- September/October 2021

Carbon capture

Lowering carbon emissions from gas turbines.

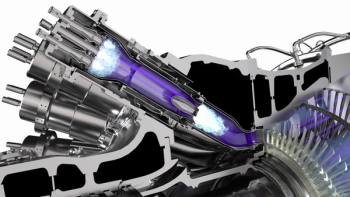

Now that coal plant emissions have been largely curtailed across much of Europe and North America, attention is swinging onto gas turbines. Such plants, by and large, do a good job at reducing emissions such as NOx and SOx.

"Power producers have already made great strides in lowering the carbon intensity of the power sector in the U.S., largely due to retiring coal and replacing it with a combination of natural gas and renewables,” said Evan Canady, Mitsubishi Power.

However, the current demand is that gas-fired plants greatly reduced their carbon emissions. This can be accomplished either by pre-combustion carbon separation (usually using methane steam reforming to syngas with subsequent water shift and CO2 removal) or post-combustion flue gas CO2 removal.

The big hurdle, of course, is cost. Current technology is expensive and energy intensive. Not only is the carbon to be captured, it also needs to be stored somewhere and increasingly utilized in some process. Hence the term carbon capture utilization and storage (CCUS). (Note: It is also sometimes called CCS.

Most attention, to date, has been lavished upon solvent-based capture i.e., the gas stream is exposed to a liquid medium to absorb CO2 via some kind of physical or chemical mechanism. Regeneration is also needed to break absor-bent-CO2 bonds.

Drawbacks include high energy consumption, corrosion, difficulties in scaling, and raw economics. Why spend money to develop and implement the technology in an environment that shows little love for fossil-based fuels. Nevertheless, advances have been made. Amine-based solvents from Mitsubishi have been used in the Petra Nova facility in Texas. Shell Global’s CanSolv is another solvent being used at the Boundary Dam project in Canada. Similarly, physical absorption solvent breakthroughs have been made such as Lurgi’s Rectisol process using chilled methanol as a solvent. Further areas of development include: solid sorbents are being developed by Svante in conjunction with Chevron and others; the Polaris membrane by Membrane Technology and Research in collaboration with the U.S. Department of Energy; SES Innovation’s cryogenic carbon capture; and FuellCell Energy’s fuel cell technology for carbon capture, using electrochemical membranes to separate CO2 from industrial waste gas streams. Further, Chart Industries (owner of LA Turbine) has developed Cryogenic Carbon Capture (CCC) technology. The cost to produce cement and capture CO2 using CCC technology is said to be 24% higher than producing cement with no capture.

Another approach is direct air capture (DAC) to strip CO2 from air using chemical and physical processes. Those working on this include Climeworks with a plant in Switzerland and Carbon Engineering from British Columbia, Canada, that plans to build a Permian Basin facility that to capture a million tonnes of CO2 per year by 2024 using a high-temperature aqueous method based on potassium hydroxide. Global Thermostat, too, has pioneered a porous, honeycomb ceramic approach to carbon capture.

According to IDTechEx, capturing a tonne of CO2 directly from the atmosphere costs between $600 and $1,300 using current technology, compared with approximately $40 to $80 for capturing a tonne of CO2 from the flue gas stream of a coal-fired power plant. Despite that, the analyst firm forecasts that DAC is likely to gain a growing share of global CO2 capture capacity over the next few decades.

CONTRASTING VIEWS

Wherever you turn, there are contrasting views concerning carbon capture. Some see it as entirely feasible, some as completely impractical, and others are somewhere in the middle.

Geert Laagland, Head of Engineering at electricity and district heat utility Vattenfall, said high upfront costs for CCUS means it is only going to be viable if a plant is going to run a lot of hours.

Mark Axford, Principal at Axford Turbine Consultants believes that CCUS represents a more credible path to lower emissions than the ongoing love affair with hydrogen.

“Carbon capture of natural gas is probably a far more economical path than trying to convert everything to 100% hydrogen,” said Axford.

“Post-combustion CO2 removal is technically viable but impractical because of the large volume flow and the need for high ratio CO2 compression,” said Klaus Brun, Director, Research and Development, Elliott Group.

Let’s hear from the OEMs on how they plan to overcome the technical and overcome hurdles present in CCUS.

SIEMENS ENERGY

According to Arja Talakar, Senior Vice President, Industrial Applications Products, Siemens Energy, the critical element in CCUS is early engagement. With carbon capture, that means engaging early in the pre-FEED and FEED study stage.

