POWERGEN 2016

COMBINED HEAT AND POWER, MICROGRIDS AND ADVANCED-CLASS TURBINES AMONG THE TOP TRENDS AT THE ANNUAL INDUSTRY GATHERING

BY DREW ROBB

The OATI data center in Minneapolis combines grid power, solar, wind,

microturbines, CHP, batteries and energy storage as part of its microgrid

The PowerGen International show in December of 2016 brought together close to 20,000 people for the industry’s biggest gathering. Some 300 speakers and almost 80 sessions covered just about every conceivable side of the industry. By far the dominant themes were Combined Heat and Power (CHP), flexible generation and microgrids.

In the first keynote, Rick Hali, Senior Vice President and General Manager for Energy at Burns & McDonnell discussed a trend toward flexible generation, driven by government policy. Baseload coal and nuclear are being replaced by gas and renewables, he said, citing the City of Denton, TX, which added 255 MW of reciprocating engine power to provide rapid ramp rates from multiple units that would require multiple starts per day. Individual power consumers and facilities are having a greater impact on the industry, he said.

“They want resiliency, security and sustainability,” said Hali. “Nowadays, the consumer has more control than ever and we are seeing more commercial companies exerting control.”

CHP is a major outcrop of consumer and commercial involvement. Universities, hospitals and refineries are seizing their energy future and building projects so they control their own destiny, added Hali. Some are even setting up microgrids for their facilities where they manage their own generation, transmission, control and storage. He cited the example of the Eight Flags CHP project in Florida’s Amelia Island.This 20 MW plant provides steam, heated water and power via a Solar Titan 250 turbine.

In the second keynote, Alex Glenn, President of Duke Energy Florida, s explained that since the Edison vs. Westinghouse fightover AC and DC power in 1885, there has been no major transformational change in the industry until 2007, with the release of the iPhone.

“This reinvented the way we buy things, how we do commerce, and it changed our industry,” said Glenn. “Such devices give customers control.”

Rather than being compared to other power providers, utilities are now measured against online services, such as Uber, Amazon Prime and Google. That is the level of service that customers expect of a utility, said Glenn. His solution is for the industry to invest even more in smart grid technology and to treat customers as individuals. Further investment is needed in power generation and energy storage, he said. Accordingly, Duke Energy is investing $40 billion over next couple of decades. Its portfolio includes 2,200 MW of peakers that are close to the end of their useful life.

William Meixner, CEO of Siemens Power & Gas Division, stressed the need to balance renewables with flexible and reliable power generation assets. Key market drivers included sustainability, economic efficiency and achieving an optimized mix of supply. He pointed out that 2015 marked the first year global investment in renewables exceeded all other power investments. He expects that trend to continue. Meixner also discussed digitization and the value it can bring to power generation.

He views power generation as a whole, rather than just one plant or one asset. “Digital value creation is expected to lead the way in power generation in the coming years,” he said.

Anthony Wilson of Mississippi Power concluded the keynotes.He spoke about the Kemper County Energy Facility, where lignite from a nearby mine is converted to synthesis gas. Two coal gasifiers and an onsite chemical plant strip out anhydrous ammonia, sulfuric acid and carbon dioxide to produce clean coal-based power.

Integrated gasification combined cycle plants, like this, are advantageous in comparison to conventional coal power plants due to their high thermal efficiency, low non-carbon greenhouse gas emissions and capability to process low-grade coal.

OEM briefings

Prior to the Alstom deal, GE did not service other-OEM steam turbinesand Heat Recovery Steam Generators (HRSG).. Thanks to the technology collaboration with Alstom, GE can now service them all. The company is taking advantage of this added capability to upgrade GT packagesat plants with equipment 10 years old or more. “Our combination with Alstom continues to pay dividends on the growth side,” said Joe Mastrangelo, President & CEO, GE’s Gas Power Systems. “In the 30 MW-to-200 MW range, combining our turbines with Doosan and Alstom HRSG technology is enabling us to achieve greater performance.”

