The future of power generation

Key concerns: plant flexibility, loss of technological expertise, deficient R&D investment and more stringent emission laws.

The global power generation industry is undergoing a period of transformation as companies strive to keep up with rising customer expectations, more stringent environmental regulations and a rapidly changing energy landscape. But uncertainty, lack of investment and resistance to change has slowed this process. More funding for gas turbine (GT) research and development (R&D) and a willingness to consider alternative technologies may be the keys to future success.

Recent Electric Power Research Institute (EPRI) surveys of power plant operators reveal that inflexible power plants and the deep loss of technology expertise were top concerns. Those in the executive suite, on the other hand, worry mainly about how CO2 regulations will impact the future generation mix.

The U.S. National Electrification Assessment cited several scenarios that may play out by 2050: The conservative scenario has coal and nuclear quite slowly declining and gas generation almost doubling over that period. Other scenarios show a steep reduction in coal with only a small amount remaining based on Carbon Capture & Storage (CCS). Along with that, traditional natural gas generation goes into a steep fall after about 2030, with gas CCS helping to maintain the share of gas in the power mix.

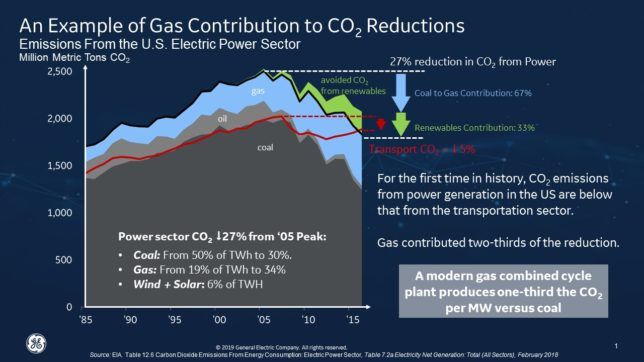

“The U.S. is responsible for 44% of global CO2 emission reductions since 2005, and 80%

of that was from the electricity sector,” said Thomas Alley, Vice President of Generation at EPRI. “Energy efficiency and cleaner generation have been the reason for these gains. Fuel blending can also help lower CO2 further.”

Alley brought up the famous California duck curve which, he said, is getting

more pronounced. 2020 predictions show California needing to add 13,000 MW in 3 hours to cope with the sudden decline of solar generation during the evening peak period.

California may have the most extreme curve, but the same phenomenon is now being noticed in other areas, such as Arizona and even Italy, said Alley. In such areas, peaking plants pick up the slack. But the damage from frequent

start-ups and shut downs must be addressed in budgeting and in maintenance

schedules to eliminate forced outages.

He pointed out that many combine cycle power plants (CCPPs) will reach end-of-life starting in 2030. By then, the industry needs to develop new gas turbine technology that harnesses low carbon fuels.

Government regulations

Nations are passing strict CO2 emissions laws, and the power generation sector is in the cross hairs. In 2018, the power generation sector produced 36.2 gigatons of CO2, the bulk from coal.

The German government has announced that it will decommission all of its coal plants by 2030 (106 are currently operating). Several U.S. states are following a similar path. An estimated 60,000 coal plants are operating worldwide.

Emissions regulations gradually forcing coal plant closures are also impacting natural gas-fired facilities. In some quarters, the intention is to eliminate gas, or at least inhibit upgrades and new build.

“Technology investment in gas turbomachinery is key to a lower carbon

future,” said Guy DeLeonardo, General Manager for Application Engineering, GE Power. “An increase of one percentage point in CCPPs in the U.S. is the equivalent in CO2 emissions reduction of taking 2 million cars off the road.”

“In the U.S., three out of four kWh come from fossil fuels and nuclear,” he

said. “Natural gas offers the lowest cost per kW of any generation source.”

CO2 levels peaked in 2005. The switch from coal to gas in the power sector has contributed to 67% of the reduction in CO2 since that peak. Renewables contributed 33%. Additionally, the transportation sector has moved above the power sector as the largest contributor to CO2 emissions.

Two out of three new kW built in the U.S. and worldwide will be renewable.

Most forecasts show gas power-based electricity growing at around 2% per year (worldwide and U.S.) through 2027.

Coal is currently receiving about 10 times the investment of gas in R&D, said

DeLeonardo. Much of this has been going to CCS. A general lack of investment in GT research and development, and a cautious stance among OEMs means that alternate technologies receive little attention, he said.

Turbine efficiency

The efficiency trajectory of simple cycle turbines has gone from around 33% in the early eighties to over 40% today, said John Gulen, Senior Principal Engineer at Bechtel. It can reach as high as 44% in some cases.

“OEM machines are finely tuned Swiss watches and their gradually improving technology path has accelerated in the past decade,” he said. “Materials, coatings, seals and cooling techniques have resulted in big gains.”

When it comes to CCPPs, the exhaust gas output monitors steam turbine output via the heat recovery steam generator (HRSG). Current GT turbine inlet temperatures (TIT) are above 1,600°C. CCPPs, like those in Irsching, Germany and Bouchain, France, are the most effi cient, he said. He estimates that the best field-measured net performance is between 61.5 and 62%.