“The most successful CCUS projects will be those where the OEM and the developer have optimized cycle performance with machinery economics and considerations,” said Talakar. “While there are few commercial projects right now, many projects are being discussed and evaluated.”

Siemens Energy is collaborating with BASF on proton exchange membrane (PEM) electrolyzers for hydrogen pro-duction with an output of 50 megawatts and the possibility of modular capacity expansions. It is also working with Aker Carbon Capture to develop carbon capture solutions that can be applied to gas turbines and gas-fired power plants.

“New turbines and CCUS can provide sustainable solutions for the 21st century,” said Talakar.

Why aren’t there more carbon capture projects addressed to natural gas-fired power facilities? He believes coal gets all the attention as it is dirtier and there represents the low-hanging fruit. He out-lined three points to bring down the cost of carbon capture projects associated with a combined cycle gas turbine (CCGT):

- Be as efficient as possible to reduce the quantity of CO2 to be captured.

- Reduce the temperature of the flue gas to reduce the need for cooling before capture.

- Increase the concentration of the CO2 in the flue gas.

Siemens Energy is conducting optimization studies with Total and others on ways to reduce CO2 emissions, focusing specifically on natural gas liquefaction facilities and associated power generation.

“To reach a 50% reduction in CO2emissions by mass, you need about 80% volume of hydrogen fuel content,” said Talakar. “While it isn’t economically viable today to operate large gas turbines at this level of hydrogen fuel mixture, these levels are within reach with smaller gas turbines, especially when considering hydrogen flare gases from petrochemical sources.”

Adding 10% volume of hydrogen to natural gas will reduce CO2 emissions by 2.7%. A 600 MW combined-cycle power plant that runs 6,000 hours a year at 60% efficiency would equate to a reduction in approximately 1.26 million metric tons of CO2. In Brazil, for example, the company has two SGT-600 turbine generator sets operating on residue gas with high hydro-gen content at a cogeneration plant.

“Compressors can be used to safely and cost-effectively transport and store CO2 or hydrogen,” said Talakar.

Alongside several companies led by Highly Innovative Fuels (HIF), Siemens Energy is developing and implementing a commercial large-scale plant in Chile for the production of e-fuel (synthetic methanol for e-diesel, e-gasoline, or e-kerosene). Electrolyzers use wind power to split water into oxygen and hydrogen via Proton Exchange Membrane (PEM) electrolysis CO₂ is captured from the air and combined with hydrogen to produce methanol. About 40% of the methanol is converted into synthetic gasoline.

ATLAS COPCO

Atlas Copco Gas and Process has been involved in CCUS for about 15 years, supplying compression equipment for a variety of applications. It is currently seeing increased activity in the utilization of supercritical CO2.

“Many major players want to continue operating their fossil-based processes so they are putting more focus on capturing and using CO2,” said Ulrich Schmitz, Marketing Manager at Atlas Copco Gas and Process. Some developed countries are not only sequestrating the CO2, they are utilizing it to produce consumer goods such as blending it with hydrogen to make methanol.”

Most R&D focuses on two main types of CO2 utilization, he said: Using existing and available CO2 molecules for CO2post-combustion processes (oxy combustion); and blending CO2 with hydrogen to create methane or methanol.

CO2 has special characteristics and challenging properties such as a heavy mole weight gas and abundant volume. Centrifugal machinery, therefore, is a very good fit to process it, particularly integrally geared compression which is a high head technology. In addition, it pro-vides a favorable pressure ratio as well as intercooling.

MAN ENERGY SOLUTIONS

MAN is another company with extensive experience in CO2 compression – more than 20 years. Out of 18 large-scale facilities in commercial operation around the world, eight use MAN’s CO2 compression technology. For instance, MAN’s RG integrally geared compressor has been deployed at a commercial-scale CCUS project to tackle carbon emissions at an oil-sand operation in Alberta, Canada. Shell’s Quest plant has captured and injected more than one million tons of CO2 underground annually since 2015.

"Power, heat generation and industries like cement and steel production are responsible for approx. 60% of all CO2 emission and thus are the focus of decarbonization,” said Peter Klotzsche, MAN Energy Solutions.

The company has signed a technology-cooperation agreement with Aker Carbon Capture to provide new energy-efficient compression solutions for CCS applications with heat recovery. Further, it supports CO2 utilization applications for urea production, Enhanced Oil Recovery (EOR), methanization, synthetic fuels and methanol production with compression and reactor technologies.

