beyond lube oil to fuel oil and other fluids.”

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.