- January/February 2019

A more optimistic PowerGen

New opportunities arise in the face of growing challenges at PowerGen.

PowerGen International offers an annual barometer of the power generation sector. The December 2018 event noted the many challenges the industry faces: the influx of renewables, an aging power grid, price volatility and changing regulations, to name a few. Yet the overall impression was one of optimism.

Organizations, such as Orlando Utilities Commission, ABB, MHPS, Emersion Power & Water and GE Gas Power, provided the view from the executive suite. Topics included digital transformation, the evolution of the grid, interaction with a new workforce generation, the rapidity of change, and how the industry can adapt. Overall, they presented a positive view of the future.

Keynotes

Teresa Hansen, Global Content Director, Clarion Events, MC’d the keynotes. She said 2018 had been a transformative year for power generation. As well as the struggle to stay competitive, renewable and small distributed energy installations are increasing steadily.

“Despite this, conventional thermal plants and combustion turbines will continue to supply most of the developed world’s electricity for many years to come,” said Hansen.

Orlando Utilities Commission President Gregory Lee described how his organization was adjusting to change. Its Stanton Energy Center, for example, has incorporated solar, natural gas, landfill gas and coal in one location. The city balances three factors: reliability, affordability and sustainability. By 2050, Orlando plans to be powered 100% by renewables, he said. “Power generation in 10 years will look vastly different from what it did a decade ago.”

Digital transformation was the theme of Robert Yeager’s keynote. The President of Emerson’s Power & Water Solutions business began by showcasing his company’s Ovation automation system that boasts 1.3 million MW of coverage worldwide.

“Digitization will eliminate human error, make it possible to innovate without fear, bring about effective knowledge transfer to retain and attract top talent,” said Yaeger. “The new generation of workers grew up with digital technology that they expect to find in their workplace. They want a digital plant, and many facilities have already started to implement digital elements to stay competitive.”

Digital twin

He urged attendees to adopt digital-twin technology. Rather than trying to innovate while a plant is online, the digital twin enables management to model potential changes, view the results and make any necessary changes to avoid risk.

These twins can be composed of as much as 10 million lines of software code. As they are automatically updated, they provide real-time synchronization of the entire power plant and its controls with the digital world.

“You can see if the changes you’d like to make would de-rate or trip your plant without risking real downtime,” said Yaeger. “It’s a great way to avoid problems in the future.”

A whole lot of software and IT changes are coming soon to the operational technology (OT) world of power generation: The cloud, augmented/virtual reality, artificial intelligence (AI), machine learning, blockchain, modern networking and edge computing. As such, power producers will need to find the right technology partners to help successfully implement them. But with all plants networked, a fix in one plant can be quickly exported to all plants.

ABB, for example, has embarked on a technology partnership to marry IT with OT. It collaborates with Microsoft and HP Enterprises to incorporate cloud and edge computing into its ABB Ability digital distributed control system (DCS) architecture.

“Digital solutions must be able to demonstrate tangible results that can scale across the enterprise,” said Greg Scheu, President, Americas Region, ABB. An integrated approach to digitization must encompass everything: from sensors and controls to security to the health of all assets.

He also covered preparation for the new workforce. By 2025, some 75% of personnel will be millennials with digital competence and knowledge, he said. Quite different from that of today.

ABB is working with partners in education to lay out career paths for industry jobs, such as lineman and plant operators. Instead of getting a degree or other skill and then showing up to work without any experience or practical know-how, they need the right training and programs to fit them for workplace.

Second-day keynotes

Todd Buchholz, former White House economic policy director and economist, highlighted the “scissors economy” where the middleman gets taken out of the equation: transportation (Uber), hospitality (Airbnb), and even energy, where direct buying, microgrids and distributed generation challenge the role of the modern utility.

“Utilities and power generators need to adapt and evolve,” said Buchholz. “You must be more flexible, not just running turbines or plants, but involved in the last mile, as well.”

Scott Strazik, the new CEO of GE Gas Power (combining equipment and services for GTs under one entity), said that 700 GW of coal and nuclear power will be retired over the next two decades. He believes natural gas is needed to provide grid resilience to support renewables.

“Renewables may be growing faster, but there is a lot of opportunity for natural gas,” said Strazik. “Gas is dispatchable, flexibly, low density and affordable.”

He noted that CO2 reductions hit their peak at 27% and have been trending downwards since. During that period, coal had dropped from 50% to 30% of the generation mix. In the same period, natural gas rose from 19% to 34%. Two-thirds of the reduction in CO2 has resulted from the coal-to-gas switch and one-third from renewables, he said.

Another opportunity for gas is in liquefaction capacity. Currently, there is

369 MTPA of LNG capacity with another 92 MTPA under construction, and 875 MTPA proposed (half of which is in North America).

LNG markets are growing. Taiwan has decided to eliminate nuclear by 2025 and reduce coal to 30%. That opens the door for 13 GW of new natural gas combined cycle power plants.

• Bangladesh is adding 43 GWs of gas by 2041.

• Brazil may add 12 GW of gas by 2030

• North America will add 30 GW to 40 GWs of gas in the next five years.

This is showing up in a spurt of orders. GE has 30 of its HA turbines running with 220,000 operating hours to date. Its orders total 83 of which many are due online in the next year or two. The company is also pushing upgrades, of the GE fleet or cross-fleets. These typically involve GE’s Advance Gas Path (AGP) or its DLN 2.6+ combustor.

“We can now turn down a 7F turbine from 40% to 26%, which lowers NOx and CO, as well as fuel burn down to 25%, and greater opportunity for energy trading via ancillary services,” said Strazik.