The next hurdle is achieving machines with a 1,700°C TIT. Gulen believes Ceramic Matrix Composites (CMC), additive manufacturing (colloquially known as 3D printing), data analytics and model-based (adaptive) controls will help enable this.

“The best you can engineer a CCPP for efficiency at 1,700°C TIT is 65.3% based on basic thermodynamics and backed by wonderful engineering,” said Gulen

The future of GTs

GT capacity currently outstrips demand by four times. 55 GW of GT orders worldwide in 2015 has declined to 25 GW in 2018. Meanwhile, trends toward decarbonization, decentralization and digitalization have made this a challenging time for power generation. Still, whatever the future holds, new GT designs are a necessity.

“Since the invention of the GT, it has been the standard practice to stick to conventional designs by increasing TIT as a means of efficiency augmentation,” said Meinhard Schobeiri, Professor at Texas A&M University. “This is no longer an option.”

Schobeiri’s ultra-high efficiency gas turbine (UHEGT) concept includes a fuel injection system, an ignition system, a stator system and a rotor system. The stator system includes multiple stators positioned radially around a central axis. The ignition system is located within the stator system where fuel is injected, and combustion takes place. The rotor system also includes multiple rotors positioned radially around the central axis downstream from the stators. This eliminates the combustion chambers, replacing them with a distributed combustion system using stator-internal combustion technology. This technology allows for an increase in GT thermal efficiency of about 7%.

“Basically, there are two combustion chambers and a low-pressure and high-pressure turbine,” said Schobeiri. “The pressure ratio has to be close to 38.”

Part of the logic of this concept is that conventional gas turbines have a large mixture and combustion zone that generates corner vortices. As a result, exit temperature non-uniformity is about 22%. This alternative design reduces these vortices by making the combustion path longer through controlled, induced secondary flows to keep fuel particles in circulation longer. Schobeiri urged investment in this approach to achieve market viability.

CHP

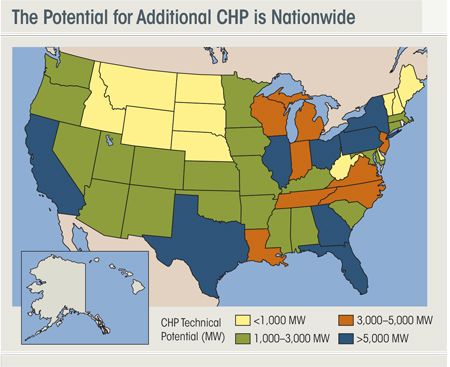

CHP is a potential growth area for GT-based power generation. Some 1,500 GTs currently provide CHP in the U.S., said Neeharika Naik-Dhungel, Combined Heat & Power (CHP) Partnership Program Manager for the U.S. Environmental Protection Agency (EPA).

Microturbine installs are up in the last decade along with small simple cycle units. But there has been a drop in larger combined cycle installs for CHP. Most installs are in California, Texas and New York. She believes there is abundant potential for CHP in the nation, but policy changes have led to speculation that energy storage could replace GT peakers. This may inhibit CHP growth.

“Gas CHP can economically improve efficiency and reduce emissions, but it requires consistent state policy to promote CHP growth,” she said. Ongoing programs for advanced turbines and future power systems include work on integrated gasification combined cycle (IGCC), i.e., using a high-pressure gasifier to turn coal into syngas then removing impurities from the gas prior to the power generation cycle.

The U.S. Department of Energy (DOE) is also funding projects that use natural gas instead of coal with this technology. “Switching from H-class to J-class turbines in an 820 MW plant is equivalent of removing 14,300 cars from the road,” said Richard Dennis, Technology Manager, Advanced Turbines and SCO2 Power Cycles Programs at the DOE’s National Energy Technology Lab. Supercritical CO2 Supercritical CO2 (sCO2) has a higher efficiency and potentially a 20% lower cost of energy than steam, said Dennis.

But ongoing R&D efforts in this technology are not enough. Supercritical CO2 will require regulation that favors the implementation of CHP and natural gas to encourage sufficient investment. GE Global Research is examining an sCO2-based closed Brayton Cycle, along with other working fluid alternatives. A 10 MW sCO2 demonstration plant is under construction. It uses CO2 instead of steam. Rather than condensing the fluid, it is cooled and reused.

Douglas Hofer, Senior Engineer at GE Global Research said sCO2 can be effective in high-temperature and low-temperature applications. With a 150°C increase in temperature beyond steam, there is a 6.8% bump in Carnot efficiency. sCO2 also has benefits for small applications. It can go below 100 MW without the need for a reduction gear. Low-temperature applications apply mainly to waste heat recovery.

“CO2’s single-phase heat transfer is a bet ter match than steam for the GT exhaust,” said Hoffer. “That means lower HRSG losses.”