BAKER HUGHES

The Baker Hughes take on CCUS is that there is no single solution. The approach to carbon capture on an offshore natural gas platform, for example, would vary from a carbon capture design for a refinery or a cement plant. Accordingly, the company has several arrows in its CCUS quiver. It acquired Compact Carbon Capture, which uses a rotating bed technology instead of static columns to dis-tribute carbon capturing solvents in a compact and modular format. It secured the exclusive license of SRI’s Mixed Salt Process, a solvent process that uses potassium and ammonia. In addition, it is examining how the chilled ammonia process (CAP), which uses aqueous ammonia as a solvent, can capture carbon dioxide from mid- to large-scale industrial sites and other sources of CO2 emissions.

“We’re also engaged in the Borg CO2 carbon capture project in Norway, which is centered on an industrial cluster approach,” said Chris Barkey, Chief Technology Officer, Turbomachinery & Process Solutions, Baker Hughes. “Separately, we are working with Horisont Energy to find optimal technologies for an offshore lower-cost carbon storage project named Polaris in Norway, part of the Barents Blue ammonia production project.”

Most recently, Baker Hughes announced an investment in Electrochaea, a company developing bio-methanation technology which enables CO2 recycling into grid-quality, low carbon synthetic natural gas (SNG), contributing to decarbonization of hard-to-abate sectors, such as transportation and heating. In conjunction with Baker Hughes post-combustion carbon capture technology including Compact Carbon Capture, Electrochaea’s bio-methanation technology can help develop and commercialize an integrated carbon capture and utilization tailored to applications utilizing CO2 sources with biogenic origin (biomass, waste-to-energy), as well as sources based on combustion of fossil fuels.

To reach net-zero for large-scale natural gas plants, Barkey added that CCUS technologies must address exhaust gases. The company is investing in post-combustion carbon capture solu-tions for gas turbine exhaust gas applications. An alternative approach is to redesign turbines to produce fewer emissions. The LM9000 aeroderivative gas turbine, for example, now has simple cycle efficiency in excess of 44%.

“Efficiency is key to driving lower carbon intensity of the LM9000,” said Barkey. “It has been designed for 15ppm NOx emissions in dry condition.”

“ The challenge of implementing large-scale CCUS will be to reduce the installed cost and minimize the operating costs,” said Chris Barkey, Baker Hughes.

Baker Hughes has been involved in CO2 compression since the 1960s where its first application was for urea synthesis. Today, it can pro-vide CO2 compression across a range of applications including reinjection of up to 550+ bars in almost pure form. It recently introduced a main compressor prototype for supercritical CO2 that is compact and high speed. It reached over 800 kg/m3 density at the discharge and operated just on the critical point of the CO2 at the suction.

“CO2 is a highly compressible gas so the main challenge we have been tackling is to build a compact, efficient machine which can deal with the huge aerodynamic forces acting on the rotor,” said Barkey.

MITSUBISHI POWER

Mitsubishi Heavy Industries (MHI) began developing CCUS technology over 30 years ago. It has an amine-based technology known as the KM CDR Process. It is used in the world’s largest post-combustion carbon capture facility, which was installed on a coal power plant in 2016. MHI was also selected as the technology provider for a feasibility study of carbon capture at Lehigh Cement Company’s Edmonton Cement Plant. This project is being jointly conducted by the International CCS Knowledge Centre and Lehigh Cement with a target delivery of fall 2021. It has received support from Emissions Reduction Alberta. The capacity is estimated to be 600,000 tonnes of CO2 annually.

Additionally, MHI and Drax Group agreed to a long-term project for Drax to use the company’s carbon capture technology in combination with MHI’s KS-21 sol-vent at Drax’s power station in Yorkshire, U.K. A further element is offshore geological storage under the North Sea. MHI also has commercial experience in carbon capture of natural gas boiler exhaust. The applications are predominantly for chemical production such as methanol or urea. NextDecade Corporation, too have signed an agreement with MHI to use KM CDR Process post-combustion technology in gas turbines at the Rio Grande LNG project in Texas.

“A number of confidential studies are underway focused on natural gas boiler exhaust as well as natural gas turbine exhaust with the goal of sequestering the CO2 or utilizing it,” said Evan Canady, Senior Business Development Manager, Renewable Fuels, Mitsubishi Power.

GE GAS POWER

GE has developed many projects using amine technology and chilled ammonia in Europe and North America to remove CO2 post-combustion. While tradition-ally applied to coal plants, these technologies can be applied to natural gas power plants.

