Seismic Shift in Global LNG Market

DEMAND IS SPURRING DEVELOPMENT OF NEW TURBOMACHINERY TRAINS, WHILE FUTURE U.S. EXPORTS PROMISE LOWER PRICES

A seismic shift is ongoing in the worldwide Liquefied Natural Gas (LNG) marketplace spurred by the boom in unconventional sources of gas, particularly U.S shale gas. The volume of LNG produced annually is set to double by 2020 from its current level of 280 million metric tons per annum (tpa), according to the International Energy Agency (IEA).

“Seven of the top ten investment projects in infrastructure in the world are LNG oriented,” said Laszlo Varra, Head of the Gas, Coal and Power Division at IEA.

This translates into a vast growing global market for turbomachinery. Companies, such as Cameron, Siemens, GE Oil & Gas, Mitsubishi and Dresser-Rand, are already scrambling to satisfy the demand.

Global LNG consumption is expected to rise from 303 million tpa in 2015 to 511 million tpa in 2030, according to IEA. That represents 14 million tpa average growth per year, which would require the equivalent of three massive 4.5 million tpa trains to be brought online every year.

Asia Pacific imports will jump from 192 million tpa to 310 million in that time span. The region now receives its imports from LNG producers such as Qatar, Australia, Indonesia, Malaysia and Nigeria. European imports will also rise from 87 million tpa to 152 million in 2030.

At the same time, U.S. demand will remain flat as the nation’s gas reserves skyrocket. U.S. gas reserves have increased by 86% in the last three years to reach 2,543 trillion cubic feet, according to Keith Teague, President, Cheniere LNG, part of the Cheniere Pipeline Co. More and more proven shale gas reserves are being added each year (Figure 1). This translates into 100 years or more of gas supply, primarily coming from shale gas plays situated across the continent.

The rapid increase in U.S. supply will trigger a price drop by 2020, according to IEA. “The U.S. is being transformed into a future LNG exporter,” said Varra. As the U.S. enters the supply chain, it will also be able to undercut other market prices.

By 2020, the price of U.S. gas is exptected to average about 11% to 15% of the price of oil, making it extremely attractive to condense that gas to LNG and export it to lucrative markets in Europe and Asia. Cheniere’s Teague laid out the math: With U.S. gas priced around $3 per million btu, it would cost another $3 for the liquefaction and $3 to ship it to Asia for a delivered cost of $9.45. That compares well with prices in Asia, which can rise as high as $15 per million btu. For Europe, the delivered cost would only be $7.70 compared to current rates of around $12.

The LNG-inspired export market will spark the construction of large LNG terminals, as well as the production of compressors, turbine drivers, and associated ancillary equipment. Smaller LNG innovations will also occur as the fuel attempts to gain market share from diesel.

“We will see increased use of LNG going forward as well as gas as motor fuel,” said Keith Elliott, Vice President of Major Projects at Noble Energy. “That means such things as Compressed Natural Gas (CNG) for school buses, and oil rigs powered by LNG.”

The flat U.S. gas market in juxtaposition to soaring global demand has driven 20 or more proposals for LNG export terminals. That includes two on the Pacific coast, two on the Atlantic coast and the bulk huddled along the Gulf of Mexico. Cheniere Corpus Christi, for example, was going to be a re-gas import terminal for LNG, but observers believe it will now become an export terminal.

The first export terminal to go into production will be Sabine Pass LNG where a four-train LNG liquefaction and export facility is being established. Sabine Pass LNG is sited on about 1,000 acres in Cameron Parish, Louisiana. It already contains a 40-foot shipping channel 3.7 miles from the coast with two berths and four dedicated tugs, five LNG storage tanks (17 billion cf), and 5.3 billion cf/day of pipeline interconnection.

Liquefaction Trains 1 & 2 at 4.5 million tpa each are estimated to go online in the 2015-2016 timeframe. Construction of trains 3 & 4 (each 4.5 million tpa) begins this year. They are destined to go online in 2016 and 2017.

Already, Cheniere LNG has secured four customers which have taken long-term contracts for the output of those trains. These are BG Group, GasNatural Fenosa, KoGas and Gail (india) Ltd. The demand has been so large that more trains are being considered. “We are investigating opportunities for a possible 5th and 6th train,” said Teague.

Bechtel has secured the Sabine Pass contract, having constructed a third of the world’s existing liquefaction facilities. In fact, it previously completed the Sabine Pass LNG re-gasification terminal, which was set up for LNG imports and began operation about half a decade ago.

