Can natural gas generation survive?

Europe will be the crucible for innovative and experimental alternative technologies.

By Drew Robb

California has the reputation of being on the leading edge of U.S. energy policy and renewable technology deployment. Yet in many ways, California follows the European example.

It is in Europe where there is by far the most advocacy for emissions reduction to address climate change. It is in Europe where renewable penetration has reached the highest levels. And it is in Europe where targets have been set to eliminate natural gas from power generation within a decade.

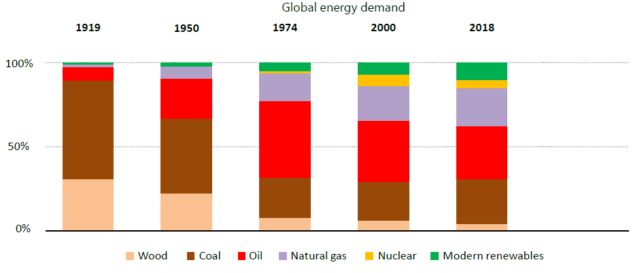

The last century has witnessed multiple transitions to and from different fuels and technologies. Source: IEA[/caption]

The price tag for this, however, is not small. According to Francesco La Camera, Director-General of the International Renewable Energy Agency (IRENA), it will take $110 trillion to meet Europe’s 2050 decarbonization goals. That amount is the equivalent of investing 2% of global GDP per year.

Several recent reports published by government bodies and consulting firms outline how this vision could potentially be executed.

World Energy Outlook

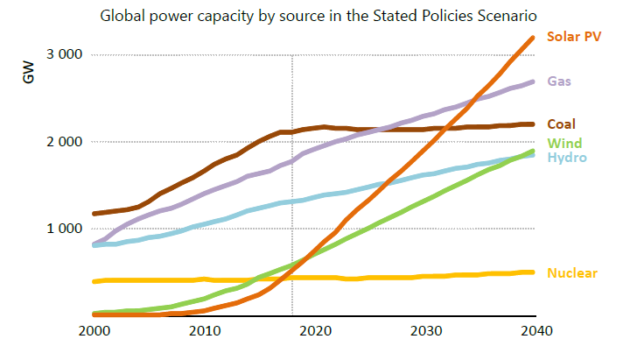

The power mix is being re-shaped by the rise of renewables and natural gas. In 2040, renewables will account for nearly half of total electricity generation. Source: IEA[/caption]

The International Energy Agency’s (IEA) World Energy Outlook 2019 emphasizes achieving climate, energy access and air quality goals. It attempts to do this within the framework of reliability and affordability.

The report offers several scenarios: One based on how stated (current) policies will play out by 2040, another based on planned policies, such as eliminating coal generation or diesel vehicles by a certain date, and the sustainable development policies scenario ― what the IEA believes needs to be done to reach targets set in the Paris Agreement and by other agencies.

The IEA considers the first two scenarios as grossly inadequate. The stated policies scenario, for example, results in a global rise in energy demand by 1% per year to 2040. Solar photovoltaic (PV) and wind will supply more than half of the growth, with natural gas accounting for another third. Oil demand will flatten in the 2030s, and coal use will decline. However, the rise in emissions slows but does not drop.

Under the planned policies scenario, the report perceives the U.S. energy sector to pose a problem: shale output from the U.S. will see the nation provide 85% of the increase in global oil production from now to 2030, as well as a 30% increase in gas. By 2025, the IEA predicts that total U.S. shale output of oil and gas will overtake all Russian oil and gas production. In Asia, too, natural gas demand is set to surge.

The sustainable development scenario, however, requires wind and solar PV to provide almost all the increase in electricity generation between now and 2040, i.e., little room for natural gas. As for coal, the study accepts usage will remain high in China, India and other parts of Asia. Thus, carbon capture, utilization and storage (CCUS) and biomass co-firing equipment are part of the scenario for those regions along with plenty of coal plant retirements.

