SPECIAL REPORT: GAS GLUT SPURS INFRASTRUCTURE BUILD OUT

LNG EXPORT TERMINALS, ETHYLENE CRACKERS, POWER PLANTS AND PIPELINE COMPRESSORS ARE ALL PART OF THE SHALE GAS BONANZA

Exploitation of unconventional energy sources, such as shale gas, coal-bed methane and oil sands, is creating abundant energy development opportunities in the U.S. So much gas available at bargain prices is triggering a rapid rise in new projects, such as pipelines, chemical process plants and ethylene crackers. That’s good news for those manufacturing, repairing and servicing gas turbines, centrifugal compressors and microturbines.

The shale gas bonanza is already influencing energy markets. The U.S. Energy Information Administration (EIA) noted that pipeline gross imports of natural gas fell by 4.1% to 8.7 Bcf/d (billion cubic feet per day) during 2011, and that they are expected to fall to 8.4 Bcf/d in 2012. Specific to U.S. imports of LNG, they fell from 1.2 Bcf/d in 2010 to 1.0 Bcf/d in 2011. At the same time, pipeline gross exports to Mexico and Canada were averaging 4.1 Bcf/d in 2011 and that should rise to 4.2 Bcf/d in 2012, compared with 3.1 Bcf/d in 2010. This could signal the end of the U.S.’s long dependency on foreign gas supplies.

James Hackett, CEO of Anadarko, said that the U.S. produces more natural gas today than Russia, and that there are more shale gas energy reserves in the country than Saudi Arabia has oil reserves. To quantify that, the EIA has ramped up its gas reserves estimate to 2,552 Tcf (trillion cubic feet) of which shale makes up 33%. Ten years back, it made up 1%. Within 20 years, the EIA expects shale gas to contribute half of all U.S. gas production.

Primary energy boom

“The fastest growing source of primary energy is projected to be natural gas through 2015,” said Forecast International’s Bill Schmalzer. “The increased domestic onshore exploration and production are likely to keep prices below $5 for the next decade.”

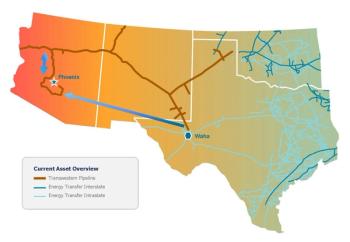

Liquefied Natural Gas (LNG) exporting, pipeline compression, and the chemical process industries will be among the big winners in the shale gas boom (Figure 1). In each case, large amounts of new or re-rated turbomachinery are required.

As a result of the gas glut, many of the dozen or so poorly utilized LNG import facilities that dot the Eastern and Gulf seaboards of the U.S. will be converted into export terminals to transport gas resources to Asia, Europe and elsewhere. Currently, these sites are engineered to receive LNG from abroad and re-gasify it for U.S. markets. The switch to exports, however, requires a different setup. As well as more pipelines to take gas to the coast, this translates into massive LNG compression trains to condense and liquefy the gas (Figure 1).

“There are a lot of companies that have LNG import infrastructure that are looking at converting to export facilities as we had seen a pretty significant build up of LNG import infrastructure before the price of U.S. gas collapsed,” said Sean Shafer, manager of consulting at Quest Offshore. “Just as a benchmark, we went from $12-14 per million cubic feet to $2.50 in the last few years due to the shale gas revolution, so these LNG import facilities really have no purpose, as LNG in the Asian market is worth at least $8-12 per million cubic feet.”

Take the case of the LNG import terminal in Dominion Cove Point, Maryland. It received its first imports from Algeria in the late seventies. These days, business has been struggling. Only five LNG shipments were received in the whole of last year. That’s why Dominion gained approval to enable the Chesapeake Bay facility to ship LNG to at least 20 countries worldwide.