Turbomachinery at Sabine Pass LNG is being provided by GE Oil & Gas. In total, GE has 70 trains of LNG operating with its turbomachinery. These range from Frame 5, 6, 7EA, PGT25+, 9E and LM6000, as well as one steam turbine driver and a Variable Speed Drive operated train. Riccardo Procacci, General Manager for Gas Turbines & Compressors for GE Oil & Gas, said that GE LM2500+G4 aeroderivative turbines are to be used as the drivers for refrigerant compression at Cheniere (Figure 2). GE is providing 12 PGT25+G4 gas turbines and 28 compressors.

The company’s LNG technology is being implemented at the Gorgon LNG project off the west coast of Australia. This includes a 6-meter-long 96.3 MW 3MCL1405 compressor with a 3-meter internal diameter. That machine was successfully string tested last year at GE’s Massa test facility in Italy. Gorgon will also use five GE MS9001E turbine modules for power generation, each capable of 130 MW. Each module has dimensions of 48m x 22m x 28m and a dry weight of 2,300 tons. The first such module has been delivered to the site (Figure 3).

Meanwhile, Australia’s Wheatstone LNG project is the first commercial use of the LM6000 MD (mechanical drive). These machines run at 42 MW and 41% efficiency. At that site, GE supplies 12 compressor units for LNG refrigeration trains and 4 power generation units.

LNG in Trinidad

As an indicator of how well LNG exportation can prosper in the Americas, Atlantic LNG on the Caribbean island of Trinidad and Tobago offers a regional success story. It is a four-train natural gas liquefaction facility producing up to 15 million tpa of LNG, making it the 7th largest in the world. It also comprises the world’s largest fleet of 26 GE Frame 5D turbines in a single location. Train 1 began in 1999 and train 4 went online in 2006.

Since those trains were put in place, the global LNG market has been turned on its head. First Qatar erected the planet’s largest export facilities. Yet it is about to be overtaken by Australia this year and perhaps by the U.S. within a decade.

But Nigel Darlow, CEO of Atlantic LNG, remains upbeat. He explained that in 2011, LNG gas trade grew by 8% globally to 241 million tpa. (Japan took over 30% of the total). Over the course of that year, the volume of LNG liquefaction grew by 2.9%. “Within 10 years, demand for LNG is expected to exceed 425 million tons while existing supply is on decline,” said Darlow. “Supply will struggle to match the growth in demand.”

With prices outside of the U.S. remaining strong, he sees a bright future for the Caribbean facility as well as global LNG as a whole. His plans include more exports to the Asia Pacific, which will be facilitated by the Panama Canal expansion, due to be opened in 2015. “Right now the canal can’t take the biggest LNG tankers but that is about to change,” said Darlow. “I am very positive about the business and the future and see no worry from the LNG build out or from U.S. competition.”

Atlantic LNG recently completed a shutdown of Train 4. Six turbines were replaced as well as inspections of 18 compressors and the installation of eight new filtration systems. Row 1 blade replacements were done in situ on eight units. “We added the filter due to pitting corrosion found on Row 1 blades,” said Darlow. “After 18 months, there is no evidence of pitting corrosion and we have not had to do any water washing.”

LNG spurs technology

The booming LNG market is spurring plenty of product development. Mitsubishi Heavy Industries is supplying LNG compressors to Royal Dutch Shell. Shell ranks as one of the biggest producers of LNG, with plants in Australia, Malaysia and Russia.

Meanwhile, Cameron is leveraging its line of mixed refrigerant compressors for LNG applications. They include a tandem dry face seal arrangement for near zero refrigerant losses which has been designed for various geographical locations and environmental conditions, said David Grabau, Product Manager for Process Gas & API, at Cameron Process & Compression Systems.

These compressors can be utilized for small LNG plants with a capacity from 50,000 tpa up to 250,000 tpa. For example, a three-stage 9,000 hp integrally geared compressor supplies refrigeration for a Shell plant, which produces over 150,000 tpa of LNG.

“Cameron has seen strong growth in this mini-LNG segment with new business from Shell and others,” said Grabau. “China is showing strong market potential for smallscale LNG gas monetization. This growth can be attributed to the abundance of new stranded shale gas wells and coal bed methane in that country. Other opportunities for Cameron’s mixed refrigerant compressors include peak shaving LNG plants.”

Shell is also working with Cameron on the Green Corridor project with Flying J, Inc. to supply 250,000 tons of LNG per year to trucks along the 900 mile (1,600 kilometer) highway from Alberta to the Pacific coast in Canada. This will replace diesel fuel. Known as the Green Corridor plant, it will contain two trains utilizing Cameron compressors.

“Cameron’s mixed refrigerant compressors are integrated with the modular liquefaction system, which provides faster field erection and flexibility for future relocation,” said Grabau.

