ETN Global Sheds Light on Gas Turbines, Supply Chain, Skill Gap Challenges, and Modular Power

Giuseppe Tilocca of ETN Global shares how the industry is responding to supply chain constraints, shifting policy conditions, and a growing need for dispatchable power.

The turbomachinery industry is navigating a period of renewed demand, technological transformation, and ongoing market volatility. With supply chain constraints, shifting policy conditions, and a growing need for flexible, dispatchable power, companies are re-evaluating their strategies and solutions.

Turbomachinery International caught up with ETN Global’s Technical Lead Giuseppe Tilocca to hear the institute’s perspective on key industry challenges and future directions.

Turbo: How are global economic conditions and energy market volatility impacting decisions in the turbomachinery industry?

Tilocca: The turbomachinery industry is currently experiencing strong demand, particularly for gas turbines, with many OEMs operating at full capacity. This is largely due to the renewed focus on dispatchable power, which remains essential for grid security and system stability. Events such as the widespread blackout in Spain and Portugal this spring have underscored how rapidly a disturbance can cascade across interconnected systems, reinforcing the need for fast-reacting, reliable assets that support grid resilience.

At the same time, economic uncertainty and volatile energy markets are creating a more complex decision-making environment:

- Volatility in fuel prices, particularly natural gas, has a significant impact on operating costs. In recent years, gas prices have doubled and exhibited fluctuations, directly affecting the economics of gas-fired power generation.

- Revenue unpredictability due to fluctuating capacity factors—caused by market dynamics, renewable output variability, and policy uncertainty—complicates the investment outlook. This directly influences the levelized cost of electricity and project viability.

- Decarbonization strategies remain uncertain, especially in regions where policy direction is inconsistent or subject to political shifts. This limits investor confidence in committing to long-term capital-intensive projects, building new power plants, and even more for low-carbon solutions like carbon capture and storage and hydrogen-ready systems.

- Long-term investments require stable market signals, including predictable pricing mechanisms and robust policy frameworks. Without these, there is hesitancy in investing in new-build assets or committing to advanced decarbonization technologies.

At the same time, the way assets operate is changing drastically, leading to fewer operating hours and more cycling, which reduces revenue opportunities and stresses machine life, raising both fixed and operating costs. In this regard, innovative configurations—such as the integration of gas turbines with battery storage—are gaining traction. These hybrid systems, which operate as integrated units, enhance the flexibility of existing assets, maximizing revenue opportunities. Compact batteries provide enough energy for fast and primary frequency responses and time for turbines to ramp up and handle longer-duration dispatch. Additionally, they offer lower up-front investment than full-scale battery systems and can often be retrofitted into existing plants, offering a practical path for operators to meet more demanding TSO flexibility requirements.

Turbo: What solutions are you seeing to supply-chain constraints and rising material costs?

Tilocca: The industry's supply chain is a major pain point, with large order backlogs in gas turbines and high turnaround times for spare parts. To mitigate supply-chain disruptions and cost pressures, the industry is adopting several strategies:

- Digitalization and predictive maintenance: Condition monitoring enables predictive, rather than preventive, maintenance, optimizing performance and reducing downtime.

- Lifetime extension programs: Detailed component assessments and life-cycle analysis can defer capital expenditure.

- Collaborative ecosystems and open dialogues: Stronger knowledge sharing among asset owners, OEMs, and service providers is fostering innovation and resilience.

In this context, ETN Global facilitates collaboration and structured innovation through its Digital Solutions Working Group, Life Assessment and Extension Working Group, Additive Manufacturing Working Groups, and Engine Specific User Groups. These initiatives exemplify how industry-wide coordination and knowledge sharing can be powerful tools in overcoming today's supply chain and cost challenges.

Turbo: Have you seen an uptick in modular/mobile technologies or in smaller-sized turbines? If so, what factors are contributing to their relevance or appeal?

Tilocca: Yes, there is a clear and growing global trend toward smaller, modular, and even mobile gas turbine technologies, especially in emerging markets and for decentralized applications.

Several factors are driving this shift:

- Fast start-up and ramp rates make small turbines ideally suited to support intermittent renewable generation and provide ancillary services.

- Lower capital expenditure (CapEx) and shorter deployment timelines make these units attractive in rapidly changing or resource-constrained environments.

- Operational flexibility is increasingly valued in power systems dealing with volatility, partial load operations, and localized reliability issues.

- Mobile power solutions are increasingly being adopted to address temporary or remote energy needs, such as in response to natural disasters, short-term power demands, or the growing trend of covering gas turbines undergoing extended overhauls.

