CAB Worldwide Secures Recapitalization Led by Heritage Growth Partners

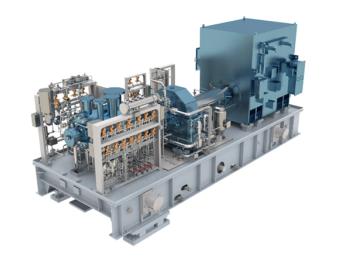

CAB Worldwide, a global engineering, manufacturing, and supply chain management business that specializes in providing precision machined steel, iron, and aluminum cast, forged and fabricated components and assemblies for OEM’s and distributors, has announced the successful completion of a growth recapitalization led by private family investment office, Heritage Growth Partners. The primary objectives of the recapitalization are to bolster CAB's growing operations, enable the expansion of its capabilities, and facilitate funding for future acquisitions. PNC Bank has provided a senior secured debt facility in connection with the transaction. However, the remaining terms of the transaction have not been disclosed.

Terri Jondahl, CEO of CAB Worldwide, shared her enthusiasm for entering this new phase of growth and collaborating with Heritage Growth. Jondahl said, "In addition to patient capital, Heritage Growth brings strategic relationships and an operational mindset, which will help CAB realize its true potential. We look forward to accelerating our growth organically as well as expanding the business through selective acquisitions that bolster our capabilities and broaden our reach."

Alex Mammen, Managing Partner at Heritage Growth, who has joined the Board of CAB, also expressed his eagerness to work with Jondahl. He said, "We are particularly excited to help this team take advantage of opportunities for organic growth, including enhanced product offerings and the creation of expanded international design and engineering service capabilities."

Evan Toporek, Partner at Heritage Growth, who has also joined the Board of CAB as part of the recapitalization, added, "We look forward to helping CAB continue to differentiate itself as an industry leader."

A number of legal advisors and support services firms have been involved in the recapitalization process.

Newsletter

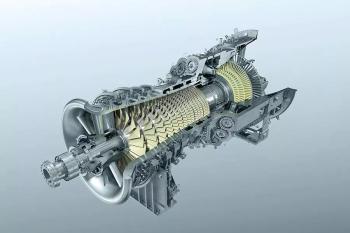

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.