Top Turbomachinery Trends of 2024

This year, the turbomachinery industry was characterized by several trends—from technological innovation to gas turbines’ supporting role in renewably integrated grids.

Over the past few years, several trends have emerged in the turbomachinery industry. Decarbonization has been a big driver, challenging the limits of technology and spurring innovation. Supply and demand are two other industry drivers as is the case with LNG and modular and mobile solutions. 2024 further magnified these trends, as industry experts weighed in on the fate of gas turbines, the struggles with energy transport and storage, the booming LNG market, and the rise in carbon capture. This year was also host to many product launches supporting net-zero momentum.

Check out the 2024 macro and micro trends.

Gas Turbines + Renewables

In a world increasingly integrating renewable energies like solar and wind, the role of gas turbines in the short- and long-term has been in question. But, as many industry experts have pointed out over the past year, gas turbines are here to stay and offer a hybrid solution to the uptick in renewable-based power.

“Gas turbines enable flexibility,” said

Renewables should account for 30 - 40% of a large grid, according to

Brough predicts that $22.3 billion will be spent on aeroderivatives between 2024 and 2033—GE/Baker Hughes will gain almost $20 billion of that share. The aeroderivative aftermarket will generate $31.5 billion over the next decade; $23 billion of that will be spent on GE/Baker Hughes machines.

Hybrid systems that combine gas turbines with renewable energy play to the strengths of both technologies, “providing reliable baseload power from gas turbines and intermittent clean energy from renewable sources,” said

So, what does this mean for gas turbines? Palmer said they have the potential to gain even more popularity.

Energy Transport and Storage

Alternative forms of energy, like hydrogen and ammonia, are garnering increased attention as turbomachinery seeks to decarbonize on an international scale, but there are several challenges associated with transporting and storing them.

“Unfortunately, hydrogen itself has a lot of nasty characteristics,”

“Another option for transporting and storing gaseous hydrogen is lowering the temperature of hydrogen to form a liquid, like what is currently done with LNG for transport by tanker or ship, seems attractive,” the duo said. “The downside of liquefaction is the amount of energy needed to reach the necessary low temperature that has to be maintained during any transport process. This means the energy required for the refrigeration process to liquefy hydrogen is equivalent to 30 - 40% of the energy content of the hydrogen itself.”

Creating hydrogen-containing compounds, such as gaseous methane or liquid organic carriers, is another option. But right now, the hot transport vehicle of choice for hydrogen is ammonia. “It can be transported as a liquid, which makes the transport process efficient,”

From a handling perspective: “Ammonia is a very toxic gas. If you touch it in liquid form, it causes skin burns rapidly. In vapor form, even at less than 100 PPMs, it’s very irritating, so it creates a lot of issues from the handling perspective,”

“A pipeline infrastructure is needed for the hydrogen supply of larger power plants,” said

Hydrogen storage solutions are critical to buffer mismatches between production and consumption. But in terms of cost, “storage systems based on pressure vessels or multi-tube arrangements are only suitable for small- to mid-sized peak-load gas turbine power plants. Underground salt caverns offer the most promising option for large-scale hydrogen storage for mid-merit and large gas turbines,” Kutne said.

Carbon Capture and Storage

Carbon capture and storage (CCS) increased significantly during 2024.

November and December filled our news feed with global carbon-capture project announcements. A few examples include:

SLB Capturi built a carbon-capture plant at the Brevik cement facility in Norway;- Babcock & Wilcox will install its

SolveBright CO2-capture technology at a waste-to-energy plant; - And

Kawasaki Heavy Industries partnered with an Australian company to develop and deploy post-combustion capture technology.

Spencer Schecht, Senior Business Development Lead, Honor Iosif, Public Affairs Manager, and Joey Minervini, Public Affairs Manager at the Global CCS Institute, said: “The Institute is seeing accelerating momentum for CCS in industries beyond the lower-cost applications of gas processing, ethanol, and ammonia production. CCS is being integrated into industries such as cement, steel, chemical plants, power plants, and even carbon-removal technologies, such as direct air capture, bioenergy with CCS, and waste-to-energy plants.”

Danny Rice, CEO of NET Power, spoke at this year’s

One of the challenges of integrating CCS is cost, so companies are exploring ways to reduce operational and capital costs. GE Vernova conducted a FEED study to reduce CCS costs and its overall footprint through its

The study findings, released by the U.S. Department of Energy’s Office of Fossil Energy and Carbon Management, found integrating GE Vernova’s EGR system, capable of capturing up to 95% of CO2 emissions:

- could reduce more than 6% of the total cost of the carbon-capture facility compared to installing carbon capture without the EGR system

- could reduce total carbon-capture operational costs per year (total costs include reductions to capital and operating costs)

Technological Advancements

The industry has been adapting technologies to support net-zero goals, and throughout 2024, several exciting turbomachinery advancements were announced.

GE Vernova announced its

“The new design … overcomes the challenges of hydrogen’s higher flame speed through precise design enhancements to the fuel nozzle, optimized water injection schedules, and advanced control modifications,” said Midhat Mirabi, Managing Director at GE Vernova’s Gas Power Aeroderivatives New Units. The unit is equipped with safety features, such as nitrogen purge systems and hydrogen fire detection systems.