Another seven U.S. LNG terminals have applied for permission to become exporters. Cheniere Energy recently received authorization to export natural gas from the Sabine Pass LNG terminal in Cameron Parish, Louisiana. Construction of liquefaction facilities is expected to commence in 2012. A total of four trains are being built, with one train completed every six-to-nine months beginning in the first half of 2015. Cheniere expects to offer bi-directional services at a rate between $1.40/MMBtu to $1.75/MMBtu (million BTU).

One customer eager to receive LNG is Korea Gas Corp. (Kogas), which has agreed to buy about 3.5 mtpa of LNG from train three once it goes online around 2017. “We have sold 16 mtpa of the 18 mtpa being developed at the Sabine Pass LNG terminal,” said Charif Souki, Chairman and CEO of Cheniere Energy Partners. “We look forward to becoming the first LNG exporter in the continental U.S.”

Price is the big motivator. “Gas in the U.S. is less than $2.7 per MMBtu; in Australia it is $13,” said Samir Brikho, CEO of AMEC, a UK engineering and project management consultancy. “For transportation, you can add in $3, so this is a big opportunity to move U.S. gas to Asia,”

Bechtel has been given a $3.9 billion engineering, procurement and construction (EPC) contract for the first two trains at Sabine Pass. It will commission two liquefaction trains using the ConocoPhillips Optimized Cascade “two-trainin- one” approach for added reliability (Sidebar). Extra turbines and compressors are being included so that one set can be closed down while the plant continues operating at a more reduced rate.

GE equipment, such as the PGT25 +G4 gas turbine and the MCL 1405 compressor, have been deployed in many liquefaction trains (Figures 2 and 3). Siemens mentioned several compression opportunities in the North American market, and that it is working on compression projects for shale gas export.

Plant construction

Others are benefiting from the surge in unconventional fuels. Vallourec of France is building a $650 million steel tube manufacturing site in Youngstown, Ohio, to supply the many wells in the region. Similarly, KBR is providing construction services and turboexpanders for a gas processing plant expansion in Oklahoma above the Woodford Shale field, said David Zimmerman, Group President at KBR Services. The existing 200 MMcf/d facility will be increased by 150 MMcf/d to purify natural gas and extract byproducts such as butane, propane and ethane. Microturbines are also thriving because of shale. Blake Zimmerman of Capstone distributor Horizon Power Systems explained the value proposition of microturbines versus piston engines. Microturbines have about 75% fewer emissions at full load, require maintenance once every six month compared to bi-weekly, and are less than half the weight, he said.

Darren Jamison, President and CEO of Capstone Turbine, reports that a major portion of its business now comes from oil and gas, with shale gas being a huge driver. Oil and gas was less than 30% of overall revenue a couple of years ago and now is more than half of Capstone’s business. “Shale gas alone has added about $20 million in revenue over the last 18 months,” said Jamison. Within a year, he expects to have 30 MW of microturbines installed at shale gas sites (Figure 4).

“Eighteen months ago we had zero penetration in shale gas,” said Jamison. “Pioneer bought the first 1 MW and they are now up to 15 MW. Anadarko, Chesapeake and Marathon have since followed suit.”

On the east coast, Dominion Transmission harnesses C65 microturbines in smaller gas transmission stations, mainly for remote power rather than to drive compressors. To date, that company has purchased some 75 C65s as well as a few larger models.Anadarko has deployed approximately130 C65s.

Most shale is off the grid so these machines are often used for prime power. Some customers initially deploy them to power auxiliary equipment, then add more power once they gain experience. In addition, these microturbines are used to pump water out of wells in preparation for gas extraction, to run drilling equipment and to pump water back into the ground after drilling is complete.

Solar Turbines, too, has noticed a change due to shale. “The huge amount of shale gas is lowering gas prices and that makes combined cycle applications very attractive,” said Uwe Schmiemann, marketing manager for power generation at Solar Turbines. “For oil and gas, we are already seeing an uptick in orders due to shale plays.”