Shell, Kinder Morgan Company and El Paso Pipeline Partners are also forming a limited liability company to develop a natural gas liquefaction plant in two phases at Southern LNG’s existing Elba Island LNG Terminal, near Savannah, Georgia. They will modify the Elba Express Pipeline and the Elba Island LNG Terminal to physically transport natural gas to the terminal and to load the LNG onto ships for export.

“This project will facilitate further development of the abundant natural gas resources in the U.S. and will be a positive factor in the balance of trade,” said Kinder Morgan Chairman and CEO, Richard Kinder. The project will use Shell’s smallscale liquefaction unit. The total project is expected to have liquefaction capacity of about 2.5 million tpa of LNG or 350 million cubic feet of gas per day.

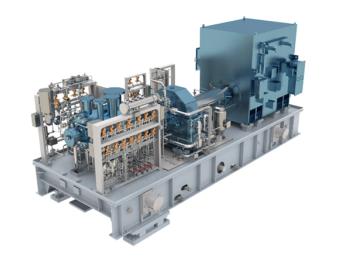

Dresser-Rand (D-R), too, is heavily involved in mini LNG. Chemtex International, for instance, uses two Datum (Figure 4) centrifugal refrigerant compressors with 16,000 hp motor gear drives at two LNG plants in China. Chemtex, with headquarters in Wilmington, NC, is the plant contractor for the projects. Black & Veatch Corp., of Kansas City, is the LNG process designer.

The equipment is planned for two LNG production facilities to be built near the Erdos Basin gas fields of Inner Mongolia. These facilities will convert stranded natural gas supplies into LNG for transportation by truck or rail to markets not served by gas pipelines. Once completed, each plant is expected to produce about 200,000 tpa of LNG.

Transporting LNG

Chemtex also has plans for three additional similar sized LNG facilities in China. The gas fields of the Erdos Basin are estimated to contain more than 700 billion cubic meters of natural gas, making it the largest reserve in China, and one of the biggest in the world.

Other mini LNG facilities convert natural gas supplies into LNG for transportation by truck or rail to markets not served by gas pipelines. These plants are producing 25,000 to 200,000 tons of LNG a year depending upon the power installed.

Today, plants worldwide are using D-R equipment, ranging from 1,000 to 8,000 hp (700 to 6,000 kW) each (Figure 4). Approximately one-third of the world’s LNG production is achieved using D-R compressors. The company’s compressors were selected for the first U.S.-based LNG installation in Kenai, Alaska.

Based on future market potential, Dresser-Rand has entered into an agreement with Tarrytown, New York based Expansion Energy LLC that grants D-R an exclusive license (for capacities up to 100,000 gallons per day) to Expansion Energy’s proprietary VX Cycle technology for the small-scale production of LNG. “We believe the market for this technology will be in the range of $100 to $200 million within just the next 2 to 3 years, and will continue to grow robustly beyond that,” said Brad Dickson, Dresser-Rand’s Vice President and Chief Marketing Officer.

Dickson believes the VX Cycle is the first technology to provide a cost-effective, small-scale LNG production process with capacities as low as 1,500 gallons per day. The mobile, skid-mounted equipment configuration for this process technology opens up applications, such as the monetization of flared gas or associated gas to increase revenues for oil companies; the production of stranded natural gas fields, which are not close to existing pipeline infrastructure; on-site fuel supply for drilling rigs converted to run on LNG; as well as downstream applications, such as the production of vehicle-grade LNG, allowing LNG to compete with diesel fuel (Figure 5). The use of LNG fuel, he said, is increasing for long-haul trucks, delivery fleets, buses, ships, barges, ferries, railroad locomotives, and construction and mining equipment.

Floating LNG (FLNG) is another area of operation for D-R. While conventional landbased LNG projects focus on an estimated 70-to-80 fields with gas reserves greater than 5 trillion cubic feet, there are more than 1,400 small-to-medium size fields with reserves between 0.25 and 5 trillion cf that can potentially be developed using floating LNG technology.

D-R was awarded a contract to supply Datum compression equipment for the world’s first FLNG. The company’s compression technology has also been selected for the main refrigeration unit for the 4 million tpa Excelerate FLNG project that will export gas from Texas. The Excelerate project is awaiting a final investment decision.

The 4 million tpa Excelerate Floating LNG facility is expected to utilize the Black & Veatch Prico liquefaction system along with Datum centrifugal compressors.

Siemens in Malaysia

Siemens also has a growing presence in the burgeoning LNG sector. The company has been awarded a contract for supplying turbocompressors and mechanical drive gas turbines for the Petronas Bintulu plant in Sarawak, East Malaysia, one of the world’s largest LNG facilities. The Sarawak facility consists of three plants, with a combined capacity of 24 million tpa.

