- March/April 2023

- Volume 64

- Issue 2

The Decarbonization Pushback Has Begun

Energy industry executives flip the script on unrealistic decarbonization goals.

The Baker Hughes Annual Meeting at the end of January 2023 gave voice to oil and gas executives calling for a reevaluation of decarbonization policies they say may be inadvertently worsening emissions while pushing consumer energy bills upwards.

Sheikh Khalid Bin Khalifa Al-Thani, CEO of Qatargas, explained that coal consumption reached an all-time high in 2022. Why? A general shortage of oil and gas was in evidence even before the Russia-Ukraine war. That crisis only heightened the problem, especially in Europe. The Europeans gobbled up any available LNG supplies at top dollar. That left a shortfall in many other areas, and coal became the solution.

“The energy crisis in 2022 highlighted the fragility of global energy markets,” said Al-Thani. “We must balance climate and emissions reduction policy with energy security.”

He believes that while the role of renewables within the energy mix will increase, it is many years before any energy transition can realistically take place.

“Substituting natural gas for coal is the key as we cannot decarbonize immediately,” he said. “Natural gas is a necessary complement to renewables for a robust energy supply and as support for climate mitigation. Natural gas is reliable, affordable, available, and has a low carbon footprint compared to coal. This makes it a destination fuel, not a transition fuel.”

Standing in the way is a policy and financing puzzle that makes it difficult and sometimes impossible to receive investment for natural gas projects. Several speakers at the event laid out how funding for large-scale natural gas and LNG projects is often thwarted as the investment field has been told that natural gas won’t be around by 2030. This idea comes from policy makers who set decarbonization targets without regard to the realities of the situation. When disruption comes, short-term policies are rapidly adjusted to accommodate a sudden switch to LNG, as in Europe in 2022. But long-term work to develop new oil and gas fields and build the infrastructure to support them is in neglect and has been for many years.

Accordingly, Qatargas plans to boost gas production significantly over the next decade. Al-Thani said the company would do so while reducing its carbon footprint. It has already cut greenhouse gas (GHG) emissions by 12% compared to 2013 and CO2 emissions by 70% via injection and reduction of flaring. Methane emissions, he said, are already less than 1% of the company’s GHG profile.

RETURN OF ENERGY REALISM

Nasir Al-Naimi, Executive Vice President Upstream of Saudi Aramco (the largest oil and gas producer in the world), called for a return to energy realism.

“The impractical reality that oil and gas must be replaced has fueled chronic underinvestment, down by more than half from 2014 to 2021,” he said. “We must shatter the misleading narrative that oil and gas can be easily and quickly replaced.”

He laid out the statistics: Fossil fuels supplied 82% of the world’s energy needs in 2021 compared to 7% for renewables. The energy transition, he stressed, will happen at different speeds in different regions as they are at varying stages of development and industrialization. With three-quarters of a billion people still without electricity, the priority in these places is to get power by whatever means necessary.

“Each country has its own unique situation, so we must develop more realistic plays for affordable, reliable, and sustainable energy,” Al-Naimi said.

Saudi Aramco plans to boost production from its current level of around 12 million barrels of oil per day (boe/day) to 13 boe/day by 2027 and increase gas production by 50% by the end of the decade. In parallel, the company is investing heavily in carbon capture, renewables, and hydrogen.

“We must convince the world that oil and gas will play a prominent role in our energy future,” said Al-Naimi.

ENERGY TRILEMMA

Lorenzo Simonelli, Chairman and CEO of Baker Hughes laid out the energy “trilemma”—how to balance sustainability with affordability and security.

“There is no future without hydrocarbons, just as there is no one climate savior,” said Simonelli. “Instead of focusing on the fuel source, we need to focus on emissions as reliance on hydrocarbons won’t disappear.”

He announced that the annual meeting was attended by more than 1,600 people, with more than 50% attending for the first time. Faced with surging energy bills for consumers and industry across the globe, he laid out three key points:

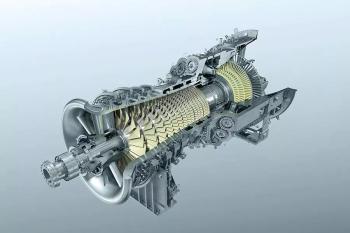

1) The need to accelerate the development and adoption of technologies to meet net-zero targets. On the turbomachinery side, that means such things as compressors and valves that don’t leak methane and other gases.

2) There is no future without hydrocarbons and there is no one climate savior.

3) There is no path to net zero without partnerships.

According to Baker Hughes surveys of oil and gas users, 57% said they are continuing with commitments to natural gas and LNG. “LNG and natural gas are not transition fuels, they are destination fuels that play a critical role in abundant, secure, and affordable energy,” said Simonelli.

DRIVING UP GLOBAL EMISSIONS

The harsh realities of global energy were driven home by a series of speakers from around the world. Nurul Ichwan, Deputy Minister for Investment Promotion for Indonesia, explained that most energy in Indonesia comes from coal. He dismissed the idea that tens of GW of coal generation can be transitioned to renewables overnight. His country’s plan is to transition gradually from coal to natural gas while adding more wind and solar.

