Gas turbine innovation, with or without hydrogen

The energy sector is in a constant state of change, perhaps more than ever. Stricter emissions requirements have come on the heels of shifting public support for environmental sustainability.

Efficiency has often been center stage in the turbomachinery sector, but as governments across the world promise carbon neutrality by mid-century, the end goal for OEMs has taken on a greater purpose. Gas turbines are now expected to burn more variations of fuel and be more flexible in their application, all while competing with wind, solar, and battery storage systems.

"With or without hydrogen, gas turbine technology continues to advance."

Natural gas generation will remain strong for decades, according to reports from the International Energy Agency. But alternatives like hydrogen have garnered intense interest due to clean burning qualities and government support. Accordingly, most manufacturers offer turbines that can handle some level of natural gas-hydrogen blend. They are working to create future-proof turbines that can efficiently run on 100% hydrogen or a high hydrogen blend.

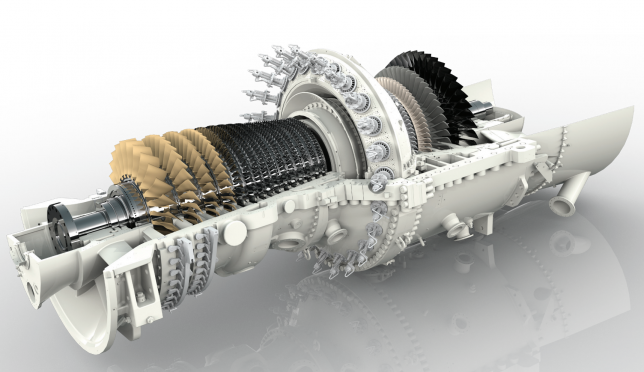

The Ansaldo Energia AE94.3A F-Class outputs 495 MW in combined cycle and 992 MW in a 2+1 configuration.[/caption]

Ansaldo Energia

Ansaldo Energia is developing larger and more efficient H-class gas turbines for the combined cycle and peaking markets. Flexibility features include part-load operation, high turndown, and cycling operation to support the renewables, and the needs of large combined cycle plants.

In addition, the company is increasing the hydrogen combustion capability of all new engines and retrofits. The trick in developing blended fuel turbines is to reduce the negative side effects of hydrogen combustion such as derating, which drops power output and efficiency, increases emissions, and lowers operational flexibility. The company already has more than 200,000 operating hours in burning hydrogen-enriched fuels in its AE94.3A gas turbine.

Sequential combustion technology, such as that in Ansaldo Energia’s GT26 and GT36 turbine models, offers advantages for hydrogen combustion. The latest high-pressure tests at full engine conditions, demonstrated that the engine’s sequential combustion is suitable for hydrogen combustion.

Ansaldo Energia’s most popular gas turbines are the GT36 H-class and AE94.3A F-Class. The GT36 H-class outputs up to 538 MW and can use hydrogen up to 50% volume without derating. It is a good fit for combined cycle plants. The AE94.3A F-Class outputs 495 MW in combined cycle mode and 992 MW in a 2+1 configuration. It can burn up to 25% hydrogen by volume. Further improvements are under testing.

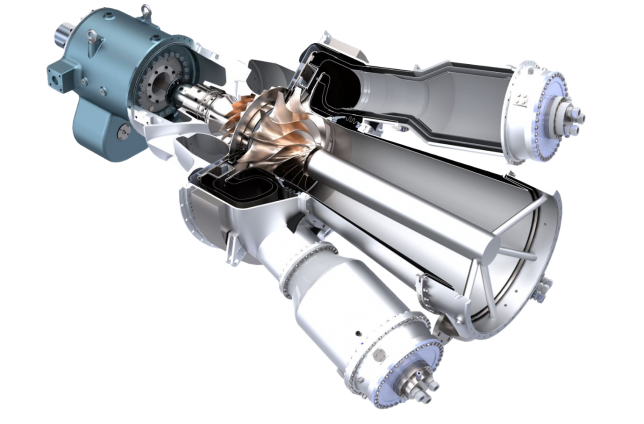

GE 9HA.02 gas turbine[/caption]

GE Gas Power

GE has a well-known gas turbine portfolio that includes H-class, F-class, B and E-class, and aeroderivative turbines. The HA and F-class turbines offer the greatest fuel flexibility and power.