GE shipped two HA-class gas turbines in the first production year of 2015, 25 units in 2016 and is targeting about 25 for this year. The company is also selling more machines for combined cycle than simple cycle duty. “The HA has great value when you want to turn down the plant very low while keeping emissions in compliance,” said Guy Deleonardo, Executive Product Manager, GE’s Gas Power Systems. “An 1,100 MW HA plant can provide a 100 MW a minute ramp.”

All this adds up $660 million in orders for GE Power. Orders include:

• Two GE 7F.05 GTs and one GE D600 steam turbine (ST) with Engineering, Procurement and Construction (EPC) responsibility for building and commissioning the expansion of Alliant Energy’s 700 MW Riverside Energy Center in Beloit, Wisconsin.

• Turbine generator equipment and technical support for the Grand River Energy Center in Oklahoma.

• Multiple HRSGs for Dynegy and Oglethorpe Power

Paul Browning, President and Chief Executive Officer of Mitsubishi Hitachi Power Systems Americas (MHPSA), discussed the demand surge for advanced class turbines (H-, Gor J-class machines). These machines have displaced the F-class as the most popular GTs in the market, he said. Almost all new orders in 2016 were for advanced class machines with few F-class sales. The pipeline for upcoming sales shows a continuation of this trend, said Browning. This marks a definite shift from previous years when a 50-50 split was the norm MHPS boasts the largest installed base and orders for advanced class machines, claiming more than Siemens and GE combined.

The MHPS J-Class turbine now has 8,000 operating hours with an air-cooled combustor while running at the T-Point facility in Takasago, Japan. “We have now released the air-cooled JClass gas turbine to the general market,” said Browning. It is currently rated at more than 63% efficiency and we are rapidly heading toward 65%.”

CHP

It is clear from PowerGen that combined heat and power (CHP) is gaining ground in the market. It was granted an entire track at the show consisting of many sessions.

Anthony Cirillo, Senior Project Director for Power at AECOM, explained that CHP has been around since the end of the 19th century. The Public Utility Regulatory Policies Act (PURPA) legislation in 1978 triggered the expansion. However, the Energy Policy Act of 2005handcuffedCHP while simultaneously exempting renewables from grid market rules. This adversely affects existing, stalwart baseload fossil and nuclear generation, and hampers the viability of some CHP plants.

“Today’s grid is antiquated, and could benefit from CHP’s sustainability and reliability characteristics,” said Cirillo. “Yet CHP is largely left out of the renewables equation and needs a little, corrective legislative help.” He extolled the virtues of CHP, such as a facility being able to self-regulate its own power imports and exports, drop from the grid and island themselves, and provide ancillary services such as blackstart capability.

“CHP can shed load to zero and island, or create load and export power,” said Cirillo. One of the big challenge of CHP is that most companies tackle a CHP project only once. So they do not gain from experience. One way around this is to apply best practices.

“CHP projects often hang up on the initial capital investment as they are not being sold the right way,” said Thomas Adams, Vice President of Power Business Development, ABS Group. “CHP brings savings on operating costs, earns a compensatory return on investment and reduces long-term energy risk.”

But that doesn’t mean that every project makes sense, he said. The green light depends upon good economics based on the cost of electricity and fuel, as well as a forecast of future costs. In addition, replacement costs for older equipment need to be considered as well as the production impact (improvement in uptime and plant reliability) and the existence of any incentives.

“It is important to look at the long-term investment horizon for CHP,” said Adams. “You also want your plant to enjoy long hours of stable operation to obtain the best value.”

One way to find out if local conditions are favorable to CHP is to check with the neighbors. If they are using CHP, then success is more likely. But equipment choice, size of plant and location must be given careful thought. Adams said it is a mistake, however, to rush ahead on equipment specs. It is better to consider all factors together to determine what kind of equipment is the best fit.

He cited an aeroderivative gas turbine design for a CHP plant at a refinery. In that case, equipment specification and procurement got ahead of everything else. Engineers wasted a lot of time by not thinking through the whole project. Siting and interconnect issues and uncertainties made it clear that there were better options than an aeroderivative in this case.

