USA Now the Biggest Exporter of LNG

The quantity of shale gas being shipped to LNG export terminals means the USA became the world’s largest exporter of LNG.

The U.S. continues to benefit from the shale oil boom. The quantity of shale gas being shipped to Liquefied Natural Gas (LNG) export terminals in the Gulf of Mexico is such that the country became the world’s largest exporter of LNG for the month of December, 2021. Most U.S. deliveries had Europe as their destination as that continent seeks to reduce its dependency on Russian gas.

The Middle Eastern state of Qatar has been number one for some time. But the U.S. stole the crown for the month mainly due to output from Cheniere Energy’s Sabine Pass plant in Louisiana, which recently brought a new LNG liquefaction train online.

Qatar may retake the lead as the countries go head-to-head on deliveries from month to month. And Australian LNG capacity is such that it is always in the running to be number one in any given month. But late 2022 could see the U.S. surge well ahead of both Qatar and Australian once Venture Global LNG’s Calcasieu Pass terminal comes online.

Meanwhile, Qatar has plans to add yet more LNG capacity. That project won’t see the light of day, though, until the end of the decade. It may be difficult for Australia and the U.S. to add much more capacity due to policies that limit natural gas opportunities. That’s good news for existing LNG terminals, which can expect plenty of supply. Overseas buyers are buying as much as 13% of U.S. gas production per month. Currently, Asia received the bulk of that supply followed by Europe.

By the end of this year, U.S capacity will rise to 11.4 billion cubic feet per day (Bcf/d). But peak capacity could be pushed to almost 14 Bcf/d if all seven LNG export facilities (Sabine Pass, Cove Point, Corpus Christi, Cameron, Elba Island, Freeport, and Calcasieu Pass) have all of their 44 liquefaction trains running full blast, according to the Energy Information Administration (EIA).

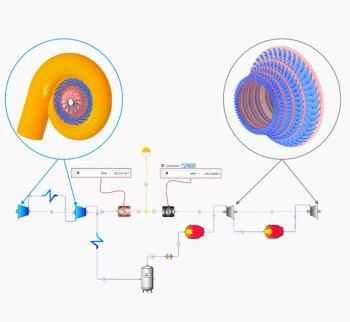

The turbomachinery aftermarket will benefit, too. Those trains contain a large variety of different compressors and turbines. Keeping those 44 trains operating at or near capacity will require plenty of help from aftermarket suppliers and OEMs.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.