- September/October 2019

Siemens prepares to launch energy company

Arja Talakar, Chief Executive Offi cer at Siemens Oil & Gas, discusses the impending separation and reorganization of its energy sector portfolio, as well as opportunities for growth

Tell us about yourself.

I began my career with Siemens in 1996 as a rotating equipment and automation systems engineer. I’ve held roles in the United States, Germany, South Korea and Saudi Arabia. Before becoming CEO of Siemens Oil & Gas, I was responsible for Siemens Saudi Arabia. We developed close ties with oil and gas, energy and petrochemicals companies, and executed large infrastructure projects. I hold an MBA from IMD Business School in Switzerland, and an Engineering degree from Germany’s Technische Universitaet Braunschweig.

Can you explain the reorganization and separation from Siemens?

Siemens AG will consolidate its Gas and Power (GP) Operating Company, which combines the Siemens oil & gas, power generation, transmission, and related service businesses into an independent, stock-listed energy company. Siemens Gamesa Renewable Energy will be part of the new company. The launch will create a pure-play company with a portfolio along the entire energy conversion value chain.

What opportunities does the spin-off offer?

It creates a company dedicated to overcoming the challenges facing the energy sector. Our portfolio will encompass conventional and renewable energy solutions from a single source. This will give us the agility we need to adapt to an ever-evolving market.

What equipment comes under the new entity?

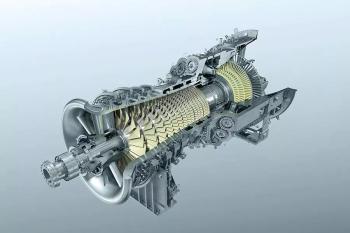

For oil and gas customers, we will continue to provide engineering and digital solutions. Our focus markets will include offshore upstream; the entire gas-to-power value chain (gas plants, pipelines, LNG, etc.); refineries and petrochemical plants; and unconventional resources. Rotating equipment (steam and gas turbines (GTs), centrifugal and reciprocating compressors) will remain integral to our portfolio, bolstered through the acquisitions of Dresser-Rand and a division of Rolls Royce.

What trends do you see developing in LNG and pipelines?

Today’s hydrocarbon conundrum is less about supply than environmental impact. Renewables and natural gas are both part of the solution. The latter is abundant and economical, thanks in large measure to the U.S. shale boom. It’s also cleaner relative to other fossil fuels.

As we work to make renewables more cost competitive, the world needs natural gas. Growing demand for clean energy is driving the build-out of transportation infrastructure, namely LNG plants and pipelines, to move natural gas to destination markets. Siemens has developed solutions to address increasing demand to reduce emissions, and the related need for electric-driven LNG designs. We have been developing turnkey solutions, in some cases as an EPC joint venture partner.

The pipeline market is also under pressure to drive efficiency and competitiveness. Machine data and Internet of Things (IoT) solutions are part of that journey. LNG and pipeline operators can harness data to optimize critical equipment, thereby reducing risk and costs while driving efficiency.

Another emerging challenge is cybersecurity. Siemens has bolstered its IoT solutions for oil and gas with a dedicated cybersecurity team.

What trends are evolving in combined cycle power plants (CCPPs)?

Historically, CCPP designs have been used in traditional power plants to boost efficiency and in onshore oil and gas applications requiring large-scale power plants. More recently, we are seeing positive development in offshore CCPPs. This could become a trend due to the advantages of all-electric solutions that reduce the dimensions of CCPPs.

What can be done to reverse the downward trend in GT sales?

We need to differentiate between gas turbines above 100 MW and those below 100 MW. Above 100 MW, the market appears to be stabilizing. The oil and gas market has picked up, driven by the need for additional power. Regions like North America are driving growth because of increased needs for power, but they’re also using using GTs as mechanical drives for compression applications. This

is particularly true for large pipeline companies and gas processing companies. We’re seeing an increase in the use of large power block GTs in compressor trains, particularly in the pipeline market, due to the advantages of using fewer compression trains driven by larger (30 MW) turbines. Studies on compressor trains driven by large power block GTs show tremendous savings potential in terms of footprint and emissions.

How will wind and turbomachinery work together?

Wind energy and turbomachinery are complementary. With oil and gas, power generation, and transmission, the new company will provide the complete spectrum of energy solutions across the conventional and renewable energy landscape.

What digital solutions have the strongest market reach?

Advances in sensor technology and data analytics have paved the way for industrial asset optimization across all verticals. We can use machine data to predict and preempt the failure of critical equipment and enhance safety and efficiency. Similarly, artificial intelligence (AI) is taking asset optimization to the fleet level. Other areas of opportunity include additive manufacturing and virtual reality. Additive manufacturing makes it possible to ‘print’ spare parts and components on demand, and digital twins enable design, testing and training in virtual, risk-free environments.

Articles in this issue

over 4 years ago

Air emission preventionover 6 years ago

Rotating machinery maintenanceover 6 years ago

The future of power generationNewsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.