The company’s ability to close transactions, particularly services parts & upgrades, has been impacted by constrained customer budgets and access to financing due to oil prices and economic slowdowns. GE said it anticipates the power market to continue to be impacted by overcapacity in the industry, increased price pressure from competition on servicing the installed base, and the uncertain timing of deal closures. The company has gained 32 orders so far in 2020. That compares with 52 for the first three quarters of 2019. The company remains the top gas turbine manufacturer; it is forecast to account for nearly 30% of units produced over the next decade.

GE’s 384 MW 7HA.02 combustion turbine, which can burn between 15-20% hydrogen by volume, is known for its ability to use various gas blends at high power and efficiency. The turbine is being used at the Long Ridge Energy Terminal, a 485 MW combined cycle power plant in Ohio, that will transition to run on hydrogen as soon as next year. The plant is the first purpose-built hydrogen plant in the U.S.

The company has also been developing a multi-tube combustion system known as the DLN 2.6e. Optimized for operation on natural gas, it can operate on blended hydrogen and natural gas, with up to 50% (by volume) hydrogen.

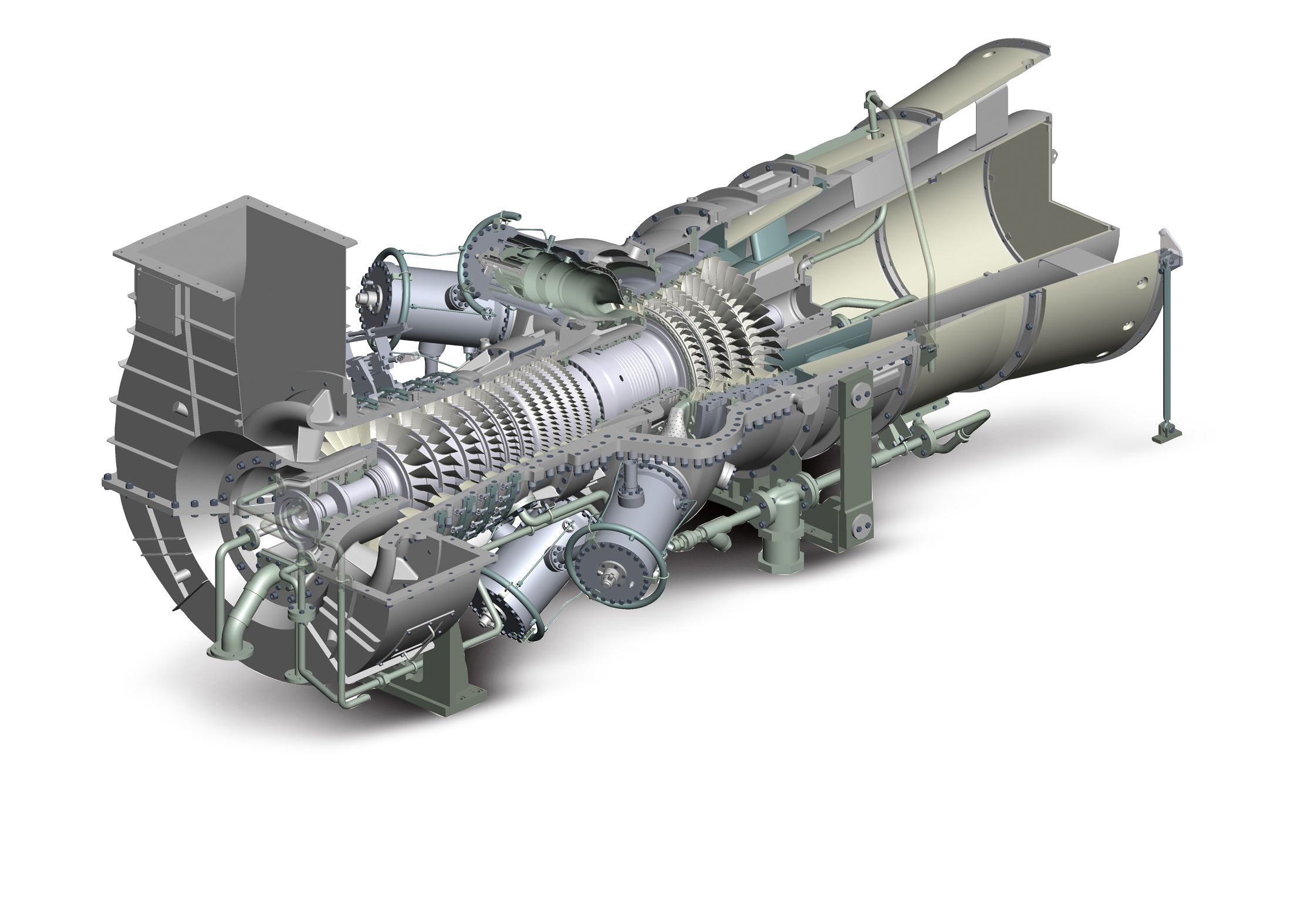

Cross section of Opra OP16 turbine engine[/caption]

OPRA

OPRA, a Dutch turbine OEM, has developed combustor technology to utilize up to 100% hydrogen in its gas turbines. Earlier this year, it ran its turbine successfully in a test using 100% hydrogen.

