Texas LNG Signs 20-Year Supply Deal with RWE for Brownsville Project

Key Takeaways

- Texas LNG Brownsville's 20-year agreement with RWE enhances Europe's energy security with 1 MTPA of LNG, focusing on low-emission production.

- The Texas LNG project aims for a final investment decision by 2026, with Kiewit as the EPC contractor under a lump-sum turnkey contract.

The agreement covers 1 MTPA of LNG and marks a key step toward financing and a final investment decision targeted for early 2026.

Texas LNG Brownsville, a subsidiary of Glenfarne Group, has signed a definitive 20-year sales and purchase agreement with

“We welcome RWE, one of the world’s most versatile energy companies, as an offtake partner for Texas LNG and look forward to helping them fulfill the needs of their customers with clean, competitive energy,” said Vlad Bluzer, Partner at Glenfarne Group, LLC and Co-President Texas LNG. “With the completion of offtake negotiations, Glenfarne is now focusing on finalizing the financing process as we advance toward a final investment decision in early 2026.”

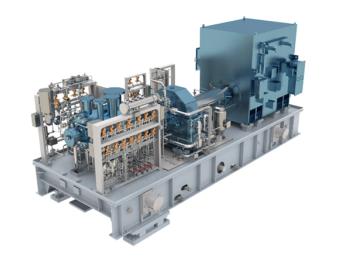

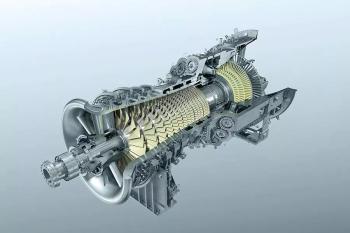

The Texas LNG project is designed to use electric drive motors for LNG production; a configuration that positions the facility among the lowest-emitting LNG terminals globally. The agreement with RWE also establishes a framework to monitor, report, and verify greenhouse gas emissions from the wellhead through LNG loading, supporting emissions reduction efforts across the LNG value chain.

“I am pleased to welcome Glenfarne as a strong partner in our LNG supply,” said Jacob Meins, Chief Commercial Officer Origination at RWE Supply & Trading. “This partnership strengthens our international LNG portfolio and supports Europe’s security of supply.”

Glenfarne has now converted all previously announced heads of agreement related to the Texas LNG project into fully binding, long-term offtake contracts, marking a key milestone for the development. Kiewit is serving as the engineering, procurement, and construction contractor for the Texas LNG project under a lump-sum turnkey contract.

Donlin Gold Mine

Per a non-binding letter of intent,

- Establishing a method to develop and construct an approximately 315-mile-long natural gas pipeline from southcentral Alaska to the Donlin Gold mine in southwest Alaska

- Building a power plant to generate electricity for the mine

Donlin Gold, located 10 miles north of Crooked Creek village, is currently among the largest known and undeveloped open-pit gold deposits.

Glenfarne became Alaska LNG’s lead developer in March 2025 and is developing the project in two financially independent phases to accelerate execution. The first phase features a 765-mile, 42-inch pipeline to transport natural gas from Alaska’s North Slope to fulfill statewide energy needs. The next phase will add an LNG terminal and associated infrastructure to export 20 MTPA of LNG.

Since March 2025, Glenfarne has secured preliminary commercial commitments with LNG buyers in Japan, South Korea, Taiwan, and Thailand for 11 MTPA of LNG, in addition to strategic partnerships with Baker Hughes and POSCO International. The company owns 75% of Alaska LNG and the Alaska Gasline Development Corp. owns 25%.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.