Cross-fleet upgrades are on offer for machines, such as the MHPS 501F, the SGT6-5000F and the SGT-800. For example, at a Naturgy plant in Tuxpan, Mexico, 501Fs, steam turbines and generators were upgraded with the AGP to extend the maintenance interval to 32,000 hours, increase output by 9.2% and efficiency by 2.9%.

“We operate in a complicated and interesting power market, but gas will play a role in a cleaner energy future,” said Strazik. “As gas requires 50-to-100 times less space per MWH than renewables, the world’s many mega-cities will look to gas for their power.”

MHPS takes lead

Mitsubishi Hitachi Power Systems (MHPS) CEO, Paul Browning, said that 2018 will be the first year where its GTs will earn the top spot in terms of megawatt orders. Browning estimates MHPS market share of around 35% for 2018. He puts this down to the transition from F-class to advanced class gas turbines, with MHPS having a head start on those machines over its rivals.

“We feel strongly that the power generation market will be dominated by natural gas, renewables and energy storage,” said Browning.

MHPS is adding renewables and battery storage to its portfolio, and it will act as a technology integrator and project developer. MHPS will begin its solar initiative in the Northeast U.S. The company has already created a development team in that area. The focus will be on offices, industrial and commercial, rather than utility-scale solar.

The company is also a developer for natural gas projects. Many Independent Power Producers (IPPs) have land and existing relationships for transmission. But they lack resources to either upgrade or expand their facilities. “As a partner we can help with finance and technology,” said Browning.

As an example, he cited a project MHPS developed in Brazil. The company arranged a 25-year gas contract with Shell, a 25-year power purchase agreement (PPA), and an investor. The project is moving forward using the MHPS JAC Gas Turbine and an MHPS Heat Recovery Steam Generator (HRSG).

The company recently announced the introduction of its 275 MW SmartER GAC (the M501GAC) turbine to compete against existing F-class peakers. It is an integration of MHPS’s G-Series turbine and MHPS-TOMONI analytics and AI.

It enables a 10-minute start, 50 MW/min ramp rate, 9 PPM NOx emissions, and an output of 275 MW. The higher output and operational flexibility is said to exceed the F units. MHPS announced its first order for this turbine from a Midwest utility and expects to announce other new orders for this technology in the near future.

“We plan to convert F-class peakers into GAC peakers,” said Browning.

Regaining the lead

MHPS may have the megawatt lead for 2018, but the big question is whether it can solidify its position moving ahead. According to Forecast International, GE is likely to install nearly half the total electrical power generating capacity to be added over the period 2019–2032. When licensees and subsidiaries are included, GE Energy is projected to deliver 49.34% of capacity installed during this period. Siemens will follow with 25.76%, while MHPS will contribute 15.53% (Figure).

“The strength of GE Energy in the power generation market is the result of a deliberate drive by the company to maximize its market penetration at a time when reduced demand, overcapacity, and soft prices look set to continue until at least the early 2020s,” said Stuart Slade, Industrial Gas Turbines Senior Analyst at Forecast International. “This strategy brought with it significant risks that were picked up by stock market analysts to reflect concern about the company’s performance.”

GE is partnering with Tampa Electric (TECO) to modernize Big Bend Power Station in Hillsborough County, FL using 7HA GTs and an upgrade to its steam turbine island. Similarly, IPP Chiahui Corp.is going to use the 7HA.O2 as part of a power-expansion project at Chiahui Power Plant in Chiayi Province, Taiwan. GE customers, such as Invenergy’s Lackawanna Energy Center in Jessup, PA and Aluminium Bahrain (Alba)’s Unit 1 at Power Station 5 in Bahrain achieved first fire status for their HA units.

Siemens

In the past few months, Siemens has unleashed an avalanche of new orders, contracts and upgrade projects. It received an order for SGT-800 GTs in Panama earlier this year, along with a long-term service and maintenance agreement for the plant.

IPP Sinolam Smarter Energy (SSE) is the end user. The deal encompasses six SGT-800 units, an SST-600 industrial ST, and electrical generators. The plant will operate with liquefied natural gas (LNG). Commissioning for the power block is expected in the fall of 2020.

Siemens received another order from Lansing Board of Water & Light (BWL) to supply three SGT-800 GTs and generators for its new gas-fired generating station in Lansing, MI. It will feature three SGT-800s, two operating in combined cycle and one simple cycle, capable of producing 250 MW. Siemens will also supply its SPPA-T3000 digital control system.

Siemens is building a new energy service and training center in Bolivia to provide education on traditional and digital services. It will also function as a hub for servicing power equipment installed in the South America region. At the same time, Siemens is upgrading three CCPPs in Bolivia: Termoeléctrica del Sur, Termoeléctrica de Warnes, and Termoeléctrica Entre Ríos.

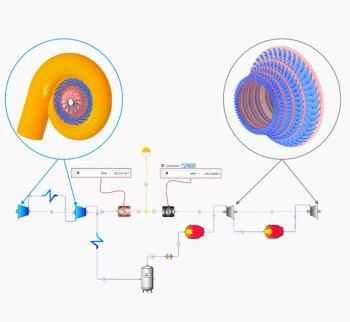

Doosan, meanwhile, showcased the Doosan DGT6-300H series gas turbine.

Now undergoing a battery of tests before being released to the market, it features an Advanced DLE combustor, new coatings and cooling systems, a 13-stage compressor, a flutter-free airfoil design, and over 3500 sensors inside. It will provide 270 MW in simple cycle and 400 MW in combined cycle. ■

Articles in this issue

almost 7 years ago

Smaller gas turbines find their nicheabout 7 years ago

GE bets on aeroderivativesabout 7 years ago

Keeping a watchful eye over the condition of rotating machinesNewsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.