From small- to micro-sized turbines, micro gas turbines (MGTs) remain an area of active innovation and deployment. These compact systems are particularly promising for distributed energy and combined-heat-and-power (CHP) applications in decentralized and integrated settings.

To support the development and adoption of MGTs, ETN Global is co-organizing the European Micro Gas Turbines Forum, which will take place in Brussels on Oct. 15 - 16, immediately following the International Gas Turbine Conference on Oct. 14 - 15. This co-location aims to bridge the gap between big, small, and micro turbines, uniting academic research, OEM innovation, and commercial deployment by facilitating knowledge transfer and collaboration across the turbomachinery value chain.

Turbo: Where do decarbonization technologies fit in considering the new U.S. energy agenda? How has the demand for these technologies shifted?

Tilocca: While the current U.S. energy agenda emphasizes affordability, competitiveness, and energy security, the focus on decarbonization remains. There is continued investment in technologies that enhance efficiency and reduce emissions, though in a more pragmatic and economically grounded manner. This includes the use of low-carbon fuels, especially for low-capacity factors, such as hydrogen-ready gas turbines and biofuels, as well as carbon capture and storage readiness for higher utilization factors.

A key factor to watch is the price of gas, which creates important tipping points:

- For utilities: influencing marginal cost in the wholesale market, potentially leading to higher or lower capacity factors.

- For industry: it determines whether gas-based solutions, e.g., CHP, or electricity-based alternatives, e.g., electric boilers, are more economically viable.

Turbo: Many companies are investing in energy-efficiency improvements—what innovations or solutions have you seen in line with these improvements?

Tilocca: Key trends in efficiency improvements include:

- High-performance air filtration systems that maintain optimal turbine output and protect against fouling.

- Advanced turbine designs, such as H-class gas turbines, offer higher thermal efficiencies.

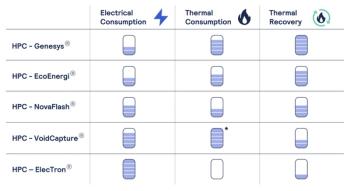

- In the industrial sector, waste heat recovery systems (steam, organic Rankine cycle, sCO2) and heat upgrade technologies, e.g., high-temperature heat pumps, are gaining traction. Heat pumps are proving to be an increasingly interesting solution for lower-grade heat, but still have substantial technical barriers for temperatures above 180 - 210° C.

- There's also growing interest in traditional gas turbine CHP with electric heating like boilers, enabling plants to respond to electricity price fluctuations by shifting between gas and electricity supply.

Turbo: What about labor shortages and skill gaps—how are these challenges being addressed?

Tilocca: The turbomachinery industry is facing a deepening workforce crisis, marked by declining vocational interest, an aging labor pool, and increasing skill mismatches. Gas turbine roles remain physically demanding, often remote, and are perceived as part of a "sunset industry," deterring new talent in favor of renewables. Unlike in other energy roles, skills in gas turbine operations and retrofits are highly specialized and not easily transferable. Despite rising demand, most energy companies report difficulty hiring qualified candidates, particularly for manufacturing, installation, and repair.

As the industry evolves—driven by decarbonization, digitalization, and greater system complexity—the need for qualified professionals intensifies. Several approaches are needed to address this challenge:

Changing the public perception of the energy sector is crucial. Communicating its central role in the transition to a sustainable future is helping attract a new generation of talent with a long-term vision.

Education and training initiatives are expanding globally. Vocational and higher education programs are being modernized to reflect current industry needs, especially in digital technologies, system integration, and energy efficiency. An example of industry action is ETN Global's Young Engineers Committee, which plays a key role in attracting and supporting the next generation of turbomachinery professionals through several impactful initiatives: It provides a platform for young professionals to work on disruptive ideas, engage in collaborative projects, and access technical and leadership training. The committee organizes events and student outreach at major industry conferences such as ASME Turbo Expo and Enlit Europe, connecting M.Sc. and Ph.D. students with industry and potential employers.

They also coordinate the Best Paper and Engineering Award (BPEA), a competition for MSc theses in turbomachinery, and are launching a structured MSc thesis collaboration program designed to match students with industry-relevant challenges. These collaborations offer guided, real-world experience and help companies address specific needs while building a talent pipeline.

Finally, the demand for energy professionals will continue to rise, especially those with cross-disciplinary skills, according to multiple industry forecasts, such as the International Energy Agency and the International Renewable Energy Agency. The whole industry needs a collaborative effort to bridge this gap, making workforce development a strategic pillar for the sector's long-term resilience. At ETN Global, we believe that by fostering open collaboration and aligning industry needs with emerging talent and technology, the turbomachinery sector can remain a competitive enabler of the energy transition.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.