Its most popular model, the OP16, is an all-radial gas turbine, which provides robustness, reliability, efficiency, and low emissions. Its main markets are industrial, oil & gas and waste-to-energy applications.

The OP16 can operate on a wide range of gases, from ultra-low calorific gases (~5 MJ/kg) to high calorific gases including 100% H2 while fulfilling stringent emissions regulations. The turbine can also handle sour or contaminated gases often seen in oil & gas applications.

The OP16 comes in three variants: The OP16-3A, a diffusion combustor; the OP16-3B, a dry low NOx combustor; and the OP16-3C, a low-calorific fuel combustor.

Kawasaki 1 MW class M1A -17 gas turbine.[/caption]

Kawasaki Heavy Industries

In the last decade, CO2 reduction has become a global trend. The Japanese government has set policy to expand the use of hydrogen to reduce CO2 emissions from its thermal power generation plants.

Kawasaki Heavy Industries came up with a hydrogen supply chain concept almost ten years ago and has been making company-wide efforts to build a hydrogen chain for producing, transporting, storing, and using hydrogen. The company is developing technologies that can handle a wide range of applications, from hydrogen mix with natural gas to 100% hydrogen combustion. These technologies are being developed for 1 MW gas turbines and will be gradually introduced to the market.

In Kobe, Japan, the company is conducting a hydrogen demonstration project. In 2018, it demonstrated that a 1 MW M1A-17 gas turbine could burn 100% hydrogen, utilizing the generated electricity and steam at a nearby large-scale event facility and hospital. This year, the demonstration is using an MMX combustor (Dry Low Emissions – DLE) instead of NOx reduction by water injection. The test operated at 100% hydrogen with DLE for the first time and achieved an efficiency improvement of 1 point from the wet (NOx) method.

“We are developing and demonstrating the technologies necessary to build a hydrogen supply chain in order to respond to the expansion of hydrogen utilization worldwide,” said Koji Tatsumi, Senior Manager of Gas Turbine Engineering Department for Kawasaki Heavy Industries.

“We are demonstrating in a pilot that we produce a large amount of low-cost hydrogen in resource-rich countries, transport it as liquefied hydrogen to other countries, and unload and store it.”

Kawasaki gas turbines are available in sizes from 1 MW up to 30 MW. The primary model is the 7 MW M7A gas turbine. It is suitable for paper manufacturers and chemical plants desiring in-house power and steam generation.

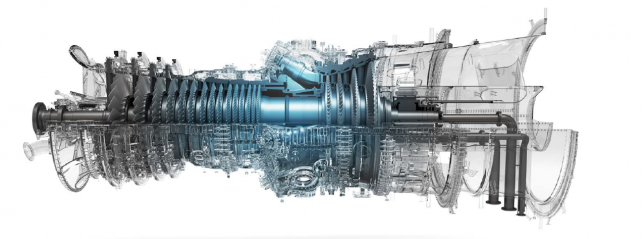

Mitsubishi Power’s hydrogen gas turbine[/caption]

Mitsubishi Power

Mitsubishi Power offers gas turbines ranging from 30 MW to 560 MW. The company has developed turbines that can operate on a mixture of 30% hydrogen and 70% natural gas. They are now working toward one that runs on 100% hydrogen.

At the company’s T-Point 2, a complete combined cycle power plant operating in a 1x1 configuration (one gas turbine, one HRSG, and one steam turbine), turbine designs undergo long-term validation of at least 8,000 hours – equivalent to nearly one year of normal operation.

T-Point 2 aims to be the power plant of the future partly because it uses machine learning and artificial intelligence technologies that will be available in a digital product called Tomoni, a customizable suite of user-driven, digital power plant solutions. The company hopes for T-Point 2 to become the first autonomous power plant in the world.