In his latest

GE Vernova and IHI are developing a two-stage combustion system with a rich dome to resolve the ammonia-NOx problem, building on IHI’s 2-MW gas turbine using 100% liquid ammonia.

“GE Vernova’s technology either runs at or near stoichiometric—i.e., fuel and air in perfect chemical balance—or on the lean side, but the rich side of the stoichiometric dome—fuel-rich and oxygen lean—provides less air for the nitrogen to turn into NOx when using ammonia,” explained

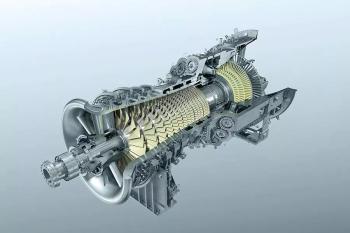

Siemens Energy developed a series of

- The STC-SVm single-shaft turbocompressorutilizes a multi-stage rotor that permits circumferential speeds at the impeller outer diameter of up to 600 m/s without exceeding material stress limits, allowing a reduced footprint by up to 50% compared to a conventional turbocompressor solution in low-mole-weight gas applications.

- The Turbo Heater employs high-speed gas dynamics to directly heat gas through a shock wave train. The machine is driven by an electric motor and does not require the direct burning of fossil fuels or a heat exchanger.

- The ROC is driven by an electric motor or a hydrogen-fired gas turbine. Kinetic energy produced via rotation is converted to heat through a controlled shock wave, creating a temperature rise in the gas to initiate pyrolysis reactions without heat transfer from heat exchanger surfaces.

LNG and Mobile Applications

The

In April 2024, the U.S. Energy Information Administration anticipated a modest increase in U.S. LNG exports for the year (2%) followed by significant growth in 2025 (an additional 18%). This growth is mirrored by expectations for a rise in U.S. natural gas exports by pipeline (3% in 2024, 4% in 2025) and a slight dip and recovery in pipeline imports in 2024 and 2025, respectively.

The United States, Australia, and Qatar produced three-fifths of the world’s LNG in 2023, with the United States leading the pack as the top global LNG exporter after Russia fell behind when the Nord Stream pipeline exploded in 2022.

The Institute for Energy Economics and Financial Analysis expects global LNG production capacity to grow by roughly 193 MTPA from 2024 - 2028, rising from ~474 MTPA of nameplate capacity at the beginning of 2024 to 666.5 MTPA by the end of 2028—the fastest capacity growth in the history of the global LNG industry, representing a 40% increase in five years.

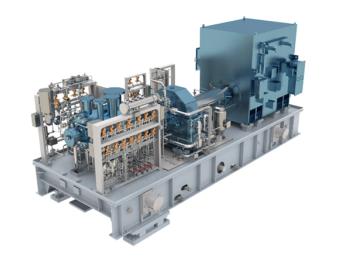

A couple of trends have emerged from this sector of the industry: modularization and e-LNG. “LNG projects are requiring modularization to eliminate risk in the field, i.e., stick built, in addition to a decline in available field labor,” said Joel Schubert, Director of Business Development LNG at Siemens Energy. “We also see a trend for future LNG projects going forward with e-LNG (electric motor drives) to reduce emissions and their carbon footprint.”

The modularization trend is mirrored by

“The global LNG market is responding with an unprecedented surge of additional export capacity,” said Andrea Intieri, LNG Platform Leader of Gas Technology Equipment, Industrial, and Energy Technology at Baker Hughes. “According to Baker Hughes, over the next three-year period (2024 - 2026) approximately 100 MTPA of liquefaction capacity is expected to reach a final investment decision.”

Ammonia in Marine Propulsion

A micro trend our team has observed is the use of alternative fuels such as methane, ammonia, and methanol to propel marine vessels.

In September 2024, Amogy’s carbon-free, ammonia-powered maritime vessel—the

“Ammonia is the world’s second most produced chemical, with around 20 million tons moving around the globe through 200 ports each year,” said Seonghoon Woo, CEO and Co-Founder of Amogy. “With that track record, shifting the industry mindset to use it as a fuel is completely achievable and can happen at an accelerated pace.”

In late 2024, MAN Energy Solutions announced a significant development for its marine-based ammonia engine work: the

“We are using synergies between two-stroke and four-stroke in both directions with a deep technological exchange," said Christian Kunkel, Head of Combustion Development and Four-Stroke R&D at MAN Energy. “[In terms of ammonia], we can copy and adapt some of the technical concepts and ideas from two-stroke engine development, mainly in the fields of safety concepts, compatibility of materials, and lube oil."

The first AmmoniaMot project focused on fundamental investigations regarding the combustion of ammonia in an internal combustion engine. The main takeaways from the AmmoniaMot project [that apply to developing four-stroke engines] were:

- ammonia seems to be a suitable fuel to operate four-stroke medium-speed engines

- a greenhouse gas reduction potential of up to 90%

- usual exhaust-gas after-treatment systems can be used to fulfill the IMO Tier 3 emission limits

Hanwha Power Systems may get involved in this field as well, deploying its

Newsletter

Power your knowledge with the latest in turbine technology, engineering advances, and energy solutions—subscribe to Turbomachinery International today.