Needed advocacy

Changes in emissions policy and permitting are needed to promote the expansion of clean gas turbine-based energy that includes low-carbon solutions, said Manfred Klein, Principal Consultant at MA Klein and Associates. The system changes as more renewables enter the grid.

“We need other solutions that can partner with renewables to address the intermittency of renewable generation,” said Klein. “Thermal power should also be used for district heating and cooling.”

He emphasized the efficiency and emissions-reduction credentials of the power industry. Cogeneration, using HEPA air filters, duct firing, steam or water injection, Dry-Low NOx (DLN) combustion, methane leak prevention, fast and flexible response time, and waste heat recovery have all helped to raise efficiency and lower all types of air emissions.

“DLN is a huge success story: no other industrial technology has prevented emissions to that degree,” he said. Klein attacked the notion that reducing NOx to tiny levels was a sensible course. States such as California try to hold gas turbine plants to NOx levels below 10 ppm and sometimes as low as 5 ppm. He believes ppm is a misleading metric and prefers pounds per MWhr of power and heat output, as it gives a more accurate picture of actual pollution. If a ppm level had to be set, he felt 25 ppm (or one lb/MWhr) was more than enough for most applications. Anything below that just adds heavy cost, does not deal with CO2 mitigation, is difficult to accurately measure and does not provide much return in terms of real emissions reduction.

Efficient natural gas should not be painted with the same brush as oil and coal, he said. It gets lumped together with these others under the fossil-fuel umbrella. This is leading to a knee-jerk reaction in some areas to try to eliminate gas generation, although more must be done to address fugitive methane leakage.

“Gas is very different from oil and coal; as a hydrogen-based fuel you don’t have to turn it from oil or a solid into a vapor to then burn it,” said Klein.

The European angle

In Europe, the big market trends are decarbonization, decentralization and digitalization, said Christer Björkqvist, Managing Director of the European Turbine Network (ETN). The EU has legislated a 20% drop in green house gas (GHG) emissions by 2020, a 40% drop by 2030 and an 80% drop by 2050 (measured against 1990 levels), he said.

But the majority of EU members states advocate net zero emissions by 2050. They believe that electrification, energy efficiency, the use of hydrogen as an energy carrier, and new technology backed by lifecycle changes will help to reach that goal.

Power-to-X, for example, is garnering a lot of attention and has two meanings. Primarily, it refers to the conversion of typically renewable energy into methane gas (Power-to-Gas), liquid methanol (Power- to-Liquid) and others. It also refers to conversion technologies that enable an integration of the energy consuming sectors — buildings (heating and cooling), transport, and industry — with the power producing sector. The X refers to the numerous conversion possibilities, for example: power- to-hydrogen, power-to-ammonia, power- to-chemicals, power-to-heat, power- to-liquid, power-to-methane, power- to-mobility, and power-to-syngas. In the latter case, the resulting synthetic gas can be transported through existing pipelines and used in gas-powered engines.

Germany alone produces more than 40,000 MW of wind and solar, yet 5,500 MW is lost as the grids cannot absorb all of it. This excess power could be used for production of hydrogen and oxygen via electrolysis. Due to the shortage of H2 infrastructure, you can add CO2 to hydrogen in a methanation reactor to produce a methane- based syngas, which would be regarded as carbon neutral. It could be used in power generation or transportation using existing infrastructure.

Björkqvist believes gas turbines have a future both in the energy transition and beyond. He cites rising investment and demand for LNG and natural gas in recent years to show that traditional hydrocarbon- based fuels still have a role to play for many years to come. Looking ahead, he thinks it is feasible to convert peaking plants and combined cycle power plants to gradually run on an increasing percentage of renewable syngas and eventually supply net-zero electricity.

Meanwhile, European countries are initiating CO2 taxes ranging from $24 to over $100 per ton. This is happening in tandem with legislation to outlaw coal. Norway already has no coal, France plans to get there by 2022, Sweden by 2022, UK by 2025, Italy by 2035 and Germany by 2038.

“Rising CO2 taxes give more incentives for coal replacement,” said Björkqvist. “Fast-growing renewables also offer grid balancing and Power-to-X opportunities for gas turbines.”

EU policy makers consider gas turbines as little more than a bridging technology to achieve the 2030 targets until other technologies mature. A major challenge lies ahead to convince politicians that GT technology can be developed to operate safely on low-carbon and carbon-neutral fuels by 2030 when natural gas may be labelled a high carbon fuel.

“The gas turbine is not just a transitional technology to 2030; it can be an enabler in meeting the long-term climate and energy targets,” Björkqvist said. “The perception of our technology has to change to ensure public funding and support for the required research & development.”

Many politicians believe that increasing energy efficiency, introducing more renewables and smart grids and implementing available storage technologies should be enough to meet their goals.

Björkqvist said this pathway will not succeed. The more intermittent renewables (wind and solar) there are in the energy mix, the higher the backup capacity and load following capability that will be required. “The future is in our hands,” said Björkqvist. “We have to make the general public and governments realize the value of our technology and, in parallel, ensure that the required technical solutions are being developed."