Mitubishi Power’s most popular model is the J-Series Advanced Class JAC gas turbine – the industry’s largest. It operates at 64% efficiency and 99.6% reliability. The company has been focusing on improved output and fuel efficiency, along with hydrogen combustion and artificial intelligence. It is currently developing dry low NOx (DLN) combustion technology (multi-cluster combustor) for 100% hydrogen fueling. The technology is borrowed from MHI’s heavy-haul rocket launch division. These rockets run on 100% hydrogen.

“Although there is still a long path for natural gas and renewable power to continue to replace coal-fired power generation and decarbonize power grids around the world, we believe energy storage will be the next important development in decarbonizing power,” said Toshiyuki

“We plan to be leaders in natural gas power generation and in storage of renewable power. We offer both Lithium Ion battery storage and green hydrogen energy storage, and see these markets growing substantially already in 2020,” said Toshiyuki Hashi, Director, Executive Vice President, CEO, of Gas Power at Mitsubishi Power.

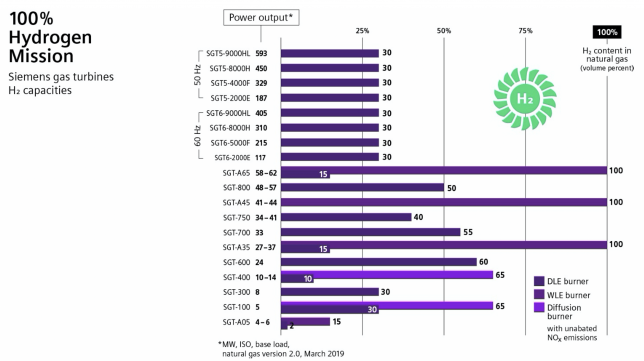

Siemens Energy

All of Siemens Energy’s large gas turbines, from the SGT5-2000E to SGT5/6-9000HL, are capable of running on up to 30% hydrogen by volume. Roadmaps are in place to develop the mid-term and long-term capability to higher hydrogen contents reaching 100%.

Similarly, the company has been enabling hydrogen operation in its medium and smaller gas turbines. The 24 MW SGT-600 runs on 60% hydrogen with near future targets of 75%, and the 50-62 MW SGT-800 runs on 50% hydrogen with an immediate target of 75% hydrogen.

All SGT turbine frames are used for power generation in either simple cycle, combined cycle or cogeneration applications. Those frames rated 40 MW or lower are also used for mechanical drive. Dry low NOx combustion systems are standard for all frames.

Recent developments at Siemens Energy include increased hydrogen co-firing capability of 85% in the near future depending on the market pull based on both rig testing at Siemens’ Clean Energy Center outside of Berlin, Germany and full engine testing in Finspang, Sweden. A road map is in place for 100% hydrogen, but 100% hydrogen capability needs joint R&D collaborations including industrial partners in order to realize full engine verifications. The company is also entering the commissioning phase of two SGT-600 DLE to run on hydrogen-rich process gas in Brazil.

A group of Capstone C65 microturbines on a rooftop in Canada, powering an apartment building.[/caption]

Capstone Turbines

Due to the limited supply of hydrogen, Capstone Turbines developed microturbines as a distributed generation energy source to be easily installed at the source of hydrogen generation, without the need for infrastructure.

The company has patented a hydrogen-fuel injector. And it’s been working with Argonne National Lab and UC Irvine to test current systems on hydrogen blends. Capstone sold its first hydrogen C65 earlier this year to Australia.

“At the moment, there is not a huge commercial market for hydrogen-fueled power generation, but we recognize the opportunity that this growing market could provide in the future,” said Don Ayers, Senior Director, Engineering and Quality, Capstone.

Capstone Turbine’s microturbines range from 30 kw to 1 MW. The larger unit can be deployed in arrays up to 10 MW. Capstone’s primary markets are energy efficiency, oil and gas, and renewable energy. Their microturbines are installed in combined heat and power (CHP) and combined cooling heat and power (CCHP), power-only, direct exhaust, and steam applications.

Capstone microturbines are often installed as the backbone of multiple microgrid installations. Many of its oil and gas projects are flare gas valorization applications using otherwise wasted gas as a power source. Its machines operate on a variety of fuels including natural gas, propane, butane, various sour gases, renewable fuels such as renewable natural gas, landfill gas, biogas or digester gas, kerosene, hydrogen, and diesel.

Capstone’s most popular model is the C65, though its C200/1000 series product has increased in volume since its launch in 2008. It is compact and can produce enough heat to provide hot water to a 100-room hotel while also providing about one third of its electrical requirements. ■