The IEA also predicts that under the stated policies scenario at least 120 GW of battery storage will exist by 2040. The hope is that the decline in battery costs will be more rapid than expected or that technological improvements will facilitate an even greater amount of battery storage.

In essence, the report views natural gas as little more than a near-term bridging fuel temporarily replacing coal and oil. Yet the IEA recognizes the value of the existing gas pipeline network as a crucial mechanism to bring energy to consumers. The agency sees low-carbon hydrogen and biomethane (from organic wastes and residues) as the ultimate successors to natural gas. But for now, hydrogen remains too expensive to play a part.

“There is no single or simple solution to transforming global energy systems,” said Dr Fatih Birol, the IEA’s Executive Director. “Many technologies and fuels have a part to play across all sectors of the economy.”

Looking across industry segments, the power generation sector is by far the most effective at reducing overall emissions. Progress in transportation, commercial, residential and industrial, however, has lagged.

Natural gas growth

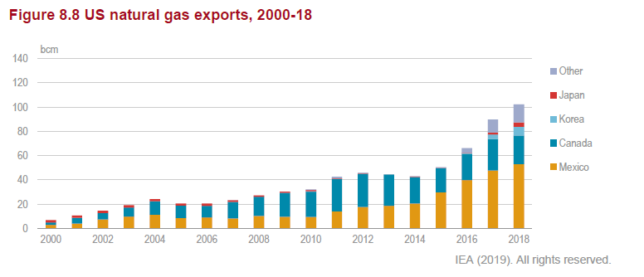

The US became a net exporter of natural gas in 2017, with LNG exports reaching destinations in Asia.[/caption]

Coal, natural gas and nuclear accounted for over 80% of total electricity generation in the U.S. in 2018, according to the IEA. But the share of renewable energy is increasing. Gas took first place at 34%, coal 29%, nuclear 19%, hydro 7%, wind 6% and solar 2%. The U.S. Department of Energy expects wind to surpass hydro generation in 2019.

The U.S. is the top natural gas producer in the world. Natural gas accounted for 32% of total primary energy supply (TPES) in 2018, up from 24% in 2008. With 852.7 billion cubic meters (bcm) available in 2018, it is no surprise that the nation is now a net exporter of natural gas.

The share of natural gas in power generation rose from 21% in 2008 to 34% in 2018. Top gas-producing states by shares of total production were Texas (23.1%), Pennsylvania (19.7%), Oklahoma (8.5%), Louisiana (7.7%) and Ohio (6.3%).

Natural gas consumption in the U.S. is also on the rise: an 18% increase from 2007 to 2017.

Heat and power generation account for 37% of the total increase, followed by industry (23%), residential (16%), commercial (11%), energy (9%) and transport (3%).

Power generation and petrochemicals (ethane feedstock) have benefited markedly from low gas prices. According to the IEA current policies scenario, natural gas is expected to remain the dominant source in the U.S. for power generation up to 2050.

Gas production in the U.S. is expected to reach 1,016 bcm by 2024, and 1,074 bcm by 2040. Prices are expected to remain low at least through 2024. This is in sharp contrast to the rest of the world. Prices in Europe and Asia are much higher – six times higher in Switzerland, for example.

U.S. gas exports reached 102 bcm in 2018. That is a 4X expansion in 10 years. Mexico took 52%, followed by Canada (23%), and then Asia Pacific. The volume of LNG has quadrupled since the opening of the Sabine Pass LNG terminal on the Gulf Coast in 2016. But exports to Europe are expected to surge. The IEA predicts that the U.S. will lead LNG market supply growth until 2023.

The U.S. natural gas system consists of more than 300,000 miles of transmission pipelines. That network delivered about 25 trillion cubic feet (708 bcm) of natural gas to 75 million customers in 2017. In addition, three large-scale LNG export terminals are now operating: Corpus Christi, Sabine Pass and Cove Point. More are on the way, including Golden Pass, Magnolia LNG, Delfin LNG, Lake Charles, Venture Global Calcasieu Pass, Driftwood and Port Arthur.

