Woodside Energy, bp Sign Natural Gas Supply Agreement for Louisiana LNG Project

Louisiana LNG will purchase approximately 640 Bcf of natural gas from bp, the primary natural gas supplier, with deliveries planned for 2029.

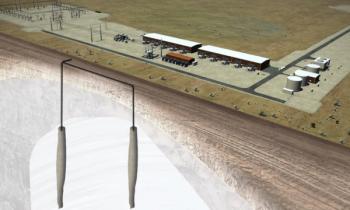

Under a recently signed agreement, Woodside Energy selected bp as the integrated major natural gas supplier for its Louisiana LNG project. Louisiana LNG Gas Management (GasCo) will purchase up to 640 Bcf of natural gas from bp, which will be delivered to Louisiana LNG’s line 200 starting in 2029.

“Louisiana LNG is a compelling investment, expected to deliver significant cash generation and create long-term shareholder value,” said Meg O’Neill, Woodside Energy CEO. “Securing this gas supply agreement is an important step for the project. Woodside has a long history of successful collaboration with bp. By drawing upon bp’s experience with MiQ certificates, we can access verifiably low methane intensity molecules for the Louisiana LNG project. This supports Woodside’s goals as a member in the UN Environment Program’s OGMP 2.0 initiative.”

GasCo will leverage Louisiana LNG’s connections to multiple production basins and pipeline network to implement a gas sourcing strategy, integrating the first diversified portfolio of feed gas to support Woodside Energy’s newest LNG endeavor.

Louisiana LNG

This week, Woodside Energy submitted the

In the future, Louisiana LNG may be expanded with two additional LNG liquefaction trains, bringing the total permitted capacity to 27.6 MTPA. Despite approving the project, Woodside Energy’s reduction targets for greenhouse gas emissions remain unchanged.

In October 2024,

bp in the News

In mid-April 2025, bp announced the successful loading of its

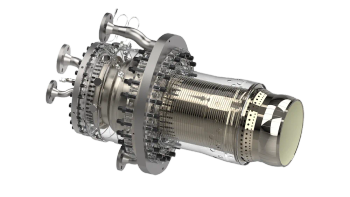

Prior to the FLNG loading, GTA’s floating production, storage, and offloading vessel, located approximately 40 km offshore, removed water, condensate, and impurities from the gas. Once on the FLNG, the natural gas was cryogenically cooled, liquefied, and stored before transfer to local LNG carriers.

GTA LNG Phase 1 is expected to produce approximately 2.4 million tons of LNG annually once fully commissioned. It’s one of the deepest offshore developments in Africa, with gas deposits located in water depths up to 2,850 meters. Mauritania and Senegal declared GTA a project of strategic national importance, satisfying global energy needs and providing gas to both domestic markets. bp entered Mauritania and Senegal in 2017 and, since then, the company established a multi-million-dollar social investment program to improve local communities and create long-term development opportunities.

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.