Woodside Energy Gives ‘Go-Ahead’ to Develop Louisiana LNG

The Louisiana LNG facility is a three-train, 16.5 MTPA development scheduled for first LNG in 2029.

Woodside Energy submitted the final investment decision to develop its $17.5 billion Louisiana LNG facility, with first LNG scheduled for 2029. The facility will initially feature three LNG liquefaction trains with 16.5 MTPA total capacity, allowing Woodside Energy to deliver approximately 24 MTPA across its global LNG portfolio by the 2030s. Louisiana LNG’s full project scope includes the facility itself, a pipeline, and LNG management reserve.

“As the largest single foreign direct investment in Louisiana’s history, Louisiana LNG will also be the first greenfield U.S. LNG project to go to final investment decision since July 2023,” said Meg O’Neill, Woodside Energy CEO. “Louisiana LNG will support approximately 15,000 national jobs during construction. Woodside appreciates the support Louisiana LNG has received from both the U.S. Federal and Louisiana State governments.”

In the future, Louisiana LNG may be expanded with two additional LNG liquefaction trains, bringing the total permitted capacity to 27.6 MTPA. Despite approving the project, Woodside Energy’s reduction targets for greenhouse gas emissions remain unchanged.

“The project benefits from access to abundant low-cost gas resources in the United States and boasts an asset lifespan of more than 40 years,” said O’Neill. “It also has access to well-established interstate and intrastate gas supply networks. The marketing opportunities Louisiana LNG offers across the Pacific and Atlantic Basins leverages Woodside’s LNG marketing capabilities and complements our established position in Asia. This will position Woodside to better serve global customers and meet growing energy demand.”

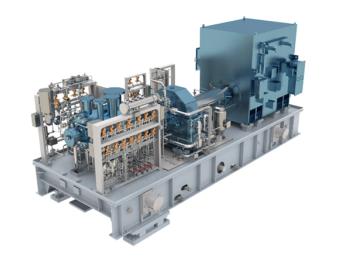

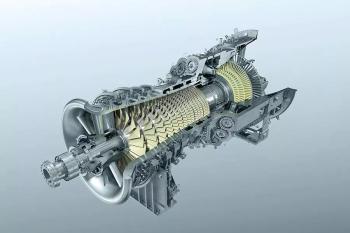

Baker Hughes + Woodside

In March 2025,

Baker Hughes and Woodside will recruit additional development partners to modify the concept in accordance with the continuously evolving requirements of various captive power generation segments. This agreement builds on a memorandum of understanding signed in 2022, which planned to decarbonize the natural gas supply chain. Baker Hughes is the sole provider of small-scale technology for the Net Power platform.

Woodside Acquisitions

In October 2024,

Also,

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.