Ethane crackers

The moribund U.S. chemical process industries have sprung to life from the explosion in unconventionals. Instead of erecting plants overseas where the cost of feedstock has long been cheaper, they are showing a preference for homeshores. It is less expensive to utilize shale gas as a feedstock for ethane than the oil-derived naphtha used in many other areas of the world.

This dramatic turnaround has spurred interest in crackers. There has not been an ethane cracker built in the U.S. since 2001. Yet plans are afoot to erect several in the vicinity of West Virginia, Pennsylvania and Ohio, close to large sources of shale gas. This could amount to $16 billion in capital investments in the region over the next few years.As the nearbyMarcellus Shale has the potential for 250,000 barrels per day of ethane, the area could support four crackers (each one needs 65,000 barrels per day).

Dow Chemical, already the world’s largest producer of ethylene and polyethylene, plans to spend about $4 billion to construct a cracker near the Gulf Coast by 2017, reopen another in Louisiana, and build two propylene plants. In addition, Dow is restarting a 2.3 mtpa ethylene plant at its St. Charles complex in Louisiana at the end of this year as well as making upgrades at its Plaquemine, Louisiana and its Freeport, Channelview and LaPorte, Texas crackers over the next couple of years (Figure 5).

Chevron Phillips Chemical (CP Chem) is looking to erect a 1 mtpa ethane cracker and ethylene derivatives plant on the U.S. Gulf Coast using feedstock from shale gas. In addition, it is building a 1.5 mtpa ethane cracker in Texas, using the services of engineering firm Shaw Group. It is due to go online by 2017. “This project represents a significant change in the ethylene marketplace as no U.S. plants have been added in approximately ten years,” said James Glass, president of Shaw’s energy and chemicals group.

Others are involved as well: Bayer is looking at developing an ethane cracker in West Virginia; Formosa Chemical hopes to boost ethylene capacity at its Point Comfort, Texas, facility by about 450,000 tpa in 2015;Westlake Chemical says it will expand ethane-based ethylene capacity at Lake Charles, Louisiana, by 105,000 tpa by late 2012; another 225,000 tpa ethylene plant is being reopened at Eastman Chemical’s Longview, Texas site; Johannesburg-based Sasol Ltd is considering building a $4.5 billion ethylene plant in Louisiana; and just as we go to press, Royal Dutch Shell announced plans for a multibillion ethane plant near Pittsburgh, PA.

Pipeline compressors

Shale gas is already causing congestion on the 300,000 miles of gas pipelines in the U.S. pipeline network, according to the American Public Power Assn. (APPA). Flowing through them is about 60 Bcf each day. To cope with the boom in unconventional gas, more lines are needed. The EIA stated that 2,400miles of new pipe line were added in 2011 as part of 25 projects.

That comes to an added 13.7 Bcf/d. Much of that is for interstate transport. To increase capacity by a further 25 Bcf to accommodate shale gas, 38,000 more miles must be added. Gregory Ebel, President and CEO, Spectra Energy, estimates that by 2035, U.S. midstream (pipeline/transport) investment is projected at $205 billion.

This is driving demand for turbines and compressors. Forecast International’s worldwide installations database reflects 6,183 existing GT-driven compressors at 3,824 locations employed in the service of gas compression, processing and distribution. Its forecast for the worldwide market for gas turbine mechanical drive engines indicates that over the next ten years, 4,499 machines with a value of $23.7 billion dollars will be installed worldwide.

“Historically, 35%of thesemachines are in the U.S., and this trend will most likely continue, with domestic shale gas development balancing out increased demand for growing infrastructure in developing countries,” said Schmalzer.

Handling shale plays

Pipeline companies are starting to invest. Williams Gas Pipeline is overhauling the Transco System, which goes from New York to Louisiana and Texas. Some 2,000 mainline miles utilize 368 compressors. The upgrade will enable the system to reverse flow to accommodate shale plays. Ross Conatser of Williams Gas Pipeline stated that over 10 Bcf/day of pipelines were added in the last five years to service the Woodford, Barnett, and Haynesville shale plays. This has resulted in 30 GW of new combined cycle projects within 50 miles of the pipeline. “Marcellus is huge for interstate pipelines,” Conaster said.

