GE Oil & Gas meeting identifies LNG and digitization as drivers

The GE Oil & Gas Annual Meeting (AM) 2017 in Florence, Italy sees over a thousand executives and engineers from the sector gather to discuss ongoing trends and the latest technologies. Turbomachinery International has been covering this show for around 15 years.

At the start of this decade, Liquefied Natural Gas (LNG) was on its ascendancy, covered by speaker after speaker. But for several years now, LNG has hardly merited a mention. That changed this year with LNG back very much in the spotlight. A huge amount of LNG capacity is coming online over the coming year or so and optimism is running high.

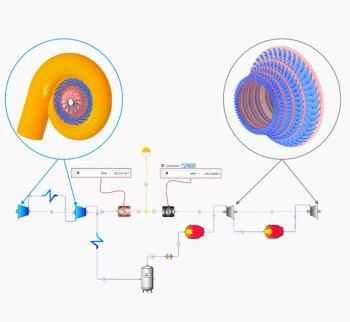

As a sign of that optimism is the fact that GE Oil & Gas has developed a brand new turbine known as the LM9000 primarily for the LNG sector. In addition, the company announced the NovaLT 12 gas turbine for various oil and gas applications.

Digitization, too, garnered plenty of attention at the show, with several discussions and panels devoted to it. GE is putting its weight behind this trend, and may even be betting the company on it. It announced multiple orders for its Predix digital platform during the show.

Keynote address

Lorenzo Simonelli, President & CEO at GE Oil & Gas, began the proceedings by saying the those in attendance were charting a new course for productivity and growth for 2017. He mentioned the merger between GE Oil & Gas and oil and gas producer Baker Hughes, but one that would transform the combined entity into one that would span the entire spectrum of the oil & gas value chain.

“We aim to be a disruptor in terms of technology, new approaches to manufacturing and to create a digital revolution as a digital company,” said Simonelli. “The old relationship between OEM and operator is not working anymore. Innovation in isolation is being replaced by close collaboration.”

He named digitization as the single largest change coming to the sector. He said it could bring about a 30% drop in capital expenditure and up to a 5% drop in operating expenditure, according to a study by McKinsey. Currently, less than 5% of the oil & gas world is connected and only 1% of data is used for decision making. This data sits in data graveyards, said Simonelli.

He was followed onto the podium by Fatih Birol, Executive Director, International Energy Agency (IEA), who spoke of key factors that will shape global oil and gas markets. In the last quarter of a century, coal has been the top power generation source followed by natural gas and oil. GRAPH,

But for the next 25 years, coal will fall to last place, with natural gas and renewables being the largest areas of growth.

“Natural gas has high growth in all our scenarios, even those where there is heavy restriction placed on carbon emissions,” he said.

You can read the full report from the GE Oil & Gas conference in the March/April issue of Turbomachinery International.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.