He commented that some countries in the region are promoting their own environmental credentials by reducing coal mining in their own countries while ordering more coal from Indonesia on multi-decade contracts.

“We want help in exploring and exploiting our own natural gas resources to aid in the transition from coal,” said Ichwan.

Farid Al Awlaqi, Executive Director of Generation for TAQA of the United Arab Emirates (UAE) said his nation has a different approach. It has plenty of solar and baseload nuclear but needs a lot more natural gas to meet swings in demand. “We are removing coal slowly out of the system and replacing with gas,” he said. “Our grids are not ready to manage intermittency.”

Helima Croft, Global Head of Commodity Strategy at RBC Capital Markets, said energy security is back as an energy priority. She is deeply concerned about energy supply over the next year, and said nations needed a diversity of sources. She added that Europe got lucky this year due to a milder winter. She complained about policy makers making it so difficult to fund oil and gas projects.

“We need to avoid underinvestment in oil and gas,” said Croft. “A stable supply of hydrocarbons is vital.”

Kazutomo Irie, President of the Asia-Pacific Energy Research Centre, went a stage further. He noted that emerging and developing nations place more importance on the security and affordability of energy supply than they do on decarbonization.

“We need natural gas to carry out coal-to-gas switching while building up renewables,” said Irie.

Octavio Simoes, CEO, Tellurian, said that while the supply of energy from renewable sources will grow massively in the coming years, it is still a long way from replacing fossil fuels. According to International Energy Agency estimates, the world will need at least 20% more gas and 40% more oil by 2050.

“No energy source has gone down in last 200 years except whale oil,” said Simoes. “The EU still gets 81% of its energy from fossil fuels, so replacing it in ten years is a fool’s errand.”

Yet the environmental lobby and the media are constantly vilifying non-renewable fuel sources. Adding to the problem is a big rise in the cost of the materials used in renewable energy.

“We are on the wrong path to decarbonization as we need affordable energy without volatility,” said Simoes. “We have written the first few and last few chapters on the energy transition and forgotten about the rest of the book. There is a big gap between vision and reality that is wide and getting wider.”

Yet investment in oil and gas in certain countries and political sectors is tabu, he added. The EU, for example, resists investment in gas but is spending far more on decarbonization and not getting there.

“Current energy transition Ideas are not executable,” said Simoes.

Onursal Soyer, Deputy Chief Executive Officer, Lambert Energy Advisory, described how Russian sanctions led the EU to buy up all available LNG at inflated prices to get through the winter and keep the wheels of industry running. As a result, a great many countries were denied LNG. That caused them to turn to coal.

“There was a record level of coal burned worldwide in 2022,” said Soyer. “Coal demand is not going away so replacing it with natural gas should be applauded.”

Hardline decarbonization policies, he added, are a major impediment to oil and gas investment. “This is causing coal to be used more and gas to be penalized, which is only making the situation worse,” said Soyer.

To further worsen a difficult global energy situation, oil and gas consumption this year will be highest ever and 2023 will be, too. But even with prices high, major oil and gas companies are not investing due to policy hurdles. This investment is vitally needed to maintain current supply and create the oil and gas resources needed to take the world through the next 30 years.

MATERIALS CRUNCH

It isn’t just oil and gas that faces shortages and high prices. Other materials are in a real supply crunch, said Kathleen Kelley, Founder and CEO, Queen Anne’s Gate Capital.

To meet the decarbonization and renewable energy targets that have been set, nickel production worldwide will have to go from 100,000 tons to 3 million tons a year. That is unfeasible. It is the same story with rare earths. Some point to the fact that Sweden has found new deposits of rare earths that can be used in batteries and other renewable energy. But those mines will take 10 to 15 years to come online.

“There was a record level of coal burned worldwide in 2022,” said Onursal Soyer, Lambert Energy Advisory.

“Investors are not allocating money to mining due to the industry’s poor performance on environmental, social and governance (ESG) metrics,” said Kelley. “We can’t possibly get to any climate goals based on the timescale of mining alone.”

Jessica Roberts, Head of Forecasting at Benchmark Mineral Intelligence, gave further specifics. Lithium batteries provided 700 kWH of power in 2022. By 2035, they are supposed to provide 5.5 TWH. That requires 300 new mines. It takes five to 25 years to open a new mine.

“We went from 100,000 tons of lithium a few years ago to a million tons last year and will need at least 2 million within a few years,” said Roberts.

Articles in this issue

over 2 years ago

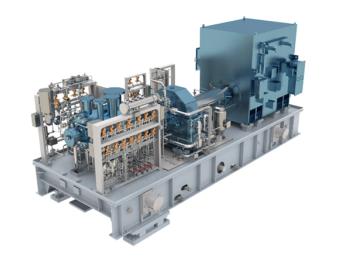

Myth: Avoid a Gearbox at All Costs for Compressor Applicationsover 2 years ago

How to Assess Turbomachinery Reliability and Strengthover 2 years ago

Hydrogen Turbines in Power Generationover 2 years ago

PowerGen 2023 Show Reportover 2 years ago

How Mobile Power Solves Unreliable ElectricityNewsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.