El Paso Corp., too, has added or replaced 125,000 hp of compression gear in Pennsylvania, New Jersey, New York and Massachusetts. This comprised one Dresser Rand HHE reciprocating compressor, six Caterpillar 3616 recips, three Solar Mars 100s, two Solar Centaurs and four Solar Taurus 70s.

Southwest Research Institute (SWRI) recently conducted a pipeline equipment analysis in the U.S. Upstream is mostly made up of small, high-speed separable recips, as well as some smaller gas turbines. Downstream is composed of mid-tolarge- size steam turbine-driven compressors, low-speed recips and gas turbines. In the midstream category about 40% to 50% are low-speed integral recips, 20% to 30% are aeroderivative GTs, 10% to 15% are high-speed engines and 5% electric motordriven centrifugals.

According to SWRI, a minimum of 3,700,000 hp of compressors must be replaced in the next 15 years — and that’s just in interstate lines (Figure 6).

“Industrial gas turbines are currently the prime mover of choice for many mainline applications,” said Jason Gatewood of SWRI. “They aremore reliable than internal combustion engines, have low maintenance costs and low emissions.”

Given the high cost of plant construction, some producers are looking to add capacity by re-rating core turbomachinery. “Re-rating the equipment adds capacity to the existing footprint and is a welcome alternative to the high cost and longer project timeline of a plant expansion,” said Robert Vitello, Director of Business Development & Marketing for Elliott Global Service.

Vitello touted Elliott expertise with refrigeration compression. The company’s rerate capabilities include engineering, design, parts manufacture, retrofit shop and field installation for Elliott and non-Elliott equipment.Vitello said that a rerate typically involves a 12-to-18-month cycle.

Beyond rerates,Kyle Carpenter, Elliott’s Regional Director, Engineered Products, reports an influx of inquiries fromgas plants currently being designed and built for power generation, LNG liquefaction, as well as downstream production—olefins in particular. The company is engaged with a number of clients looking at existing LNG terminals and reviewing the feasibility of liquefaction and export.

“We are actively pursuing many potential LNG liquefaction train and ethane cracker projects in North America,” said Carpenter. Elliott recently booked a large project for Williams Olefins and is engaged with other ethylene producers to rerate and upgrade its existing turbomachinery to enhance production and efficiency. Projects of this scale, he said, sometimes require new machinery to provide additional power and compression. He highlighted the efficiency and reliability of Elliott’s Edge sideload mixing technology for compression staging. He also sees good days ahead for GT-based power plants. “Simple cycle and combined cycle power generation producers will see the potential of lower fuel gas prices as a means for better operating margins.”

Cautionary note

John Krenicki, President and CEO of GE Energy, cautioned that itwasn’t necessarily a sure thing that shale gas would fulfill its immense potential. Environmental lobbying and shifts in the world market could change the picture rapidly. “Five years ago, shale was not a factor,” saidKrenicki. “Ultra heavy oil, coal bed methane and oil sands are also very hot areas, especially if oil stays above $100 a barrel.

Cost could be a factor. Shipping highvolume LNG overseas will raise prices. “A 6 Bcf/day LNG export market could raise the price of gas at Henry Hub by more than $1.00 by 2018,” said Robert Brooks of RBAC, Inc., a developer of energy market models, such as the GPCM Natural Gas Forecasting System. “Our study shows an impact of a bit more than 1% (0.8 Bcf/day) of demand reduction due to LNG exports. But unrelenting pressure on coal-fired generation due to environmental concerns will result in increasing gas-fired generation, even at these somewhat higher prices.”

He called attention to Cheniere’s proposed Sabine Pass liquefaction project. At 100% utilization, it would require almost 2 Bcf/day from nearby gas fields in Louisiana and Texas. “In our study, we found a $0.32 impact for that level of exports alone,” said Brooks.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.