Based on IEA analysis, then, unless U.S. energy policy pivots, natural gas generation is likely to remain a central part of the power generation sector worldwide for many decades to come.

Capgemini World Energy Markets Observatory

Analyst firm Capgemini issued a report entitled the World Energy Markets Observatory, which predicts continuing demand and growth for gas. In 2025, it forecasts that the U.S. should account for more than half of worldwide oil and gas production growth (75% for oil, 40% for gas).

“No energy-related technical breakthroughs are expected by 2040, and nuclear fusion, if demonstrated, will not be at an industrial stage,” said Colette Lewiner, Senior Advisor, Capgemini. “However, improvement of existing technologies will enable lower costs for renewables, electric batteries, electric vehicles, and small modular nuclear reactors.”

She concludes that hydrogen for storage and mobility should be at the industrial stage by 2040. Digitalization, too, will bring productivity gains in all energy value chain segments. Smart grids will be deployed at scale with increased sensors, data collection, and data mining being used to improve forecasting and operations. Likewise, decentralized supply will increase. De-carbonization, decentralization and digitalization are on the rise. Some 23% of U.S. energy and utility companies, for example, have deployed intelligent automation initiatives.

Overall, Capgemini believes low prices for natural gas and renewables will mean they will continue to be the top U.S. sources for new capacity additions until 2050.

Storage, for now, will continue to rely on government incentives and investment tax credits. That said, 760.3 MWh came onto the U.S. grid in 2018.

Europe, too, is heavily dependent on natural gas. It imports much of its supply, with Russia being the biggest source. But LNG imports are rising from places such as Algeria, Qatar and the U.S. Europe is keen to lessen its dependency on external sources of energy. It has set aggressive emissions reduction goals and is the most vocal continent for the elimination of natural gas.

California, too, has set forth ambitious goals: 60% renewables by 2030 and a zero-emissions economy by 2045. The Golden State hopes to achieve this by eliminating natural gas as an electricity resource while upgrading its local distribution and regional transmission systems. This includes expanding access to renewables via the western regional grid.

“California’s renewables and emissions goals represent an extremely daunting challenge, and if we try to achieve them without a regional electricity market, we will regret it,” said Carl Zichella, Director for Western Transmission, Natural Resources Defense Council.

California sits in contrast to the rest of the U.S. Total natural gas demand grew more than 40% over the past decade and rose by another 13% from 2017 to 2018, according to the American Gas Association.

At the same time, natural gas prices for retail customers adjusted for inflation were the lowest in decades. That is why Capgemini makes it clear that natural gas-fired generation will remain the dominant fuel in the electricity power sector through 2050. Coal will not go away either, but its use will gradually decline.

Gas for climate change

Consulting firm Navigant issued a Gas for Climate Report, which sought to find the optimal role for gas in a net-carbon-zero world. It assessed the cost of decarbonizing the EU energy system by 2050, as well as the role of renewable and low-carbon gas within the existing gas infrastructure.

In other words, the goal is to largely eliminate natural gas from Europe. Any gas remaining would either be low in carbon or would be fulfilled by gas produced from renewable sources, such as biomethane and green hydrogen (hydrogen produced by electrolysis powered by renewable energy). It also considered blue hydrogen: natural gas combined with CCUS and split into hydrogen and CO2.

Navigant concluded that full decarbonization of the energy system would require a tenfold increase in renewable electricity production from wind and solar. This would have to be backed up by abundant dispatchable electricity production by either solid biomass or gas. The analysts concluded that replacing any type of gas with battery seasonal storage would be unrealistic even at strongly reduced costs.

In addition, the value of gas grids became clear ensuring the reliability and flexibility of the energy system. The belief is that these pipelines can be used to transport and distribute renewable methane and hydrogen instead of natural gas by scaling up production of biomethane, green hydrogen and power to methane.