“In terms of output, buy only what is justified economically, as sometimes smaller may be better,” said Adams. “Also, don’t just look for the lowest heat rate as heat recovery is the goal.”

The 145 MW City of Holland CHP facility in Michigan, for example, is replacing an aging coal plant. It includes two Siemens SGT800 GTs and one SST400 steam turbine. Waste heat from circulating water provides supplemental heat for the city’s underground snowmelt system.

“CHP offers opportunities for different applications based on proven technologies,” said Dalia El Tawy, Business Development Manager at Siemens Energy. “CHP is also the anchor of microgrids and serves an important role in integrating renewables.”

Further examples of CHP were provided by Jonathan Wohl, Vice President of Project Development at EPC contractor, DCO Energy. Bergen County Utility Authority, Little Ferry, NJ implemented a 2.8 MW reciprocating engine design using biogas from wastewater treatment as well as natural gas to fuel the engines.

The CHP serving Montclair State University is a 5.4 MW CHP plant that provides steam and electricity via a Solar Taurus 70 GT with a York ST to drive a chiller and a waste heat recovery unit from Rentech.

The Marina Thermal Facility in Atlantic City, NJ is a Solar Taurus turbine-based CHP plant. Emergency gear and sensitive electric equipment built on the second floor avoids the potential of flooding.

Microgrids CHP is also gaining ground as a way of implementing a microgrid, said Anne Hampson, Senior Manager, Distributed Grid Strategy and Management for CHP at ICF International. She defined CHP as a form of distributed energy with the ability to isolate from the grid, having an active management system and is self-sustainable for critical loads during power outages. “

End users are looking for more resilience, energy security and lower energy costs,” said Hampson.. “CHP can often act as the anchor for microgrids.” She suggested this approach for campuses, universities, hospitals, military bases and a group of buildings owned and operated by a single entity. They can generate their own power, sell excess power to the local utility and use the main grid for backup power. Microgrids can also be tied to district energy systems to provide steam, hot or chilled water and electricity.

“Natural gas systems are best suited for this role as natural gas supply lines are rarely affected by natural disasters,” said Hampson. There are already 82 GW of CHP in the U.S in over 4,400 installations, according to ICF. It expects the market to expand greatly in the next few years due to smaller CHP packages with high replicability, more own-operate business models, and more incentives “With multiple CHP systems in proximity, it is wise to identify strategic opportunities for interconnected microgrids that could serve critical facilities,” said Hampson.

U.S microgrid capacity is currently at 1,100 MW, according to GTM Research. About 50% of existing microgrid capacity includes CHP and 80% of microgrid capacity exists in 7 states. An evolving feature of CHP-based microgrids is the willingness to harness multiple sources of power. The City of Fairfield, Connecticut, for example, has a 30 MW gas turbine, 2.8 MW of biogas-based fuel cells and 1.2 MW of photovoltaic solar power.

“By 2020, the number of microgrids could at least double,” said Hampson. “They represent a great opportunity for existing CHP and new potential CHP.”

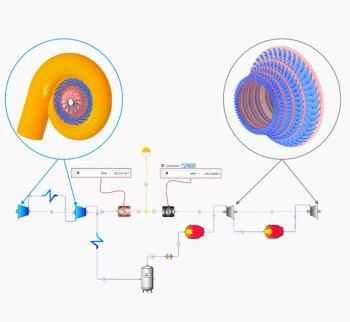

Open Access Technology International’s data center in Minneapolis is powered by the local grid, solar panels and six wind turbines on the roof, a Capstone C600 microturbine, Lithium ion batteries and a diesel generator. Energy storage technology is provided by Encync Matrix. “CHP is being diverted into multiple areas of our five story, 100,000 square foot tower,” said Terry Mohn, Executive Microgrid Consultant at OATI. “Waste heat is used for chillers to keep the data center cool.”

In emergency mode, the facility is capable of self-generation using natural gas power from its microturbine as well as its batteries. Similarly, if electricity becomes too expensive, it can go into island mode and operate as a microgrid. This new campus replaces an aging facility.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.