The target is to re-liquefy excessive Boil-Off Gas (BOG) evaporating out of LNG storage tanks, and currently flared. It will deploy the world’s first gas-turbinedriven cryogenic-temperature BOG turbocompressor from Siemens. “Instead of being flared, the boil-off gas will be re-liquefied, converted into LNG and routed back to the LNG storage tanks,” said Adil Toubia, CEO of the Oil & Gas Division at Siemens Energy.

The LNG project in Sawarak is being implemented by Malaysia LNG, a subsidiary of Petronas. Engineering, procurement, and construction management (EPC) is contracted to Munich-based Linde Engineering.

The Siemens’ scope of supply covers the engineering, manufacturing and testing of one tandem-casing, cryogenic-temperature BOG turbocompressor and one single-casing LNG-refrigerant turbocompressor. Both compressors will be directdriven by Siemens SGT-700 mechanical drive gas turbines. Project completion is expected in April 2014; the plant will start operation in October 2014.

The compressor is equipped with Variable Inlet Guide Vane (IGV) control technology, which provides flexibility to handle the BOG volume flow fluctuation range. Load balancing between the BOG compressor and the LNG mixed refrigerant compressor allows for utilizing identical mechanical drive gas turbines. The SGT- 700 handles high-nitrogen content as it burns natural gas with up to 40% nitrogen. To meet the growing needs of the LNG market, GE Oil & Gas is working on a new 3D high-efficiency impeller family for ethylene and methane, which is said to be 2% more efficient that the current generation of equipment, as well as a 3D impeller family for propane which raises efficiency by 2%. These are higher Mach and higher flow impellers.

In addition, better abradable seals are under development which can also raise LNG efficiency by 1%. “These advances will bring about a 1% jump in LNG production,” said Leonardo Baldassarre, Engineering Manager, Turbomachinery, GE Oil & Gas.

He also promoted the value of the LM6000 PG/PH MD in this field. At 52 MW and 42% efficiency, it has enhanced Dry Low Emissions (DLE) combustor fuel flexibility (it can run with more than 35% N2 in the fuel gas). Three units are now in mechanical drive operation, though with a standard combustor. Two DLE units are expected to be in the field by 2014. A string test using this aeroderivative machine is scheduled for the first quarter of 2013.

Next up is an MD version of the LMS100 with over 100 MW of power, improved hot day performance due to the addition of an intercooler, 45% simple cycle efficiency, and a pressurized compressor start-up without a helper motor. “We have several prospective customers and the official launch of the LMS100 MD will be next year,” said GE’s Ricardo Procacci.

Like Cameron and D-R, GE sees opportunities for smaller scale equipment, though it prefers the micro LNG moniker. “We are working on technology across the LNG spectrum, from exploration and production to demand,” said Heintzelman. “This includes CNG vehicles, and the use of micro LNG in new spaces like transportation.”

Micro LNG is intended for plants that produce 50-to-150 kilotons of LNG per year. When installed in a network of fueling stations along major highways, truck fleets can lower emissions and reduce fuel costs by more than 25% compared with diesel. Alternatively, the LNG stored at the site can be re-gasified for pipeline natural gas or used for local power generation.

For Micro LNG, GE will supply a variety of products ranging from centrifugal and integrally geared compressors to turboexpander compressors, reciprocating compressors and controllers for these sites. While reciprocating compressors will primarily be utilized, centrifugals might come into play depending on site requirements. The Micro LNG system may also include Waukesha gas engines for mechanical drive and power generation.

Such a plant can liquefy natural gas at any point along a gas distribution network, making it good for supporting the fueling of vehicles in remote locations by reducing the impact of long distance fuel transport.

LNG in a box

Another recent innovation is CNG in a Box. This is a GE concept for fueling natural gas vehicles that enables regional gas companies to serve vehicle owners. The package includes a high-speed reciprocating compressor and a Wayne fuel dispenser (Figure 6).

As the natural gas and LNG industries grow, challenges are emerging. Elliott of Noble Energy said there is greater intolerance of actual, as well as perceived, mistakes and that this is driving stricter regulation globally. The economic mining of shale gas was made possible by two techniques perfected at the Barnett Shale Play in Texas — horizontal drilling and hydraulic fracturing (or fracking).

It is the latter practice which is drawing environmental fire. A single frack project can require a million gallons of water, not to mention lots of trucks in and out. It is no surprise that there is intolerance for that sort of impact. “Within North America there is already a damaging perception,” said Elliott. “It’s really about wellbore integrity. We have to manage it correctly and provide the appropriate level of environmental stewardship.”

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.