The EU has high hopes for power to methane, or methanation ― a technology by which synthetic methane can be produced based on hydrogenation of carbon dioxide. This can take place in a methanation reactor as an additional step to electrolysis with hydrogen produced from renewable electricity or as a coupled process in biogas plants using residual CO2.

Hydrogen and CO2 can be combined in a digestor where microorganisms would act as bio-catalysts. Synthetic natural gas can be then produced with a methane content of 96% to 99%.

All of these alternatives would need to be supplemented by blue hydrogen, said Navigant, until the cost of green hydrogen drops and enough wind and solar capacity exist to produce green hydrogen. But eventually, the plan is to eliminate blue hydrogen (and hence natural gas).

There is a small problem. The EU currently imports more than 50% of its energy. If it is to phase out coal, nuclear and natural gas, where will the required energy be produced? Analysts at Navigant surmise that international trade in renewable energy will provide imports of solid biomass and green/blue hydrogen. A further idea is to transport blended methane and hydrogen through gas grids, while gradually creating dedicated hydrogen transport networks.

At the same time, the report expects light road transport (passenger cars, light commercial vehicles) and domestic shipping will be primarily electric by 2050.

Long-distance heavy transport is another matter. It requires fuels with high energy density. Similarly, direct use of electricity (from batteries) is less suitable for international shipping and aviation. In heavy road transport and international shipping, hydrogen and bio-LNG dominate in the optimized gas scenario while large quantities of biodiesel are used in the minimal gas scenario.

Carbon capture of gas

The bottom line on this and the other reports cited is that the elimination of natural gas from power generation in Europe seems unlikely in the foreseeable future. The projections for its removal depend too much on developing technologies that have yet to scale economically.

Meanwhile Europe is quietly beefing up its LNG import infrastructure. The billions being invested in LNG tend to contradict the sabre rattling about ending the use of natural gas on that continent.

What is likely to happen is that many of these alternative technologies will be fast-tracked toward maturity. That is good news in terms of lower emissions and greater energy efficiency. This movement will also bleed over to the U.S. in areas such as carbon capture of natural gas.

To help the U.S. do its part in reducing emissions from coal and natural gas, the Department of Energy (DOE) Office of Fossil Energy (FE) announced $110 million in funding for research and development (R&D) projects for CCUS.

“CCUS technologies are vital to ensuring the United States can continue to safely use our vast fossil energy resources, and we are proud to be a global leader in this field,” said former DOE secretary Rick Perry.

As well as reducing emissions, part of the purpose is to utilize the captured CO2 in enhanced oil recovery to maximize energy production. What is interesting about these grants is that they go beyond traditional CCUS for coal and branch into how to harness this technology for natural gas.

One project aims to retrofit a 2x2x1 natural gas-fired gas turbine (GT) combined cycle power plant (CCPP) with CCUS. Bechtel National will conduct the study at an existing Panda Energy Fund plant in Texas. The post-combustion capture plant is an amine-based conventional absorber-stripper scrubbing system with a solvent.

Another project concerns the design of Linde-BASF advanced post-combustion CO2 capture technology at a Southern Company natural gas-fired power plant. This will either be at Alabama Power Company’s Plant Barry in Bucks, Alabama or Mississippi Power Company’s Plant Daniel located in Moss Point, Mississippi.

An aqueous amine solvent-based post-combustion CO2 capture technology will be used at the chosen CCPP. Linde-BASF technology is based on a lean-rich solvent absorption/regeneration cycle for CO2 capture.

A different approach is to be taken by the University of Texas at Austin using the Piperazine Advanced Stripper (PZAS) process for CO2 capture at the Mustang Station of Golden Spread Electric Cooperative (GSEC) in Denver City, Texas. This is a CO2 scrubbing process with solvent regeneration for post-combustion carbon capture from natural gas flue gas. The project will provide insight on the benefits and economics of integrating CO2 captured from a power station.