There are plenty of opportunities, too, in CO2 compression at the capture site, along the transportation corridor, and the injection site. At a power plant, for example, the CO2 needs to be dried of any moisture, and compressed to 70 – 80 bar for pipeline transportation. At the well head or injection point, booster compression is often needed to increase pressure for injection into the Earth’s crust.

“Most new CCS project requests tar-gets natural gas power,” said John Catillaz, Director of Decarbonization – Marketing GE Gas Power.

ELLIOTT GROUP

CCUS deals primarily with the separation and sequestration of carbon dioxide either pre- or post-combustion from a hydrocar-bon power plant fuel or from an industrial process that emits CO2. The most com-mon forms of separation are pre-combustion from synthesis gas in a gasification plant, post combustion from flue gas, and blue hydrogen production from natural gas reforming. Thus, CCUS can also require compression and pumping of synthesis gas, hydrogen, nitrogen, oxygen, natural gas or other gaseous feed-stocks. Elliott Group manufactures centrifugal compressors that can be utilized for the compression and transport of carbon dioxide and any of the other gases of the various CCUS processes. The company has several ongoing R&D activities that focus on the improvement of compressors for CCUS as well as the development of new products.

Most of the discussion of CCUS for natural gas-fired turbines is directly related to the production of blue hydro-gen. Blue hydrogen can be either produced near a hydrocarbon source and then transported to the plant via pipeline or the hydrocarbon can be transported to the power plant using existing infra-structure to be converted to blue hydro-gen near the power plant consumer site.

"Most new CCS project requests targets natural gas power,” said John Catillaz, GE Gas Power.

“The latter option appears more practical since it avoids the cost of having to develop an entirely new hydrogen transportation infrastructure,” said Klaus Brun, Director R&D, Elliott. “There are three value streams in blue hydro-gen-based CCUS: Natural gas, hydrogen, and carbon dioxide.”

Elliott is currently working with several end-users and operators throughout the world to develop customized com-pression solutions for blue hydrogen pro-duction. This includes Elliot’s Fex-Op compressor arrangement which can be utilized for both hydrogen transport and CO2 applications as well as the company’s existing line of TCH140H pipeline compressors for natural gas compression.

“Post-combustion carbon capture tends to be significantly more challenging and costly than pre-combustion separation because of the low concentration of CO2 in the flue gas,” said Brun.

Elliott has been in discussion with process developers to provide the high pressure ratio compression solutions required to take near-atmospheric flue gas CO2 to pipeline and injection pressures.

MORE PROJECTS TO COME

In 2020, there were 26 commercially active CCUS projects in the world, representing a carbon capture capability of approximately 40 million tonnes per annum (Mtpa). Currently, there are a handful of other CCUS facilities currently under construction, with a few more in advanced development and several more in early development. However, these facilities collectively represent less than 100 Mtpa of carbon capture capacity set to come online. That is far from enough to satisfy the goals set by bureaucrats in Europe and the U.S.

Whether pre- or post-combustion, or some other approach entirely, comes to dominate, what is certain is that more projects are very much on the horizon. As well as those noted above, LNG exporters Cheniere Energy and Sempra Energy plan to add CCUS capabilities to U.S. LNG projects. This may be in response to an order cancellation from France which claimed U.S. LNG was too dirty. Sempra’s Port Arthur LNG terminal in Texas and Cameron LNG plant in Louisiana are being looked at for CCUS, as are Cheniere’s Corpus Christi plant in Texas and Sabine Pass terminal in Louisiana.

Meanwhile, Venture Global LNG intends to capture and sequester carbon at its Calcasieu Pass and Plaquemines LNG facilities in the U.S. After compressing CO2, it will be transported and injected into subsurface saline aquifers. The goal is half a million tons of carbon per year. ExxonMobil, too, has announced plans for deep storage of carbon in the Gulf of Mexico.

“We have committed real dollars to development and engineering,” said Cheniere CEO Jack Fusco. “Customers are going to expect us to continue to offer a sustainable LNG product.”

Articles in this issue

about 4 years ago

Compressor chokeabout 4 years ago

Resolving varnish challengesabout 4 years ago

Methane emissionsabout 4 years ago

Q&A: The need for oil-free compressionabout 4 years ago

Vendor spotlight: FS Elliottover 4 years ago

The economics of hydrogenover 4 years ago

Turbine fuel controlover 4 years ago

Myth: New turbomachinery is always better than older machinesover 4 years ago

Turbo tips: High-pressure turbocompressorsover 4 years ago

Western Turbine Users part IINewsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.